Rocket Lab Corp (NASDAQ:RKLB) shares are trading lower Tuesday afternoon, extending recent volatility. Here’s what investors need to know.

- Rocket Lab shares are experiencing downward pressure. Why is RKLB stock trading lower?

SpaceX IPO Rotation Hits Space Stocks

Rocket Lab shares have been volatile in recent sessions, driven largely by Congress’ decision to withhold funding for a planned 2031 Mars sample-return mission, an overhang that had already been pressuring the stock in recent sessions.

The funding setback has become a key swing factor, prompting investors to recalibrate expectations for the company’s longer-term opportunity set.

At the same time, renewed chatter around a potential SpaceX IPO, rumored to be valued above $1.5 trillion, is weighing on publicly traded space names as investors reposition ahead of any possible listing.

Instead of adding exposure to existing stocks, traders are potentially taking profits from 2025’s rally and shifting into a wait-and-see posture, potentially preserving capital for a future SpaceX offering.

That rotation has contributed to double-digit pullbacks across several launch and satellite peers in recent weeks, adding incremental pressure to Rocket Lab shares.

Rocket Lab Drops Amid Mixed Signals

Despite a generally positive market day, Rocket Lab’s performance suggests company-specific concerns may be at play. The stock’s downward movement comes as investors digest recent technical indicators and market sentiment.

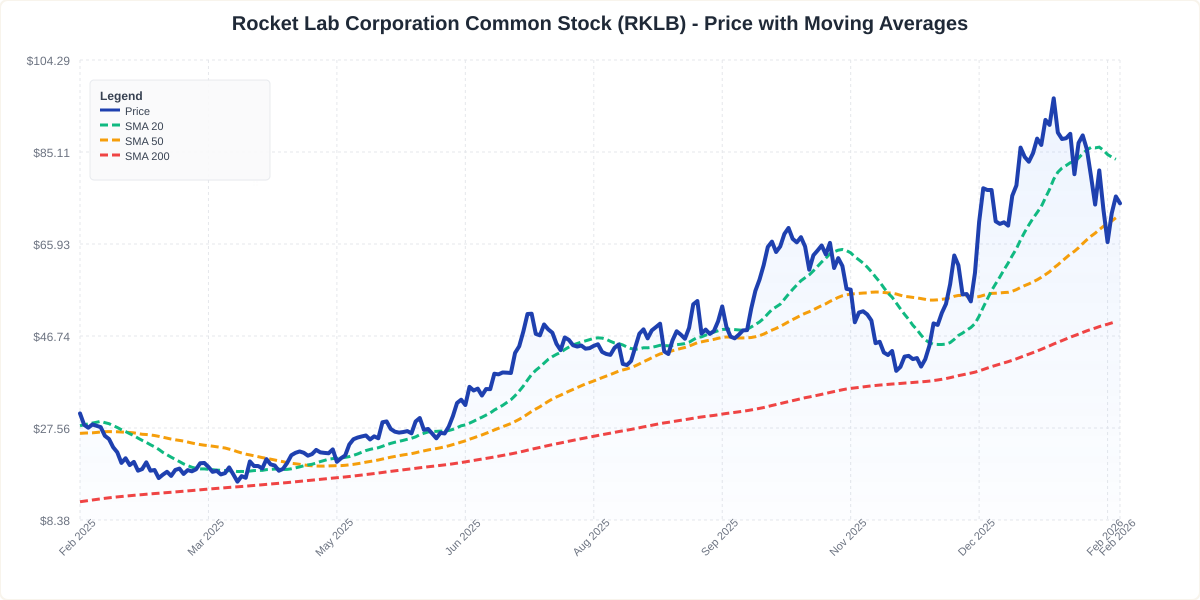

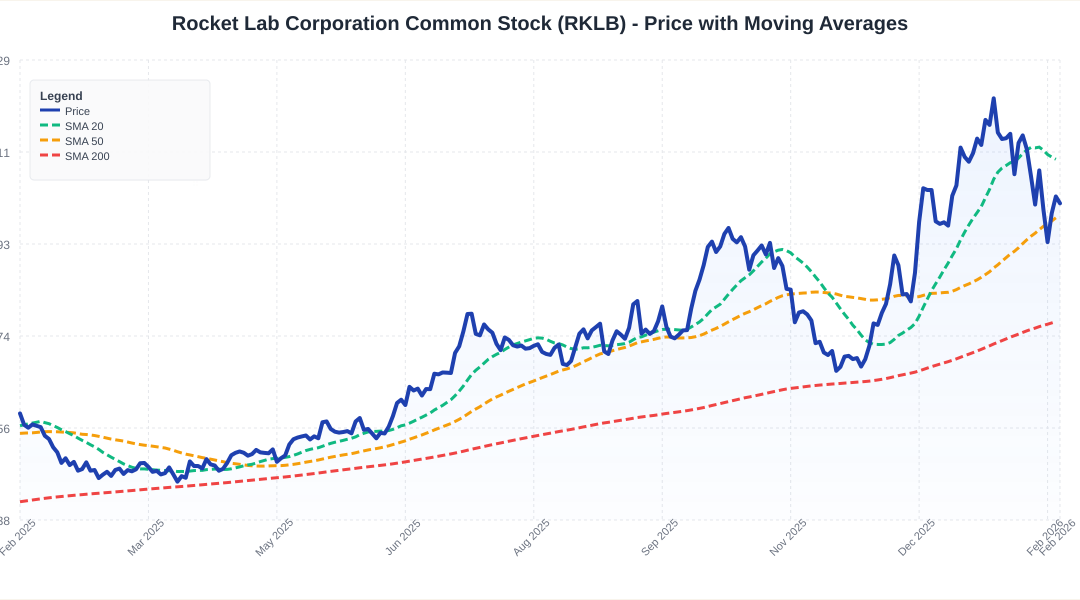

Technical indicators suggest that Rocket Lab is currently trading 11.1% below its 20-day simple moving average (SMA) but is 4.1% above its 50-day SMA, indicating a mixed short-term outlook. Additionally, shares have increased 143.15% over the past 12 months, reflecting strong long-term performance, though they are currently positioned closer to their 52-week highs than lows.

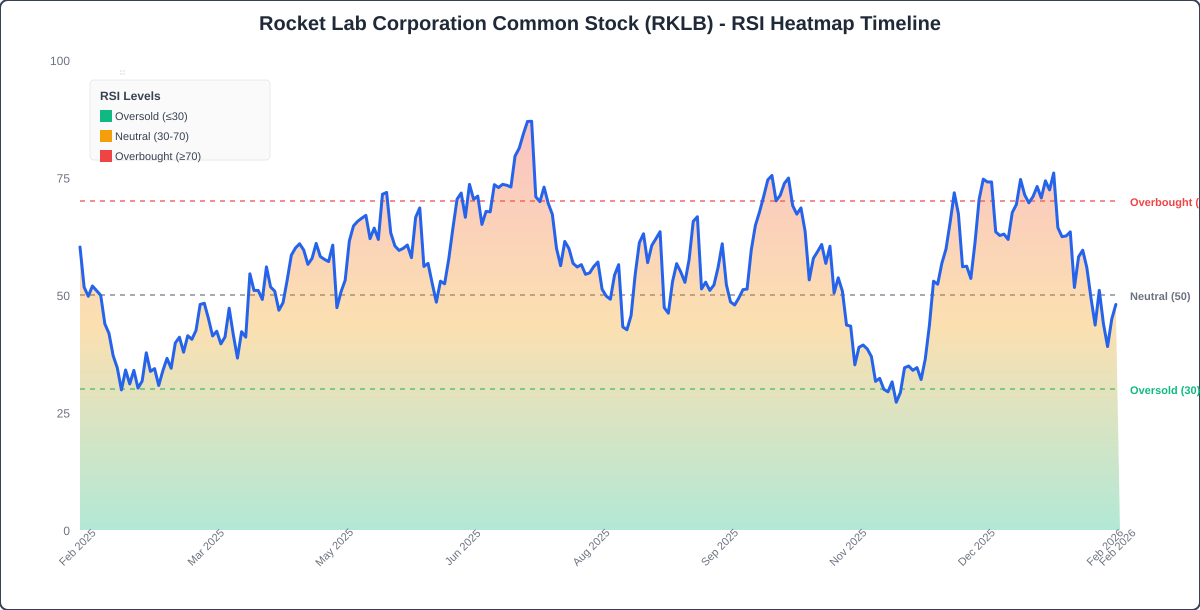

The RSI is at 48.38, which is considered neutral territory, while the MACD is below its signal line, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum, highlighting potential caution for traders.

- Key Resistance: $80.00

- Key Support: $67.00

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Rocket Lab, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Strong (Score: 95.97) — Stock is outperforming the broader market.

The Verdict: Rocket Lab’s Benzinga Edge signal reveals a strong momentum score, indicating that the stock is currently outperforming the broader market. However, investors should remain cautious given the recent funding challenges and mixed technical indicators.

RKLB Shares Edge Lower Tuesday

RKLB Price Action: Rocket Lab shares were down 1.82% at $74.52 at the time of publication on Tuesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments