U.S. stock futures dropped on Monday following Friday’s sharp rebound. Futures of major benchmark indices were lower.

The decline follows a positive close across indices in Asia, with the Nikkei 225 breaking the 57,000-point barrier for the first time, fueled by Prime Minister Sanae Takaichi‘s landslide election victory and a high-profile endorsement from President Donald Trump.

Investors will be on the lookout for a slew of economic data that will be released this week, along with earnings from Coca-Cola Co. (NYSE:KO), McDonald’s Corp. (NYSE:MCD), Ford Motor Co. (NYSE:F), and T-Mobile US Inc. (NASDAQ:TMUS).

Meanwhile, the 10-year Treasury bond yielded 4.22%, and the two-year bond was at 3.50%. The CME Group’s FedWatch tool‘s projections show markets pricing an 84.2% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | -0.12% |

| S&P 500 | -0.37% |

| Nasdaq 100 | -0.63% |

| Russell 2000 | -0.33% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Monday. The SPY was down 0.33% at $688.35, while the QQQ declined 0.63% to $605.80.

Stocks In Focus

Strategy

- Strategy Inc. (NASDAQ:MSTR) continued its drop, falling 3.65% in premarket on Monday, following its earnings last week. It reported a massive $12.4 billion net loss (or ~$42.93 per share), driven by mark-to-market Bitcoin declines, far worse than expectations and contributing to heavy stock selling.

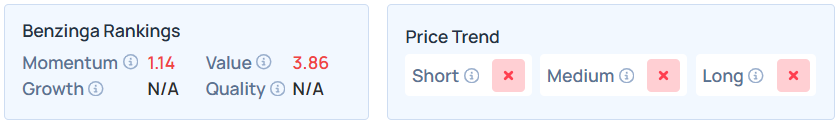

- MSTR maintains a weaker price trend over the short, medium, and long terms with a poor value ranking, as per Benzinga’s Edge Stock Rankings.

STMicroelectronics

- STMicroelectronics NV (NYSE:STM) jumped 5.93% after securing a multibillion-dollar deal with Amazon.com Inc.‘s (NASDAQ:AMZN) cloud-computing arm AWS.

- STM maintains a stronger price trend over the short, medium, and long terms, with a poor quality ranking, as per Benzinga’s Edge Stock Rankings.

FedEx

- FedEx Corp. (NYSE:FDX) rose 0.47% after a consortium led by it and Advent announced plans buy InPost for €7.8 billion or $9.254 billion.

- Benzinga’s Edge Stock Rankings indicate that FDX maintains a stronger price trend over the short, medium, and long terms, with a strong value ranking.

Kroger

- Kroger Co. (NYSE:KR) gained 5.33% on the news that it is considering former Walmart Inc. (NASDAQ:WMT) executive Greg Foran as its next chief executive officer.

- Benzinga’s Edge Stock Rankings indicate that KR maintains a strong price trend over the long, medium, and short terms, with a solid quality ranking.

ON Semiconductor

- ON Semiconductor Corp. (NASDAQ:ON) fell 1.38% as analysts expect it to post quarterly earnings at 62 cents per share on revenue of $1.54 billion after the closing bell.

- ON maintains a stronger price trend over the short, medium, and long terms, with a moderate value ranking, as per Benzinga’s Edge Stock Rankings.

Cues From Last Session

Industrials, energy, and information technology stocks led the S&P 500’s gains on Friday, though consumer discretionary and communication services sectors closed lower against the trend.

| Index | Performance (+/-) | Value |

| Dow Jones | 2.47% | 50,115.67 |

| S&P 500 | 1.97% | 6,932.30 |

| Nasdaq Composite | 2.18% | 23,031.21 |

| Russell 2000 | 3.60% | 2,670.34 |

Insights From Analysts

After the Dow Jones Industrial Average closed above 50,000 for the first time on Friday, financial experts noted that cooling inflation and technical rebounds were primary drivers of the 1,200-point rally.

Jeffrey Roach, Chief Economist for LPL Financial, noted that median 1-year inflation expectations hit their lowest levels since early 2025. He said, “We think the Fed will cut rates later this year, which will grease the skids for more market appreciation,” Roach said.

Jamie Cox, Managing Partner for Harris Financial Group, noted that the rally was a reaction to corporate strength rather than political headlines. “The Warshout is over. Markets realized that outsized spending on Capex by large tech firms and a strong economy are bullish after all,” Cox stated.

Adam Turnquist, Chief Technical Strategist for LPL Financial, observed that while the Dow cleared a “major psychological barrier,” the broader market still faces resistance.

“We expect the S&P 500 may have difficulty clearing the 7,000-point milestone without stronger contributions from the tech sector—especially from software,” Turnquist added.

Mohamed A. El-Erian, Allianz Chief Economic Adviser, warned that while a “total ‘disorderly process’ was averted by the persistent ‘Buy the Dip’ (BTD) mentality,” upcoming CPI data and labor market softening remain critical factors for the year ahead.

Upcoming Economic Data

Here’s what investors will be keeping an eye on this week.

- On Monday, Atlanta Fed President Raphael Bostic will speak at 10:50 a.m., Fed governor Christopher Waller will speak at 1:30 p.m., Fed governor Stephen Miran will speak at 2:30 p.m., and will appear on a podcast interview at 5:00 p.m. ET.

- On Tuesday, January’s NFIB optimism index will be out by 6:00 a.m. Also, the fourth quarter’s employment cost index, December’s delayed import price index,] and delayed U.S. retail sales will be released by 8:30 a.m. ET.

- November’s delayed business inventories data will be out by 10:00 a.m., Cleveland Fed President Beth Hammack will speak at 12:00 p.m., and Dallas Fed President Lorie Logan will speak at 1:00 p.m.

- On Wednesday, January’s U.S. employment report, unemployment rate, and hourly wages data will be out by 8:30 a.m. ET.

- Kansas City Fed President Jeff Schmid will speak at 10:10 a.m., and monthly U.S. federal budget data will be out by 2:00 p.m. ET.

- On Thursday, initial jobless claims data for the week ending Feb. 7 will be released at 8:30 a.m. ET.

- January’s existing home sales data will be out by 10:00 a.m., and Fed governor Stephen Miran will speak at 7:00 p.m. ET.

- On Friday, January’s consumer price index data will be released by 8:30 a.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 0.11% to hover around $63.62 per barrel.

Gold Spot US Dollar rose 0.73% to hover around $4,997.47 per ounce. Its last record high stood at $5,595.46 per ounce. The U.S. Dollar Index spot was 0.29% lower at the 97.3470 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 1.94% lower at $68,652.67 per coin.

Asian markets closed higher on Monday, as India’s Nifty 50, Japan’s Nikkei 225, Hong Kong’s Hang Seng, China’s CSI 300, Australia’s ASX 200, and South Korea’s Kospi indices rose. European markets were also higher in early trade.

Photo: Shutterstock

Recent Comments