The US, European Union (EU), and Japan moved to counter China’s dominance of the global critical minerals’ supply chains.

The US and the EU committed to a deal within 30 days to “identify areas of cooperation to stimulate demand and diversify supply” in critical minerals, they said in a joint statement on Wednesday. The deal will include efforts to prevent supply chain disruptions, promote research and innovation efforts, and facilitate the exchange of information on stockpiling, they said.

The three economic powers, which make up almost 50% of the global economy, made the announcement after the Critical Minerals Ministerial in Washington. Fifty-four nations attended the meeting that aimed to “secure vital supplies,” US Secretary of State Marco Rubio said in his opening remarks.

Critical minerals have become the latest flashpoint in a global scramble to protect supply chains from what Washington views as predatory trade practices. China controls 60% to over 90% of the global critical mineral processing, depending on the mineral and stage of the supply chain, needed for missile defense, energy infrastructure, and emerging technologies.

US Vice President JD Vance called for preferential trade zones and price support for critical minerals to protect against dumping. He urged ministers at the meeting to protect their economies from supply chains that “can vanish in a blink of an eye” without “control or influence from any of the countries in this room.”

The US and Japan signed a Framework for Securing the Supply of Critical Minerals and Rare Earths. Japan’s State Minister for Foreign Affairs Iwao Horii said global supply “diversification is essential.” He added that “diversity as opposed to concentration is what makes us resilient.”

Chinese Trade Measures Spur US Actions

Delegates at the meeting avoided directly accusing China of predatory pricing or dumping of critical minerals. The message was clear: the world’s second-largest economy has implemented trade policies, including dumping and price manipulation, to undermine mining in the US and other nations.

“On maintaining the stability and security of global critical mineral industrial and supply chains, China’s position remains unchanged,” China’s foreign ministry spokesperson Lin Jian said on Wednesday. “China maintains that countries need to follow the principles of a market economy and international trade rules.”

The Chinese Ministry of Commerce imposed rare earth export restrictions on October 9. It cited national security and the civilian and military use. The measure expanded controls to five more elements, in addition to seven others. China now has restrictions on 12 out of 17 rare earth element exports.

“The new measures mark a sharp escalation in Beijing’s long-running strategy to weaponize its dominance in rare earths,” Gracelin Baskaran, director of the Critical Minerals Security Program, at the Centre for Strategic and International Studies, said on October 9.

Trump Launches $12B Project Vault

The US has taken these actions to curb China’s dominance of the critical mineral supply chain.

The US will deploy hundreds of billions of dollars in capital, between debt and equity, into the mining sector, David Copley, Senior Director at the National Security Council (NSC), said at the meeting in Washington. He oversees the NSC’s international economics and supply‑chain/critical minerals portfolio.

US President Donald Trump launched the $12 billion Project Vault to stockpile critical minerals on February 2. A bipartisan group of US lawmakers in January introduced a bill to encourage domestic mining and refining. The Critical Mineral Dominance Act passed in the House of Representatives on Wednesday.

This is “a major step toward ensuring our domestic critical mineral dominance and breaking China’s control of global critical mineral supply chains,” Subcommittee on Energy and Mineral Resources Chairman Pete Stauber (R-Minn.) said. “We will help ensure the United States is a place where we can mine, process, and refine the critical minerals needed to compete and win in the 21st Century.”

The US has recognized that its policies have been counterproductive.

“We’ve had some of the worst mine development timelines in the world,” Copley said. “In the United States, for a number of decades, we’ve neglected our mining sector and, frankly, been happy to outsource mining activities to others around the world.”

Copper Supply Fears Raise Prices

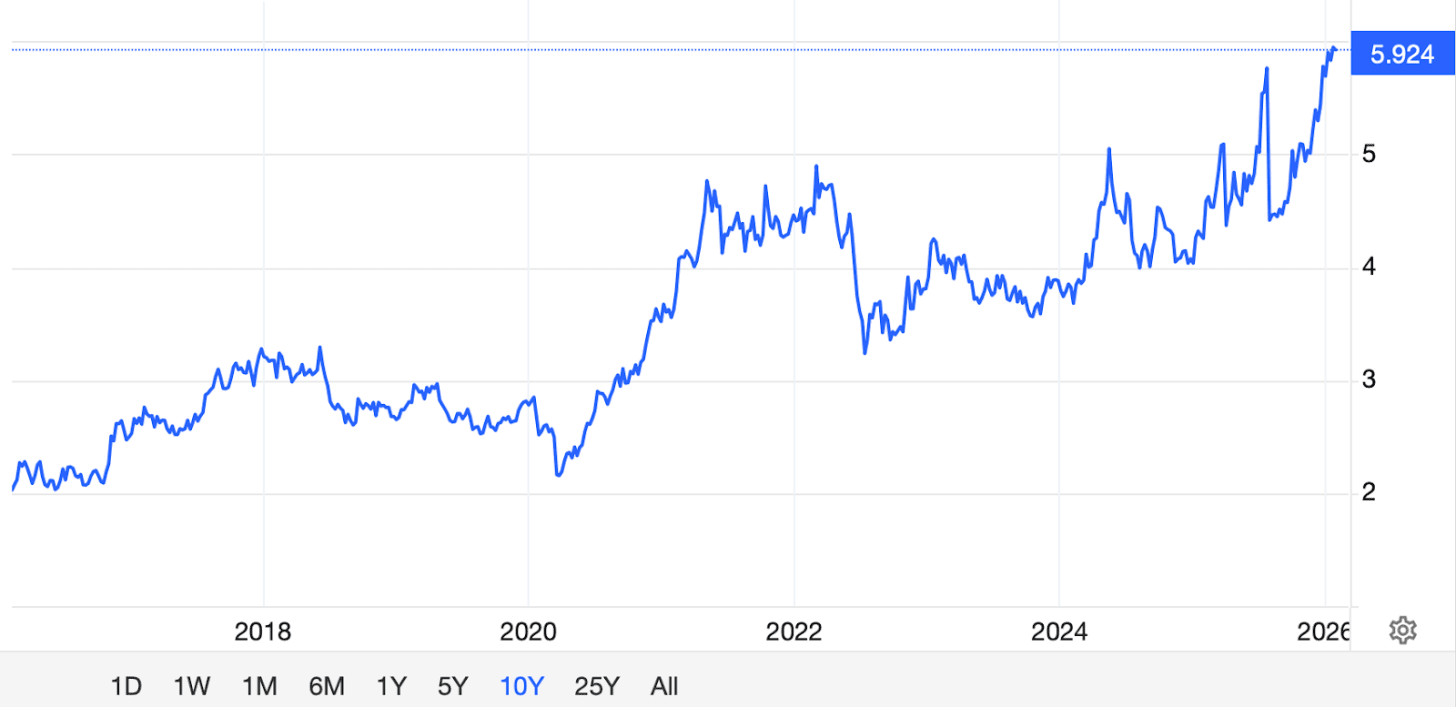

As governments move to secure supply chains, markets are already reacting most sharply in one metal: copper. Prices of copper prices hit a record high above $13,000 per ton on January 29, amid supply fears.

Demand Expected to Surge

Copper demand will rise 50% to 42 million metric tons by 2040. S&P Global has estimated copper supply will decline by 7% between 2025 and 2040. Demand will outstrip supply by 10 million tons by 2040.

Copper is an essential component for AI data centers, electric vehicles, and defense arsenals. AI could be a “major growth area” for copper, according to S&P. China controlled about 53% of the world’s copper processing in 2025.

Humanoid robots could drive copper demand up by 1.6 million tons per year by 2040. That equivalent to 6% of today’s total demand.

Venture capitalist Chamath Palihapitiya said copper remains “the only game in town” for a scarce, high-demand material, absent superconductors.

Tech Companies Search for Copper Supplies

Forecasts of copper shortages have spurred companies to secure supplies. There is increasing concerns that it will impact the rollout of data centers and AI.

Amazon Inc. (NASDAQ:AMZN) on January 16, inked a two-year deal with Rio Tinto Group (RIO)’s Nuton venture. The pact secures tens of thousands of tons from Arizona’s Resolution mine for data centers. It is the first new US copper output in over a decade.

Mitsubishi Corporation (TYO:8058) invested $600M for a 30% stake in Arizona’s Copper World project of Hudbay Minerals (NYSE:HBM). This positioned it as the US’s third-largest copper mine by 2029.

In May 2025, Peter Thiel-backed Apeiron Investment Group invested in Canadian-based Super Copper Corp.. It is a junior copper company conducting exploration work in Chile.

Copper Miners Ramp-Up Output

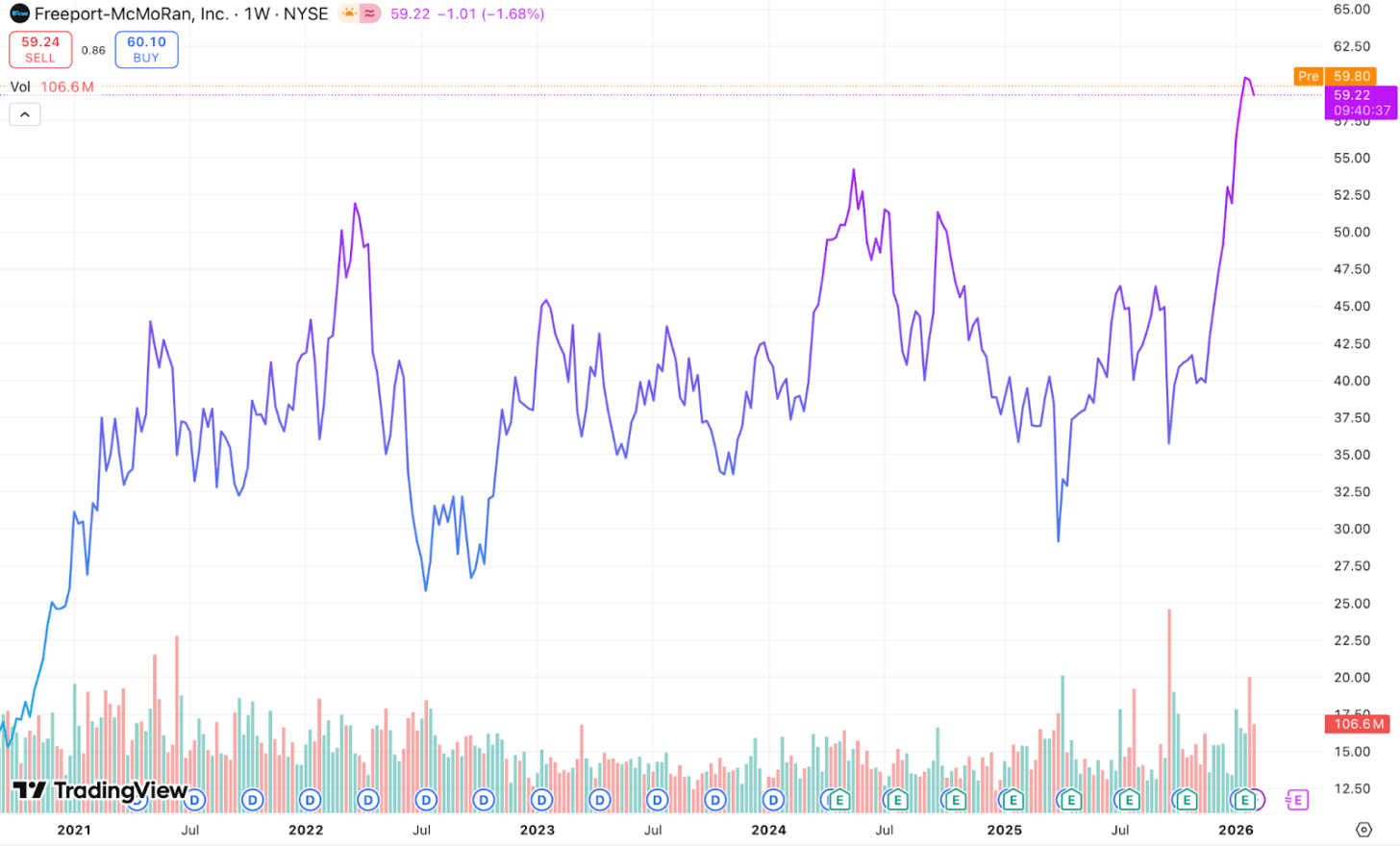

Freeport-McMoRan Inc. (NYSE:FCX), BHP Group Ltd. (NYSE:BHP), Teck Resources (NYSE:TECK), and Rio Tinto Group (NYSE:RIO) have ramped up output.

Freeport-McMoRan boosted US copper production 5% in Q4 2025, mainly from leaching technologies at its Arizona mines. Rio Tinto has raised production by 11% to 883,000 tons, beating guidance via the Oyu Tolgoi ramp-up in Mongolia.

Copper supplies are susceptible to disruptions. Freeport-McMoRan declared force majeure at its Grasberg mine, the world’s second-largest copper operation, after an accident killed two workers, with five missing, on September 8.

FCX’s shares climbed 15% in 2025 on demand forecasts. Teck Resources’ share price surged from $19 in mid-2021 to over $53 in February 2026. Since its inception in 2023, iShares Copper and Metals Mining ETF (NASDAQ:ICOP) has more than doubled from $24 to $50.

AI, Data Centers, EVs Spur Copper Demand

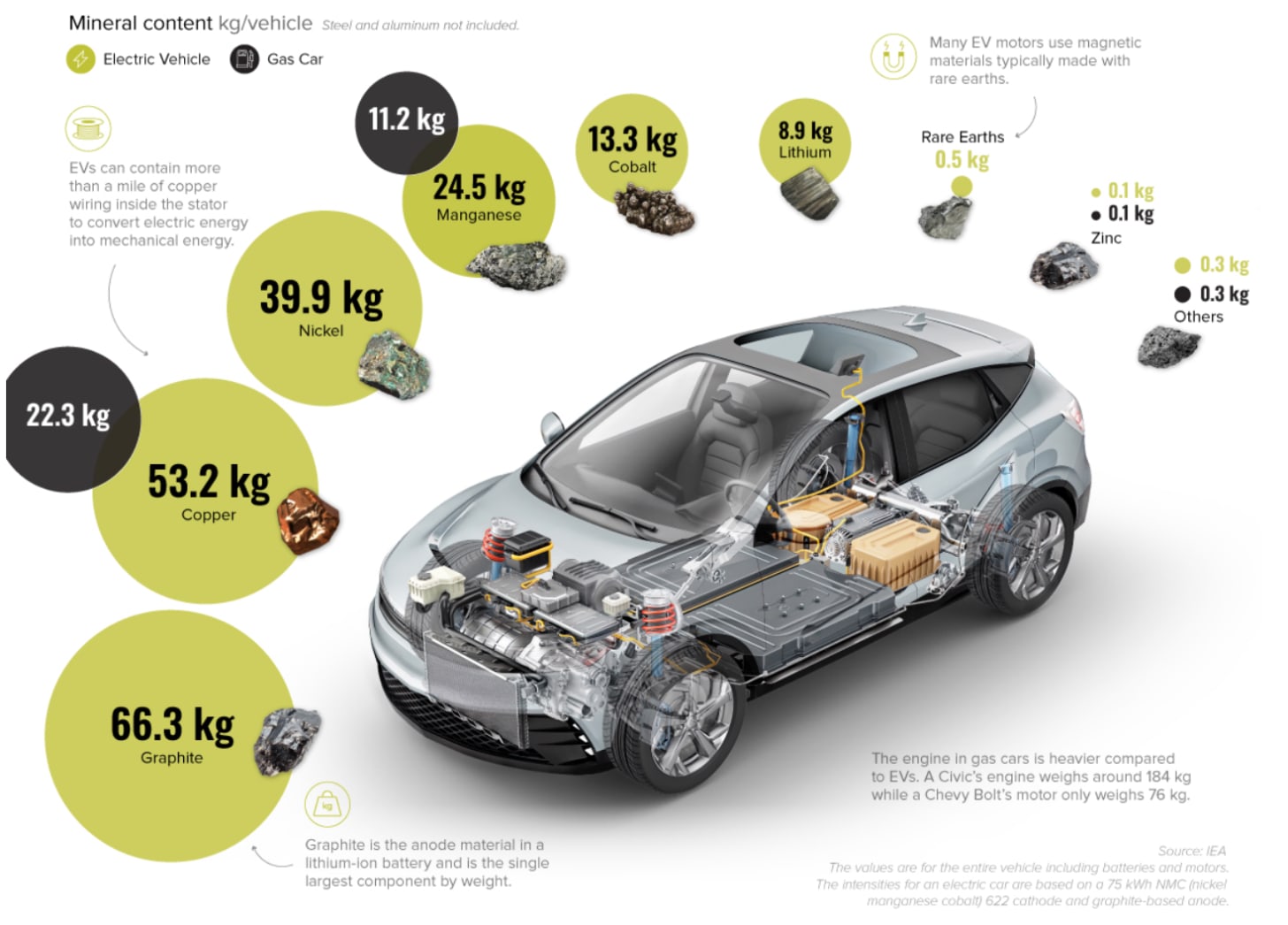

Artificial Intelligence, data centers, and electric vehicles have spurred demand for copper, and other critical minerals. A single data center can use between 5,000 and 15,000 tons of copper.

Hyperscale data centers built for AI can require up to 50,000 tons of copper per facility, the Copper Development Association said.

Microsoft Corp’s (NASDAQ:MSFT) data center in Chicago used 2,177 tons of copper for construction. That amounts to roughly 27 tons per megawatt of power capacity.

Some Tesla cars use up to 82 kg of copper. Tesla’s Model S uses a mile of copper just in connecting the battery packs to all electronics. An internal combustion engine car uses about 20 kg.

“The AI revolution we’re living through is leading to record historic demand for everything from copper to cobalt, nickel, zinc, aluminum, silicon, and virtually every element on the periodic table,” Jacob Helberg, the Under Secretary of State for Economic Affairs, said during the ministerial meeting in Washington.

Disclaimer: Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments