E.l.f. Beauty, Inc (NASDAQ:ELF) shares are falling sharply Monday afternoon, driven by investor reactions to the company’s recent earnings report. Here’s what investors need to know.

- e.l.f. Beauty stock is among today’s weakest performers. What’s weighing on ELF shares?

Strong Sales Growth, Higher Guidance Highlight Quarter

E.l.f. topped expectations in the third quarter, posting adjusted EPS of $1.24 versus the 72-cent consensus and revenue of $489.5 million, above estimates of $459.1 million.

Net sales rose 38% year over year, driven by U.S. and international growth across retail and e-commerce channels, while gross margin slipped to 71% due to higher tariffs, partially offset by pricing and mix.

Adjusted EBITDA jumped 79% to $123.0 million, or 25% of net sales. GAAP net income came in at $39.4 million, and adjusted net income totaled $74.5 million.

The company also raised full-year guidance, lifting adjusted EPS to a range of $3.05 to $3.10 from $2.80 to $2.85 and boosting revenue guidance to $1.60 billion to $1.61 billion from $1.55 billion to $1.57 billion, both above consensus estimates.

Post-Earnings Rally Fades

Right after the report last Wednesday, the stock moved higher as investors reacted to the earnings beat and the improved outlook. But in the trading sessions since, the market reaction became more cautious.

Investors are potentially taking a closer look at the details behind the headline numbers and reconsidering what the guidance increase really implied in the context of broader market conditions.

By Monday, the stock was pulling back again, pressured by a potential combination of profit-taking, a more measured interpretation of the guidance update and analyst rating changes that followed the earnings release.

TD Cowen analyst Oliver Chen on Monday maintained a Buy rating and lowered the price target from $110 to $100.

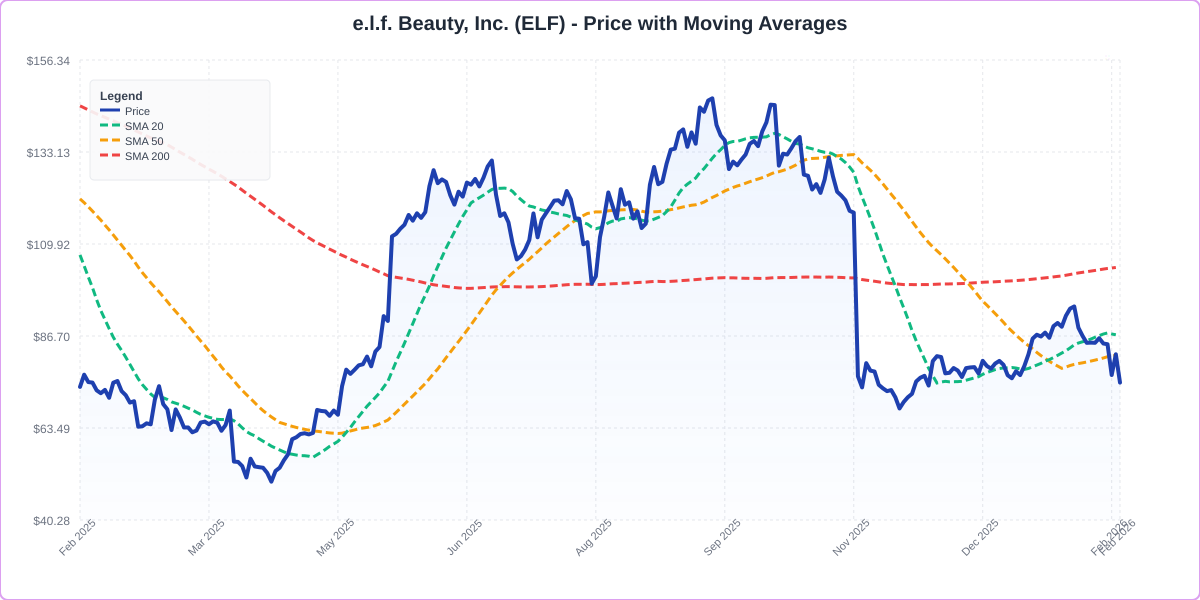

ELF Technical Analysis

E.l.f. Beauty is currently trading 13.9% below its 20-day simple moving average (SMA) and 24.6% below its 100-day SMA, indicating significant short-term weakness. Shares have decreased 1.48%

over the past 12 months and are currently positioned closer to their 52-week lows than highs, reflecting ongoing challenges in maintaining upward momentum.

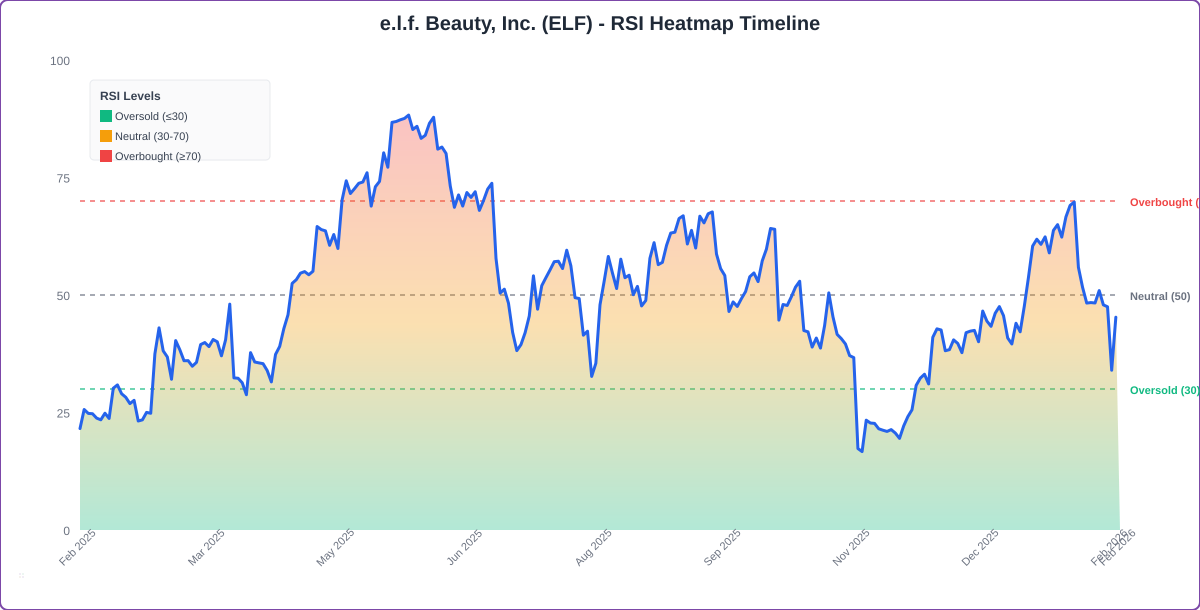

The RSI is at 46.74, which is considered neutral territory, suggesting that the stock is neither overbought nor oversold at this time. Meanwhile, MACD is below its signal line, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum, indicating that traders should remain cautious.

- Key Resistance: $82.00

- Key Support: $69.00

ELF Shares Fall Sharply Monday

ELF Price Action: E.l.f. Beauty shares were down 8.15% at $75.40 at the time of publication on Monday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments