Bloom Energy Corp (NYSE:BE) shares are trading lower Tuesday morning, giving back a slice of last week’s gains as investors reassess the fuel-cell maker’s rapid run-up. Here’s what investors need to know.

- Bloom Energy stock is showing notable weakness. Why are BE shares down?

Record AI-Driven Revenue Lifts Margins

Tuesday’s pullback follows a powerful move higher after Bloom reported record 2025 revenue of $2.02 billion, up 37% year-over-year, underscoring how AI data centers and power-hungry manufacturers are turning to on-site generation.

The latest quarter showed similar strength. Bloom delivered fourth-quarter revenue of $777.7 million, a 35.9% jump from a year earlier, with adjusted earnings per share of 45 cents topping the 31 cents consensus. Management highlighted improving gross margins, rising operating leverage and strong cash flow as demand scales.

AI Power Demand And Backlog Support Long-Term Story

Behind the volatility, Bloom’s fundamentals continue to ride powerful AI tailwinds. The company is positioning its fuel-cell systems as a primary power layer for next-generation data centers, including a native 800-volt DC solution aimed at cutting conversion losses in server racks.

Product backlog has swelled 140% year over year to $6 billion, with total backlog near $20 billion, and management is guiding 2026 revenue to $3.1–$3.3 billion, ahead of Street estimates.

Mizuho Lifts Target, Stays Neutral On Valuation

On Tuesday, Mizuho analyst Maheep Mandloi maintained a Neutral rating on Bloom Energy while raising the price target to $110 from $89, reflecting upgraded growth expectations but a more measured stance on valuation risk.

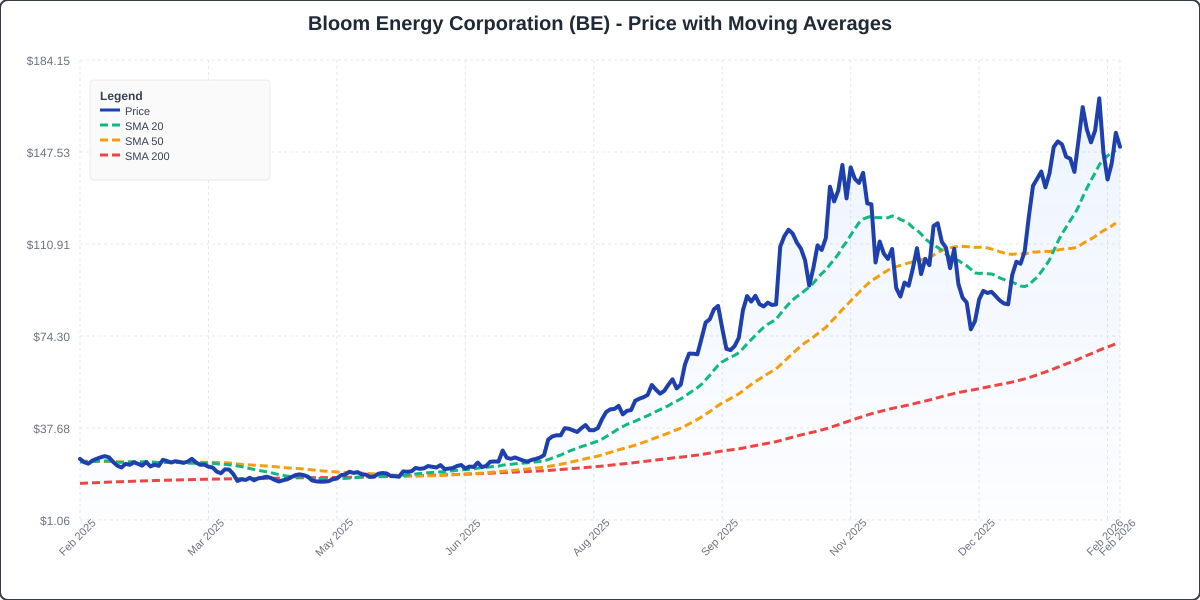

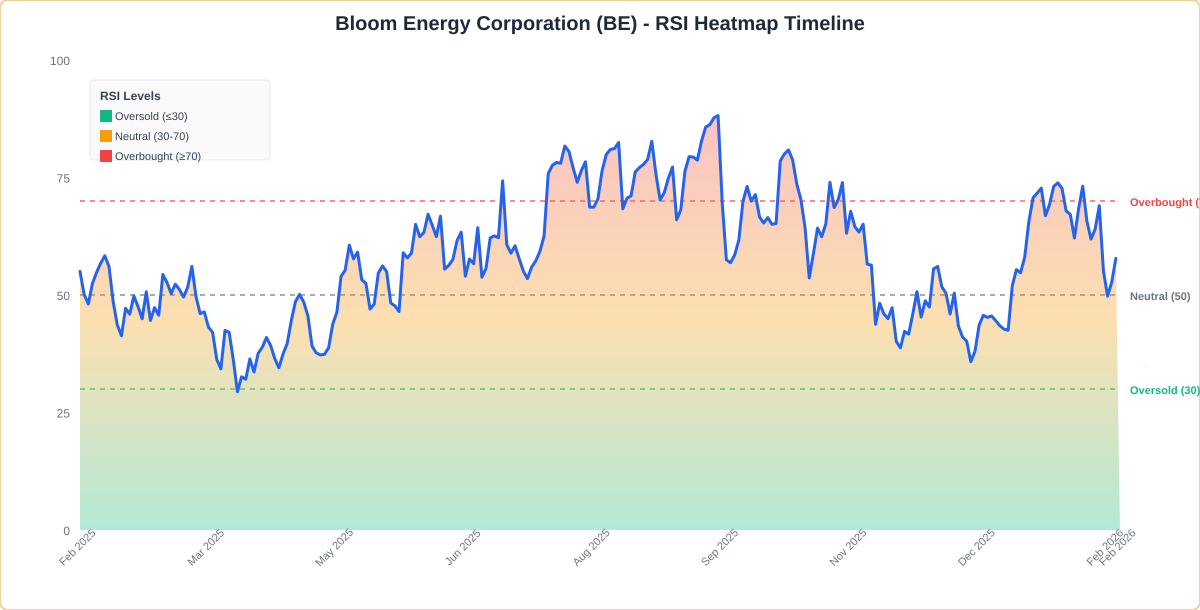

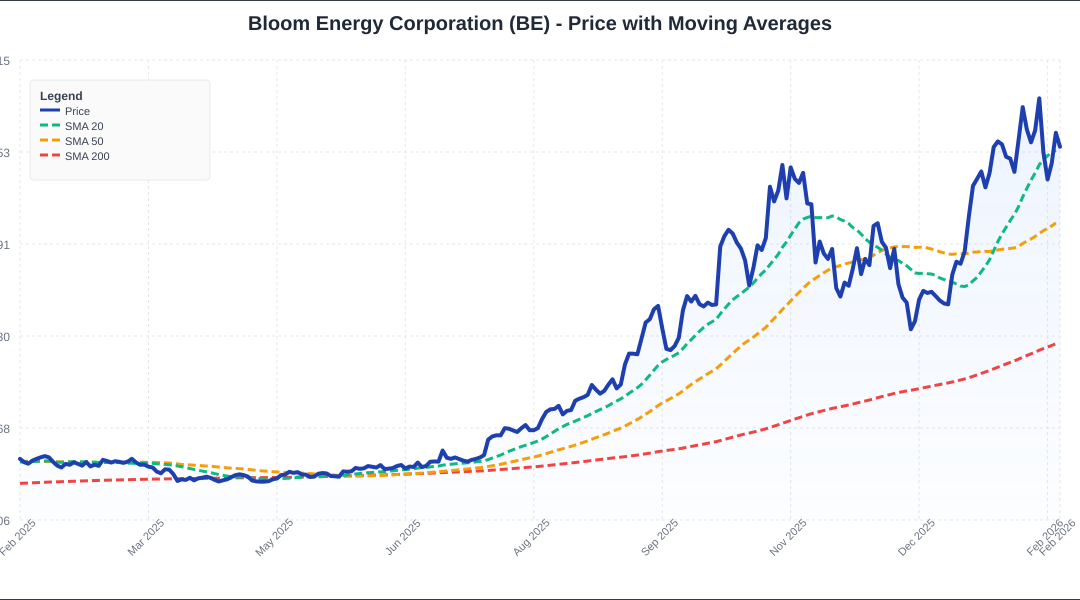

BE Shows Mixed Momentum

The technical indicators reveal that Bloom Energy is currently trading 1.2% above its 20-day simple moving average (SMA) but remains 25.7% above its 50-day SMA, showcasing a stronger long-term trend.

Over the past 12 months, shares have surged by 489.25%, and they are currently positioned closer to their 52-week highs than lows, which suggests sustained investor interest.

The RSI is at 58.28, indicating neutral momentum, while the MACD is below its signal line, suggesting bearish pressure on the stock.

This combination indicates mixed momentum, reflecting the stock’s current indecisiveness in the market.

- Key Resistance: $176.50

- Key Support: $136.50

Bloom Energy’s Business Model

Bloom Energy designs, manufactures, sells, and installs solid oxide fuel cell systems for on-site power generation. Bloom Energy Servers are fuel-flexible and can use natural gas, biogas, and hydrogen to create 24/7 electricity for stationary applications.

The company’s focus on providing sustainable energy solutions positions it well in the current market, especially as demand for reliable power sources continues to grow. With the rise of AI and data centers, Bloom’s innovative offerings could play a crucial role in shaping the future of energy consumption.

Analysts Lift Targets Following Q4 Results

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $103.27. Recent analyst moves include:

- Mizuho: Neutral (Raises Target to $110.00) (Feb. 9)

- JP Morgan: Overweight (Raises Target to $166.00) (Feb. 6)

- BMO Capital: Market Perform (Raises Target to $149.00) (Feb. 6)

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Bloom Energy, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Strong (Score: 99.59) — Stock is outperforming the broader market.

The Verdict: Bloom Energy’s Benzinga Edge signal reveals a strong momentum score, indicating that the stock is currently outperforming the market. However, the mixed technical indicators suggest that investors should remain cautious as they navigate potential volatility ahead.

BE Shares Slide Tuesday Morning

BE Price Action: Bloom Energy shares were down 3.04% at $150.45 at the time of publication on Tuesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments