Famed ‘Big Short’ investor Michael Burry has signaled a massive technical breakdown for Palantir Technologies Inc. (NASDAQ:PLTR), releasing a chart that suggests the high-flying AI stock is headed for a nearly 60% collapse.

The Bearish Blueprint

In a post on X on Feb. 10, Burry shared a technical analysis of Palantir’s stock price history, identifying a classic “Head & Shoulders” reversal pattern.

The chart—captioned with the ominous note, “I am working on something $PLTR”—marks a definitive “Left Shoulder,” “Head,” and “Right Shoulder” formation.

Burry’s analysis points to a “Next Support” level near $80 and an ultimate “Landing Area” between $50 and $60.

With the stock trading at $142.91 apiece, as of Monday, a drop to the $60 mark would represent a staggering 58% downside.

This technical outlook aligns with Burry’s existing fundamental skepticism; last November, he clarified a massive options bet against the company, stating, “So, I bought 50,000 of these things for $1.84… Each of those doodads let me sell $PLTR at $50 in 2027.”

“Frauds Of The Modern Era“

Burry has earlier termed the tech stocks that he has shorted as “frauds of the modern era.”

He recently shuttered his hedge fund, Scion Asset Management, after filing papers to de-register the firm. In a letter to investors, he noted the move followed a period where the market failed to align with his assessments, writing, “With a heavy heart, I will liquidate the funds and return capital… by year’s end.”

Valuation Concerns

While Palantir CEO Alex Karp has previously dismissed Burry’s short positions as “BatS—t Crazy,” the investor remains steadfast.

Burry’s latest chart suggests that the “AI bubble” he has frequently warned about is finally losing its structural integrity, regardless of the company’s recent earnings performance.

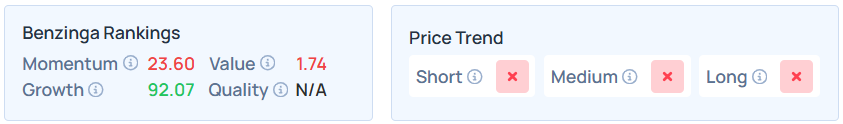

PLTR maintains a weaker price trend over the short, medium, and long terms, with a very poor value ranking, as per Benzinga’s Edge Stock Rankings.

PLTR Underperforms In 2026

Shares of PLTR have declined by 19.60% year-to-date, while the Nasdaq 100 was up 0.25% in the same period. It was also down 23.56% over the last six months but up 28.92% over the year.

On Monday, the stock closed 5.16% higher at $142.91 per share, and it was up 1.02% in after-hours.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Recent Comments