Constellation Energy Corp (NASDAQ:CEG) shares are trading higher Monday afternoon after its Calpine LLC unit signed a major new power agreement with data-center operator CyrusOne in Texas. Here’s what investors need to know.

- Constellation Energy stock is surging to new heights today. Why are CEG shares rallying?

Constellation, CyrusOne Expand Texas Data Center Power

Calpine agreed to supply 380 megawatts of power, grid connectivity and site infrastructure for a new CyrusOne data center to be built next to the Freestone Energy Center in Freestone County, with an exclusive option for a second 380-MW phase.

Combined with two earlier 200-MW deals at Calpine’s Thad Hill Energy Center, Constellation now has more than 1,100 MW under contract to serve CyrusOne facilities across the state.

Constellation said the project will use its “Powered Land Capabilities” model, which packages generation assets, land and transmission access to help large power users move to market faster while supporting grid reliability.

Management framed the partnership as a way to capture growing electricity demand from artificial-intelligence workloads and other data-economy growth.

Data Center Demand Boosts Power Markets

The U.S. data center boom is significantly impacting power markets, as noted by Goldman Sachs. This development is driving demand for utilities and grid stocks, positioning companies like Constellation Energy to benefit from increased energy consumption and investment in renewable resources.

In recent weeks, the energy sector has faced various pressures, including regulatory changes and market volatility. The Trump administration’s reported plans for an emergency auction to accelerate power plant construction within the PJM grid could further influence market dynamics, as discussed in recent reports.

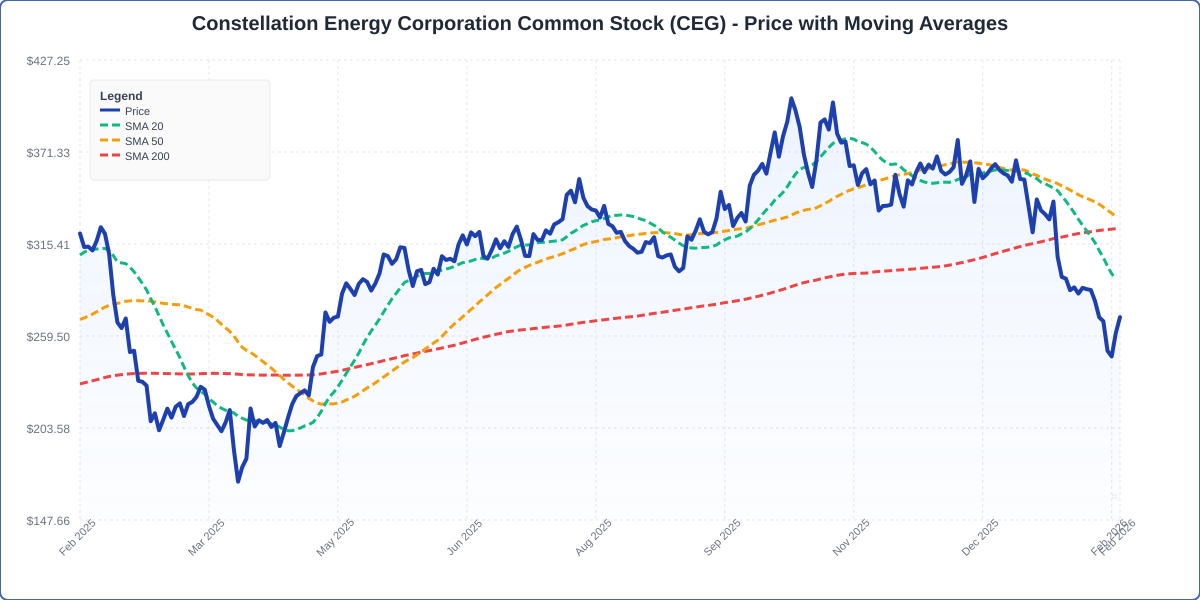

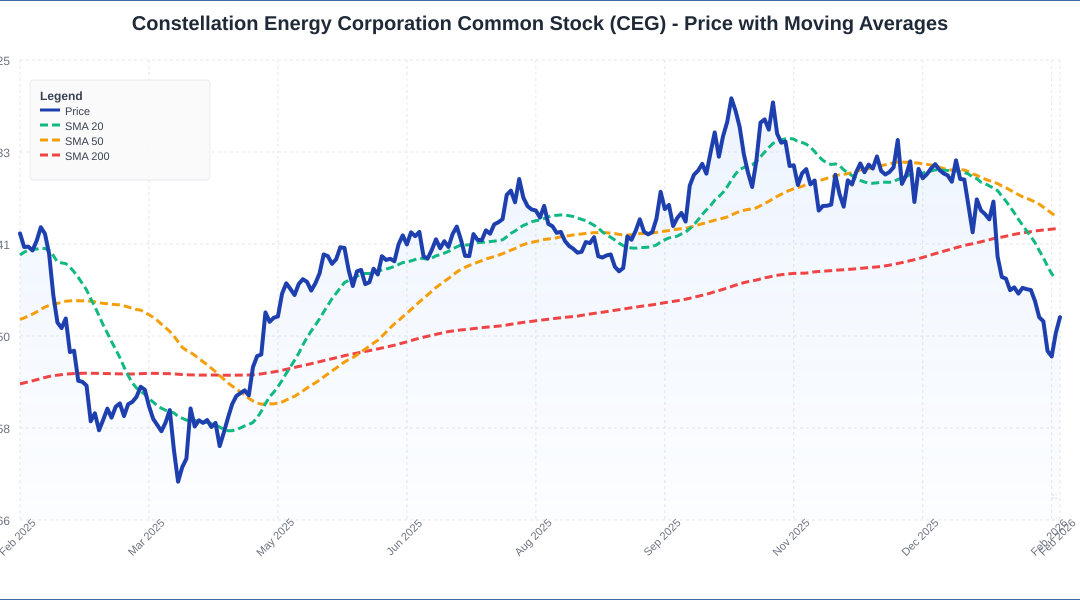

Constellation Energy Trades Below Key SMAs

Currently, Constellation Energy is trading 7.9% below its 20-day simple moving average (SMA) and 21.5% below its 100-day SMA, indicating some short-term weakness.

Over the past 12 months, shares have decreased by 15.81%, and they are currently positioned closer to their 52-week lows than highs, suggesting a challenging year for the stock.

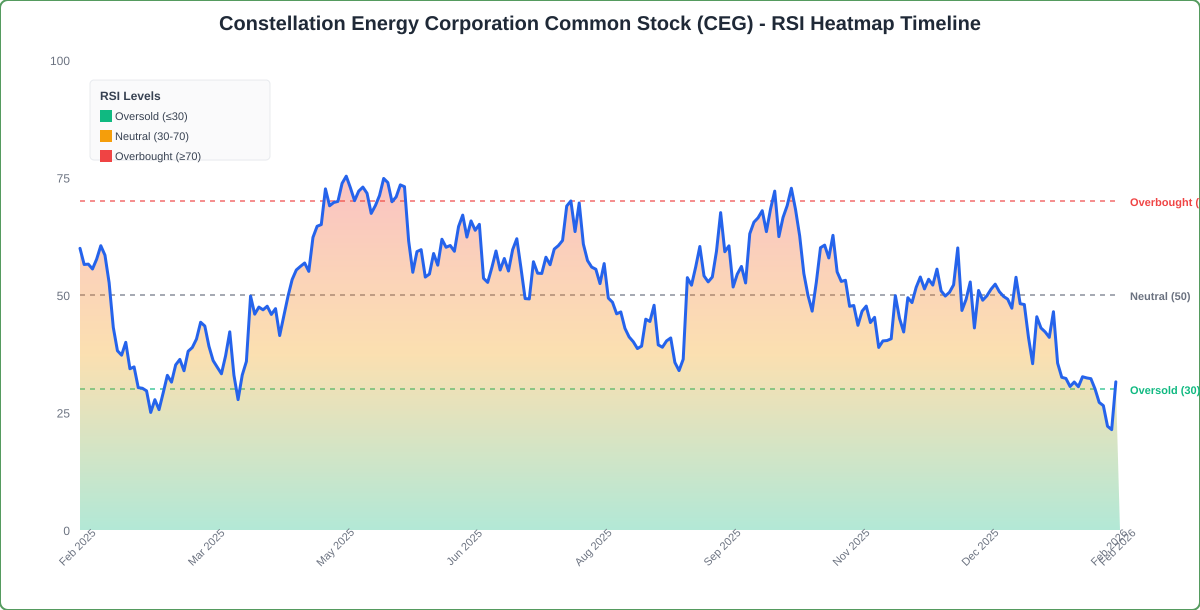

The RSI is at 31.68, which is considered neutral territory, while the MACD is below its signal line, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum, reflecting uncertainty in the stock’s near-term performance.

- Key Resistance: $324.00

Benzinga Edge Shows Mixed CEG Rankings

According to Benzinga Edge stock rankings, Constellation Energy shows a Value score of 56.44, alongside Growth at 33.85 and Momentum at 10.67, offering investors a mixed fundamental and technical profile.

CEG Price Action: Constellation Energy shares were up 3.42% at $270.37 at the time of publication on Monday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments