As of Feb. 5, 2026, two stocks in the materials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

Almonty Industries Inc (NASDAQ:ALM)

- On Feb. 4, DA Davidson analyst Griffin Bryan maintained Almonty Industries with a Buy and raised the price target from $12 to $18. The company’s stock gained around 39% over the past month and has a 52-week high of $13.82.

- RSI Value: 74.1

- ALM Price Action: Shares of Almonty Industries fell 0.2% to close at $13.36 on Wednesday.

Air Products and Chemicals Inc (NYSE:APD)

- On Jan. 30, Air Products & Chemicals reported better-than-expected first-quarter financial results. Chief Executive Officer Eduardo Menezes said, “We had strong results from the base business, with a 10 percent increase in adjusted EPS compared to the prior year period and also posted a 12 percent improvement in adjusted operating income despite helium headwinds in the quarter. This is a solid start as the Air Products team continues to focus on unlocking earnings growth, optimizing large projects and maintaining capital discipline.” The company’s stock gained around 12% over the past five days and has a 52-week high of $336.64.

- RSI Value: 75.9

- APD Price Action: Shares of Air Products rose 3.1% to close at $286.59 on Wednesday.

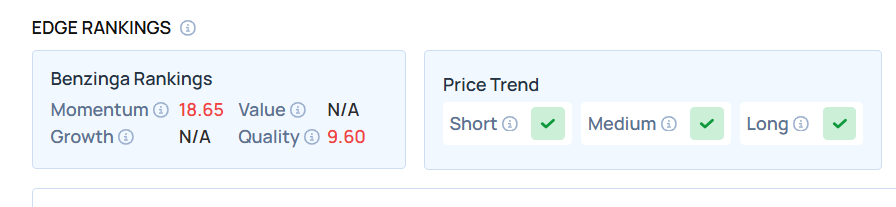

- Edge Stock Ratings: 18.65 Momentum score.

Don’t miss out on the full BZ Edge Rankings—compare all the key stocks now.

Photo via Shutterstock

Recent Comments