U.S. stock futures rose on Tuesday following Monday’s positive close. Futures of major benchmark indices were higher.

Investors are bracing for a heavy slate of data on Tuesday, headlined by a delayed data deluge of retail sales and employment costs that will serve as a critical compass for the Federal Reserve’s interest rate path.

Meanwhile, on Monday, President Donald Trump acknowledged that his 2017 decision to pass over Kevin Warsh for Federal Reserve Chair was a “really big mistake,” attributing the move to pressure from his former Treasury Secretary.

The 10-year Treasury bond yielded 4.18%, and the two-year bond was at 3.48%. The CME Group’s FedWatch tool‘s projections show markets pricing an 82.3% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | 0.13% |

| S&P 500 | 0.18% |

| Nasdaq 100 | 0.15% |

| Russell 2000 | 0.26% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Tuesday. The SPY was up 0.23% at $695.56, while the QQQ advanced 0.26% to $615.91.

Stocks In Focus

Credo Technology Group

- Credo Technology Group Holding Ltd. (NASDAQ:CRDO) jumped 16.89% in premarket on Tuesday, following its preliminary third-quarter earnings. It expects to report revenue in the range of $404 million to $408 million, up from prior guidance of $335 million to $345 million.

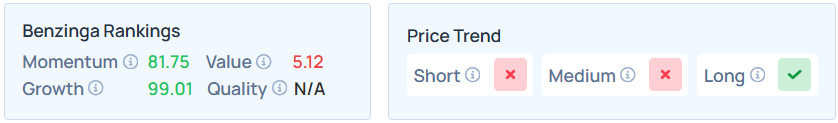

- CRDO maintains a weaker price trend over the short and medium terms but a strong trend in the long term with a solid growth ranking, as per Benzinga’s Edge Stock Rankings.

Koninklijke Philips

- PHG maintains a stronger price trend over the short, medium, and long terms, with a poor quality ranking, as per Benzinga’s Edge Stock Rankings.

Oracle

- Oracle Corp. (NYSE:ORCL) was up 1.47% after launching its new, prebuilt AI agents for Oracle Fusion Cloud Applications, designed to automate end-to-end supply chain workflows and accelerate strategic decision-making at no additional cost.

- Benzinga’s Edge Stock Rankings indicate that ORCL maintains a weaker price trend over the short, medium, and long terms, with a poor value ranking.

Clear Channel Outdoor Holdings

- Clear Channel Outdoor Holdings Inc. (NYSE:CCO) advanced 6.85% after announcing that it has entered into a definitive agreement to be acquired by Mubadala Capital, in partnership with TWG Global. The all-cash transaction values Clear Channel at an enterprise value of $6.2 billion.

- Benzinga’s Edge Stock Rankings indicate that CCO maintains a strong price trend over the long, medium, and short terms.

Ford Motor

- Ford Motor Co. (NYSE:F) rose 0.29% as analysts expect it to post quarterly earnings at 19 cents per share on revenue of $41.83 billion after the closing bell.

- F maintains a stronger price trend over the short, medium, and long terms, with a strong value ranking, as per Benzinga’s Edge Stock Rankings.

Cues From Last Session

Materials, energy, and tech led the S&P 500 higher on Monday, while consumer staples and health care shares declined.

| Index | Performance (+/-) | Value |

| Dow Jones | 0.040% | 50,135.87 |

| S&P 500 | 0.47% | 6,964.82 |

| Nasdaq Composite | 0.90% | 23,238.67 |

| Russell 2000 | 0.70% | 2,689.05 |

Insights From Analysts

LPL Financial strategists Jeffrey Buchbinder and Adam Turnquist express a constructive outlook for the global economy, specifically highlighting the potential for Emerging Markets (EM) to continue their recent outperformance.

The strategists describe the 2026 environment as an “extended but aging expansion” where growth remains sturdy enough to support corporate earnings despite being uneven across different regions.

They anticipate that the U.S. economy will avoid a recession, fueled by “ongoing enthusiasm around AI and further easing of monetary policy from the Fed”. While they expect a modest slowdown in early 2026, they project a rebound later in the year as inflation continues to moderate.

Technically, Turnquist notes that the broad market’s long-term uptrend remains intact, though investors should brace for occasional volatility.

A major driver for their positive bias is the “avalanche of AI investment in Asia” and the U.S., with Buchbinder noting that “nothing is bigger than AI right now”. They specifically highlight that EM earnings are expected to grow by 29% in 2026, more than double the 14% projected for the U.S.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Tuesday.

- January’s NFIB optimism index will be out by 6:00 a.m. Also, the fourth quarter’s employment cost index, December’s delayed import price index, and delayed U.S. retail sales will be released by 8:30 a.m. ET.

- November’s delayed business inventories data will be out by 10:00 a.m., Cleveland Fed President Beth Hammack will speak at 12:00 p.m., and Dallas Fed President Lorie Logan will speak at 1:00 p.m.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 0.12% to hover around $64.44 per barrel.

Gold Spot US Dollar fell 0.25% to hover around $5,046.29 per ounce. Its last record high stood at $5,595.46 per ounce. The U.S. Dollar Index spot was 0.03% higher at the 96.8440 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.89% lower at $69,203.57 per coin.

Asian markets closed higher on Tuesday, except Australia’s ASX 200 index. India’s Nifty 50, Japan’s Nikkei 225, Hong Kong’s Hang Seng, China’s CSI 300, and South Korea’s Kospi indices rose. European markets were mixed in early trade.

Photo courtesy: Shutterstock

Recent Comments