Major U.S. stock benchmarks closed higher on Monday, with the Dow Jones Industrial Average edging up 0.04% to 50,135.87, the S&P 500 rising 0.47% to 6,964.82, and the Nasdaq climbing 0.9% to 23,238.67.

These are the top stocks that gained the attention of retail traders and investors through the day.

Kyndryl Holdings, Inc. (NYSE:KD)

Kyndryl Holdings stock tumbled 54.92% to close at $10.59, trading between an intraday high of $11.43 and a low of $10.10, with the stock sitting at its 52-week trough of $10.10 versus a 52-week high of $44.20.

The IT infrastructure services provider shocked the market with third-quarter results that missed earnings expectations, trimmed its fiscal 2026 adjusted pretax income and free cash flow outlook, and disclosed the departure of its Chief Financial Officer David Wyshner, moves that were followed by a sharp downgrade and price-target cut from JPMorgan; the combination of weaker guidance, leadership change and a delayed regulatory filing fueled a steep slide as investors reassessed the company’s turnaround prospects.

Credo Technology Group Holding Ltd (NASDAQ:CRDO)

Credo Technology Group Holding Ltd (NASDAQ:CRDO) jumped 10.78% to finish at $123.41, after touching an intraday high of $124.33 and a low of $111.08, while the stock remains well below its 52-week peak of $213.80 and comfortably above a 52-week low of $29.09. The stock shot up nearly 16% to $142.80 in the after-hours trading.

The connectivity chip maker rallied after issuing preliminary third-quarter results that pointed to revenue of $404 million to $408 million, far above its prior forecast, with the company flagging triple-digit year-over-year growth and expecting continued sequential gains; enthusiasm for that upgraded revenue trajectory and the promise of further expansion helped propel shares higher.

ON Semiconductor Corp. (NASDAQ:ON)

ON Semiconductor Corp. (NASDAQ:ON) slipped 0.15% to end at $65.10, trading between an intraday high of $65.92 and a low of $64.62, leaving the stock just shy of its 52-week high of $66.86 and well above its 52-week low of $31.04. In extended trading, the stock fell 3.22% to $63.

The chipmaker saw modest pressure after posting mixed fourth-quarter results that beat earnings forecasts but fell short on revenue, even as CEO Hassane El-Khoury emphasized disciplined execution and ongoing investment in intelligent power and sensing technologies; investors also parsed guidance for the current quarter that projected earnings and revenue broadly in line with expectations.

AppLovin Corp (NASDAQ:APP)

AppLovin Corp (NASDAQ:APP) soared 13.19% to close at $460.38, with shares ranging between an intraday high of $471.73 and a low of $419.52, still well off a 52-week high of $745.61 but far above a 52-week low of $200.50. In the after-hours trading, the stock rose 4.65% to $481.80.

The mobile app technology company advanced after CapitalWatch publicly apologized and corrected a prior report that had tied a major shareholder Hao Tang to criminal organizations, retracting key allegations just days before AppLovin’s upcoming earnings release; the clarification, along with earlier vocal defenses from CEO Adam Foroughi and a string of bullish analyst calls and rising price targets, helped fuel a sharp rebound in sentiment.

Oracle Corp. (NYSE:ORCL)

Oracle Corp. (NYSE:ORCL) rallied 9.64% to finish at $156.59, trading between an intraday high of $159.75 and a low of $147.00, with the shares still below a 52-week high of $345.72 and comfortably above a 52-week low of $118.86.

The enterprise software giant gained ground after it detailed progress in its healthcare cloud strategy, highlighting the migration of several Ontario hospitals’ electronic health records to Oracle Cloud Infrastructure and the launch of an Oracle Health Clinical AI Agent pilot designed to streamline documentation and boost clinician efficiency; an analyst upgrade from DA Davidson to “Buy” with a higher price target further underpinned the move.

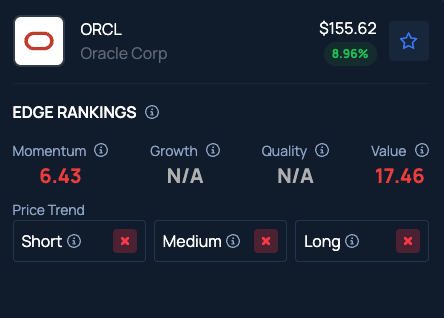

Benzinga Edge Stock Rankings indicate Oracle stock has a Momentum in the 6th percentile and a Value in the 17th percentile.

Photo Courtesy: StockPhotos.GALLERY on Shutterstock.com

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Recent Comments