Japanese equities surged to unprecedented heights on Monday as the Nikkei 225 broke the 57,000-point barrier for the first time, fueled by Prime Minister Sanae Takaichi‘s landslide election victory and a high-profile endorsement from President Donald Trump.

Market Euphoria And The ‘Takaichi Trade’

The benchmark Nikkei 225 rallied 4.27% to close at 56,568.24, after earlier touching an all-time intraday high of 57,337.07.

The rally follows Sunday’s snap election, where Takaichi’s Liberal Democratic Party (LDP) secured 316 seats in the 465-member Lower House.

Alongside coalition partner Japan Innovation Party, the bloc now controls 352 seats—a two-thirds supermajority that grants Takaichi a mandate to pursue aggressive “Sanaenomics” reflationary policies and increased defense spending.

Trump Endorsement And Strategic Ties

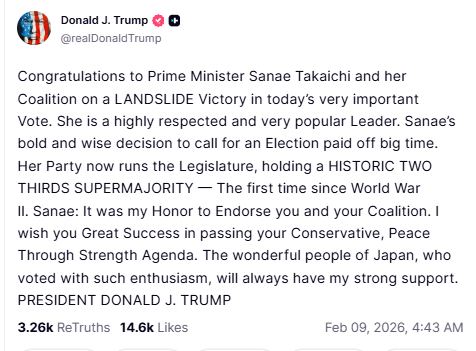

The market’s momentum was further bolstered by public support from Washington. Following the results, Trump congratulated Takaichi on social media, writing: “She is a highly respected and very popular leader. Sanae’s bold and wise decision to call for an election paid off big time.”

Trump, who had previously offered a “complete and total endorsement” of the Prime Minister, added: “I wish you Great Success in passing your Conservative, Peace Through Strength Agenda.”

Responding to the support, Takaichi emphasized the permanence of the Trans-Pacific Partnership. “The potential of our Alliance is LIMITLESS,” Takaichi stated. “Our Alliance and friendship with the United States of America are built on deep trust and close, strong cooperation.”

Regional Impact, Economic Outlook

The Takaichi sweep resonated across Asia, with the South Korean KOSPI index rising 3.62% and Taiwan’s weighted index jumping 2.3%.

While stocks soared, the bond market signaled caution; yields on 10-year Japanese Government Bonds (JGBs) rose to 2.28% as traders priced in heavy fiscal stimulus.

The supermajority provides the political stability necessary for Takaichi to bypass opposition and implement promised tax cuts, though the yen remains under pressure, trading at ¥156.62 against the dollar as of Monday morning.

Meanwhile, the U.S. futures were also trading higher on Monday following a positive close on Friday. The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, closed higher on Friday. The SPY was up 1.92% at $690.62, while the QQQ advanced 2.11% to $609.65.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments