Amazon (NASDAQ:AMZN) will spend more money this year than it makes. Meta (NASDAQ:META) is burning through its cash reserves. Oracle (NYSE:ORCL) just borrowed $25 billion to fund a deal with a company that loses money on every customer.

Something fundamental just broke in Big Tech’s business model, and many investors haven’t noticed yet…

For two decades, these companies printed money by owning almost nothing physical. Google built a trillion-dollar empire with servers and code. Facebook connected billions without laying cable. The formula was quite simple: low costs, high margins, infinite scale.

Now they’re pouring $660 billion into data centers, chips, and in some cases, their own power plants. The same companies that revolutionized business by staying asset-light are suddenly acting like 19th-century railroad barons, racing to build infrastructure they can’t easily abandon.

The AI boom demanded it. But see what the earnings calls won’t tell you: most of them are spending more than they earn, borrowing hundreds of billions, and betting everything on a future that might not arrive fast enough to justify the costs.

When Spending More Than You Earn Becomes the Plan

Looking back to 2022, we see the moment everything changed. Tech stocks crashed. The easy money era ended. Companies needed a new story to justify their valuations.

Then ChatGPT launched in November 2022. Suddenly, everyone found their answer. AI became the justification for every valuation, every growth projection, every investor question.

Now, barely two years later, Alphabet (NASDAQ:GOOGL), Amazon, Meta, Microsoft (NASDAQ:MSFT), and Oracle will spend roughly $660 billion this year on AI infrastructure. Not on software or on hiring engineers, but on physical stuff: chips, data centers, cooling systems, and in some cases, their own power generation.

But with a crucial point: most of these companies will spend more than they make.

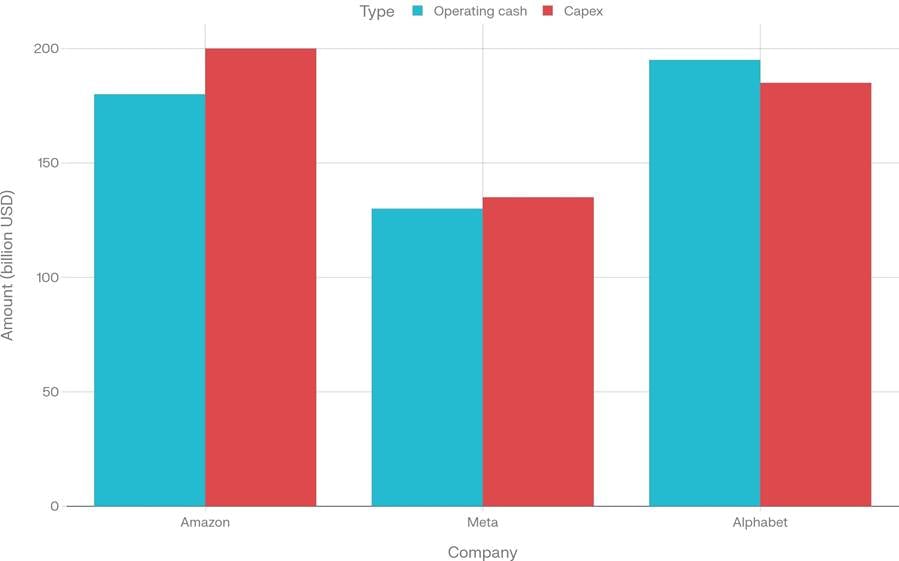

Amazon expects to generate about $180 billion in cash from its operations this year. Its capital spending plan is about $200 billion. That’s a $20 billion shortfall. For the first time in years, the company filed paperwork suggesting it might raise money through debt or stock sales. Yes, Amazon has always spent heavily. But this is the first time they’re spending more than they generate, crossing from reinvestment into deficit territory

Meta’s story is similar. Analysts expect the company to generate roughly $130 billion in operating cash. The high end of their spending guidance is $135 billion. Facebook’s parent company might run out of cash building AI systems.

Even Alphabet, which still prints money from search ads, will come close to the line. They expect to spend up to $185 billion against projected operating cash of about $195 billion. That sounds safe until you remember they also buy back stock and pay dividends.

Microsoft is the only outlier. They’re spending big but keeping their free cash flow positive. Everyone else is either breaking even or going negative.

Big Tech AI Capex vs Operating Cash Flow (2026, approx.)

Big Tech’s AI build‑out is pushing capex to the edge of, or beyond, their annual operating cash generation.

When Cash Machines Start Running on Empty

When companies spend more than they earn, they have three choices: use savings, cut dividends and buybacks, or borrow money.

In this case, they’re doing all three.

Oracle just raised $25 billion in bonds. Meta raised $30 billion last October. Amazon signaled more could be coming. JPMorgan analysts expect tech and media companies to issue at least $337 billion in investment-grade bonds this year.

Think about that number. In a single year, tech companies will borrow roughly half of what they’re spending on AI. The other half comes from raiding their cash piles, money they built up over decades of profitable operations.

The bond market is happy to lend. Corporate bond spreads have widened a bit, but not that much. Investors see the names like Google, Amazon, Meta, and figure these companies are safe.

But here’s what makes this different from past tech spending: you can’t pivot away from a data center.

Why You Can’t Pivot Away From a Power Plant

Back in the 1800s, American companies spent fortunes building railroads. The winners (Union Pacific, Southern Pacific) became giants. The losers went bankrupt and their rails got bought for pennies.

The tricky part, however, was guessing which routes would matter. Build track to the wrong city, and you’re stuck with expensive metal in the ground that nobody uses. Build to the right place, and you print money for fifty years.

Big Tech is facing a similar problem now. They’re building huge, expensive infrastructure on the bet that AI demand will keep growing. But unlike software, which you can update or abandon cheaply, data centers are permanent spaces.

If you spend $200 billion building data centers and the AI boom slows in two years, you’re left with:

- Buildings you can’t easily repurpose

- Massive depreciation expenses eating your profits

- Debt payments you still have to make

- No quick and easy way out

Software companies became valuable because they could move fast and change direction. Instagram pivoted from a location app to photos. YouTube started as a dating site in 2005. Flexibility was the advantage.

That advantage is gone when you pour concrete and install cooling systems the size of football fields.

The $300 Billion Bet on a Company That Loses Money

The most telling deal isn’t from Alphabet or Amazon. But from Oracle.

Oracle committed to provide $300 billion worth of computing infrastructure to OpenAI, the company behind ChatGPT. OpenAI doesn’t really make money. It loses money on every customer, burning cash to train better AI models. That’s their plan.

To fund just the start of this deal, Oracle had to raise $25 billion in bonds. The bond market said yes.

But see here the structure that should make you pause: Oracle builds first, gets paid later. They’re constructing massive data centers and filling them with equipment on the promise that OpenAI’s revenue will eventually materialize.

If OpenAI can’t pay (and right now, there’s no clear path to profitability), Oracle is left holding many buildings full of equipment that’s already depreciating, plus $25 billion in bonds coming due.

This isn’t how bond markets usually work. You lend money to stable companies with proven cash flows. But now bondholders are taking startup-level risk, betting that OpenAI will figure out how to make money before the bills come due.

When venture capital logic (betting on future growth despite present losses) enters the bond market, things get strange. Maybe OpenAI becomes the next Google. Or maybe it becomes the next Webvan, burning through billions before collapsing.

The bond market is saying the risk is worth it. History suggests someone usually ends up wrong.

The Costs That Keep Getting Worse

The $660 billion figure is in fact more expensive than it sounds.

Graphics cards that power AI have doubled in price since 2023. The memory chips that go inside them are up 200%. Construction costs for data centers have jumped 36% since 2024.

If these companies had announced this same spending spree three years ago, that $660 billion would have bought roughly twice as much computing power. They’re caught in their own inflation loop: rushing to build capacity while the cost of building keeps rising.

And the part that should really worry you is this: those expensive chips don’t last.

Graphics processing units make up about 40% of a data center’s initial cost. When you run them hard (which is just what AI training requires), they burn out in 18 to 36 months. Sometimes faster.

This isn’t like building a bridge that stands for fifty years. It’s more like buying a fleet of trucks that need replacing every two years. The spending never stops. You’re not buying infrastructure. You’re buying a subscription to stay in the race.

Do the math: If $264 billion of this year’s spending goes to chips (40% of $660 billion), and those chips need replacement in two years, these companies will face another $264 billion bill in 2028. And again in 2030. And again in 2032.

The railroads only had to lay track once.

When Google Starts Acting Like a Utility Company

Beyond the chips, there’s another limitation a few want to talk about: electricity.

These AI data centers need power. Lots of it. A single large facility can draw as much electricity as a mid-sized city. Multiply that across dozens of facilities, and you’re looking at demand the U.S. power grid wasn’t built to handle.

Tech companies are now looking at building their own power generation. Natural gas plants. Small nuclear reactors. On-site solutions because they can’t rely on the grid.

Stop and think about what this means. Google and Amazon (companies built on the idea that software scales infinitely at zero marginal cost) are now planning to generate their own electricity.

When was the last time a software CEO had to think about electrical transformers, cooling towers, and industrial power systems? Never. This is new territory.

And one thing about power plants: they’re even harder to pivot away from than data centers.

The One Number They Won’t Put on Paper

Notice what’s missing from every earnings call: revenue projections.

Amazon will tell you in precise detail that they’re spending $200 billion. They’ll break down the categories: AWS infrastructure, robotic fulfillment, satellite launches. But they won’t tell you what they expect to earn from any of it.

Meta guides capital spending to $135 billion. No AI revenue target. Alphabet projects $185 billion in spending. Silent on returns.

Microsoft gives the most color about AI demand (data centers running at full capacity, customers waiting for access), but even they won’t put a number on what that demand translates to in dollars.

When companies spend $660 billion but won’t project a single dollar of return, you should ask why. Either they don’t know, or they know and don’t want to say. Neither answer is comforting.

The optimistic read is, it’s too early to forecast, the returns will be enormous, and they don’t want to limit themselves with conservative projections.

The pessimistic read is they’re building because everyone else is building, and nobody wants to be the one who didn’t spend enough if AI really does take off. But they’re not confident enough in the returns to put numbers on paper.

You decide which sounds more likely.

Railroads, Fiber Optics, and Now This

The bull case is simple: AI is the biggest wave of innovation since the internet. The companies that build the infrastructure now will dominate for decades. Spending $660 billion today means trillions in returns tomorrow.

The bear case is equally simple: What if they’re overbuilding?

History suggests they probably are. During the late 1990s, telecom companies spent hundreds of billions laying fiber optic cable. The demand was real. The internet did grow. But they built too much, too fast. Most went bankrupt. The survivors bought the assets cheap and made fortunes.

The same thing played out with railroads, canals, and pretty much every major infrastructure wave in history. Someone overbuilds. Debt piles up. A few stumble. Assets get repriced. The strongest survive and win big.

We don’t know yet which Big Tech companies end up winners and which end up overleveraged. But we do know this: the stakes are higher than any previous tech cycle because the spending is irreversible.

The Only Company Playing It Smart

Microsoft is the only major player keeping positive free cash flow while spending heavily on AI.

That’s not an accident. Microsoft has been through boom-and-bust cycles before. They remember the 2000 crash. They’ve learned to grow aggressively while protecting their balance sheet.

The others (particularly Meta and Amazon) seem willing to go further, faster, betting everything on being first.

Wall Street rewarded Microsoft’s caution. While Amazon’s stock dropped 10% after announcing its spending plans last week, Microsoft held steady. The market sees the difference between smart aggression and dangerous acceleration.

What You’re Actually Holding Now

If you own these stocks, understand what you’re holding now is different from what you owned two years ago.

You used to own asset-light software businesses with 30-40% operating margins and infinite scale. Now you own capital-intensive infrastructure plays with declining free cash flow and multi-year payback periods.

That doesn’t make them bad investments. But it makes them different investments. Riskier in some ways. Less flexible. More dependent on the AI story playing out exactly as planned.

The companies with the strongest balance sheets (Microsoft, Alphabet) can survive if AI takes longer to pay off than expected. They have cash cushions and diverse revenue streams.

The ones running close to the edge (Amazon burning through reserves, Meta cutting buybacks) need AI to work soon. They’ve made the big bet. Now they need it to pay off.

There’s No Going Back

We’re watching software companies transform into something closer to utilities or railroads. They’re borrowing billions, spending down their savings, and building infrastructure that will define the next twenty years.

Maybe they’re right. Maybe this is the internet boom all over again, and the companies building the infrastructure now will be the giants of 2040.

Or maybe some of them are about to learn an expensive lesson about the difference between code you can rewrite and buildings you can’t unbuild.

Time will tell. But one thing is certain: there’s no going back.

Disclaimer: This analysis is based on publicly available information and company guidance, including financial filings from Alphabet, Amazon, Meta, Microsoft, and Oracle, as well as analyst reports from JPMorgan, S&P Capital IQ, and TD Securities. All figures are approximate and subject to change.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments