The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Dolly Varden Silver Corp (NYSE:DVS)

- Precious metals shares traded lower on Thursday as gold and silver sell off from recent strength. The company’s stock fell around 14% over the past five days and has a 52-week low of $2.30.

- RSI Value: 29.7

- DVS Price Action: Shares of Dolly Varden Silver dipped 10.4% to close at $4.22 on Thursday.

- Edge Stock Ratings: 91.92 Momentum score with Value at 93.51.

- Benzinga Pro’s charting tool helped identify the trend in DVS stock.

Vizsla Silver Corp (NYSE:VZLA)

- Precious metals shares traded lower on Thursday as gold and silver sell off from recent strength. The company’s stock fell around 27% over the past month and has a 52-week low of $1.69.

- RSI Value: 26.2

- VZLA Price Action: Shares of Vizsla Silver fell 13.2% to close at $4.29 on Thursday.

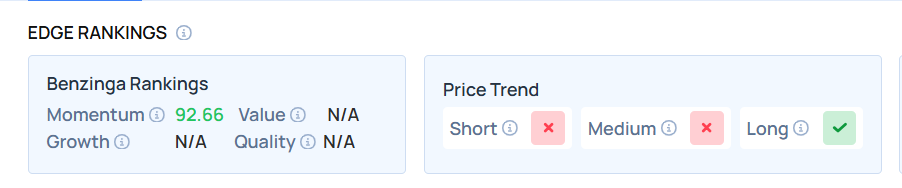

- Edge Stock Ratings: 92.56 Momentum score.

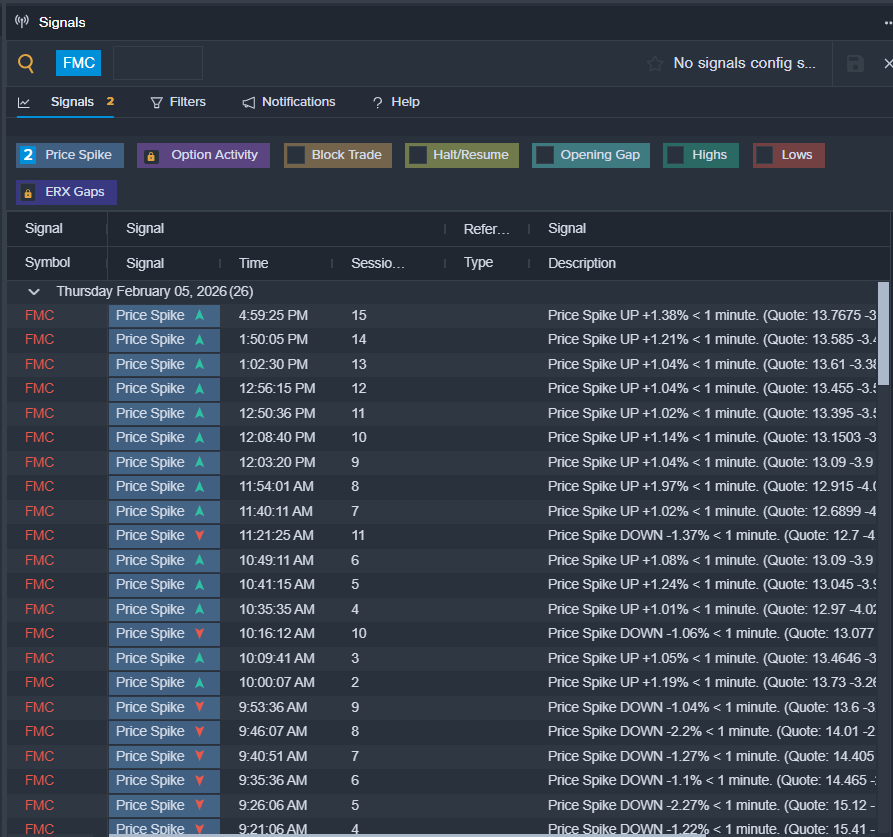

FMC Corp (NYSE:FMC)

- On Feb. 4, FMC reported worse-than-expected fourth-quarter sales results and issued its FY26 guidance below estimates. Also, the company issued its first-quarter guidance below estimates. “Our focus in 2026 is on executing our operational priorities, which include strengthening the balance sheet and improving the overall competitiveness of our portfolio,” said Pierre Brondeau, chairman, chief executive officer and president. “In parallel, the Board has authorized the exploration of strategic options to maximize shareholder value and to help ensure our valuable assets and pipeline are positioned for long-term success.” The company’s stock fell around 13% over the past five days and has a 52-week low of $12.17.

- RSI Value: 23.68

- FMC Price Action: Shares of FMC fell 19.5% to close at $13.67 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in FMC shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Photo via Shutterstock

Recent Comments