U.S. stock futures advanced on Friday following Thursday’s sharp sell-off. Futures of major benchmark indices were higher.

Meanwhile, President Donald Trump announced the launch of a new website aimed at bringing down drug prices. The website will offer consumers access to more affordable prescription medications.

The January jobs report, which was scheduled to be released today, will be delayed to next week on Wednesday, following the partial government shutdown at the beginning of this week.

The 10-year Treasury bond yielded 4.20%, and the two-year bond was at 3.48%. The CME Group’s FedWatch tool‘s projections show markets pricing a 81.3% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | 0.23% |

| S&P 500 | 0.40% |

| Nasdaq 100 | 0.52% |

| Russell 2000 | 0.95% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Friday. The SPY was up 0.37% at $680.10, while the QQQ advanced 0.47% to $599.84.

Stocks In Focus

Amazon.com

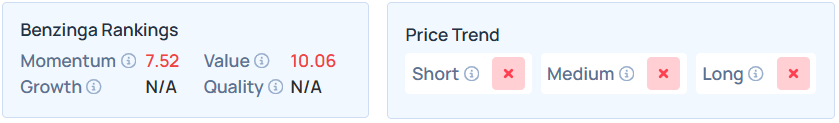

- Amazon.com Inc. (NASDAQ:AMZN) dropped 8.39% in premarket on Friday after reporting mixed fourth-quarter financial results on Thursday after market close.

- AMZN maintains a weaker price trend over the short, medium, and long terms, with a solid quality ranking, as per Benzinga’s Edge Stock Rankings.

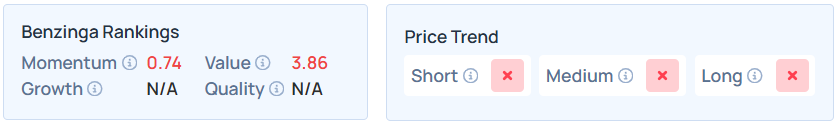

- Reddit Inc. (NYSE:RDDT) jumped 11.22% after announcing better-than-expected fourth-quarter financial results and issuing a strong sales forecast for the first quarter.

- Benzinga’s Edge Stock Rankings indicate that RDDT maintains a weaker price trend over the short, medium, and long terms, with a poor value ranking.

Strategy

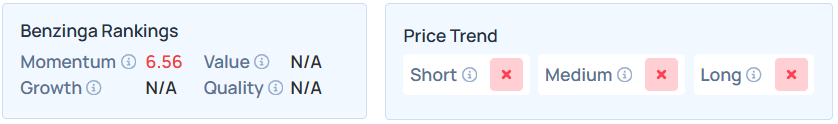

- Strategy Inc. (NASDAQ:MSTR) jumped 6.98%, following a sharp decline on Thursday after it reported fourth-quarter revenue and EPS beating analysts’ estimates.

- MSTR maintains a weaker price trend over the short, medium, and long terms with a poor value ranking, as per Benzinga’s Edge Stock Rankings.

Affirm Holdings

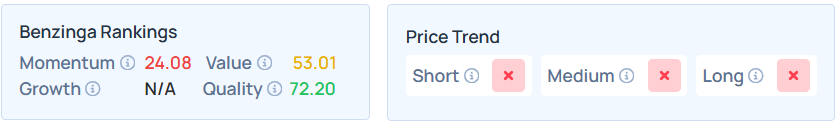

- Affirm Holdings Inc. (NASDAQ:AFRM) surged 0.35% after exceeding market expectations by reporting quarterly earnings of 37 cents per share on $1.12 billion in revenue while simultaneously announcing a new partnership to provide transparent hardware financing for Virgin Media O2.

- Benzinga’s Edge Stock Rankings indicate that AFRM maintains a weak price trend over the long, medium, and short terms, with a solid growth ranking.

Roblox

- Roblox Corp. (NYSE:RBLX) surged 14.41% after the company released its fourth-quarter earnings report, beating estimates across most metrics.

- RBLX maintains a weaker price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings.

Cues From Last Session

Consumer discretionary, materials, and information technology stocks recorded the biggest losses on Thursday, while consumer staples and utilities bucked the trend to close higher.

| Index | Performance (+/-) | Value |

| Dow Jones | -1.20% | 48,908.72 |

| S&P 500 | -1.23% | 6,798.40 |

| Nasdaq Composite | -1.59% | 22,540.59 |

| Russell 2000 | -1.79% | 2,577.65 |

Insights From Analysts

Scott Wren, Senior Global Market Strategist at the Wells Fargo Investment Institute, maintains a resilient outlook for the U.S. economy in 2026. He frequently employs a nautical analogy, describing the domestic economy as a “gigantic aircraft carrier” that is difficult to knock off course.

Wren expects the “American Economy” to maintain a “steady growth course” characterized by moderating inflation. Key drivers for this continued progress include:

- AI Infrastructure: Massive capital expenditures on data centers and the power grid.

- Fiscal Incentives: Over $190 billion in consumer tax cuts from the “One Big Beautiful Bill Act”.

- Corporate Performance: Anticipation of a fourth consecutive year of record S&P 500 earnings.

While acknowledging that the year has begun with a “swirl of headlines,” Wren believes the economy will weather any potential volatility. He views market pullbacks not as a reason for retreat, but as “opportunities to increase exposure” to favored sectors like Financials, Industrials, and Utilities.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Friday.

- January’s U.S. employment report, unemployment rate, and hourly wages data, which was supposed to be released today, has been delayed to next Wednesday, Feb. 11, following a partial government shutdown that temporarily paused the agency’s operations at the beginning of this week.

- February’s preliminary consumer sentiment data will be released at 10:00 a.m., and consumer credit data will be out by 3:00 p.m. Fed Vice Chair Philip Jefferson will speak at 12:00 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 1.44% to hover around $64.20 per barrel.

Gold Spot US Dollar rose 1.72% to hover around $4,862.74 per ounce. Its last record high stood at $5,595.46 per ounce. The U.S. Dollar Index spot was 0.01% lower at the 97.8120 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 7.86% higher at $65,760.87 per coin.

Asian markets closed mixed on Friday, as India’s Nifty 50 and Japan’s Nikkei 225 indices rose. While Hong Kong’s Hang Seng, China’s CSI 300, Australia’s ASX 200, and South Korea’s Kospi indices fell. European markets were also mixed in early trade.

Photo courtesy: Shutterstock

Recent Comments