Boston Scientific Corporation (NYSE:BSX) will release earnings for its fourth quarter before the opening bell on Wednesday, Feb. 4.

Analysts expect the Marlborough, Massachusetts-based company to report quarterly earnings of 78 cents per share. That’s up from 70 cents per share in the year-ago period. The consensus estimate for Boston Scientific’s quarterly revenue is $5.28 billion (it reported $4.56 billion last year), according to Benzinga Pro.

The U.S. Food and Drug Administration (FDA), last month, said it is aware that Boston Scientific has alerted customers to remove certain AXIOS stents and electrocautery-enhanced delivery systems from use and distribution, citing concerns that could pose a high risk to patients during procedures.

Shares of Boston Scientific fell 0.3% to close at $91.62 on Tuesday.

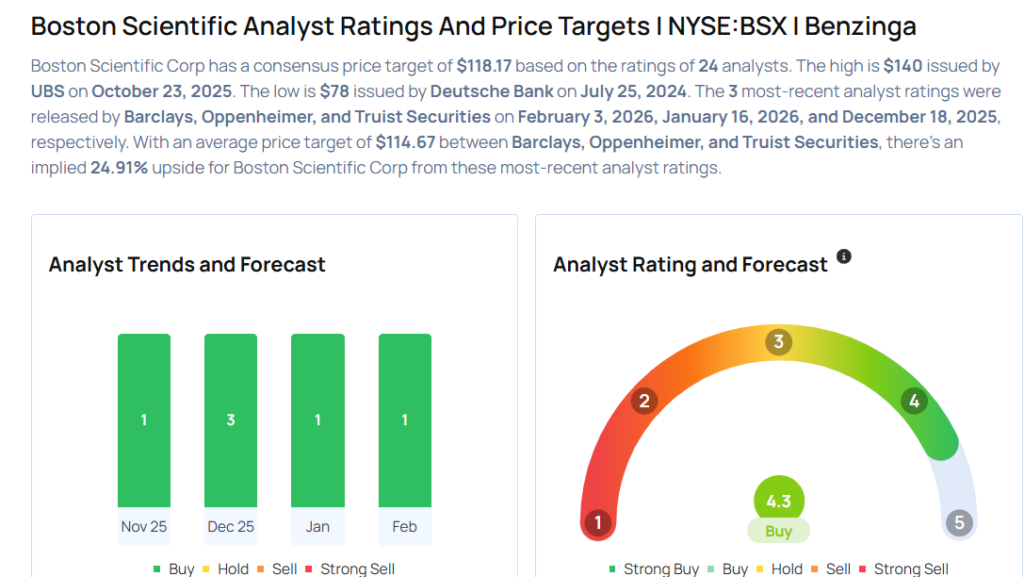

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

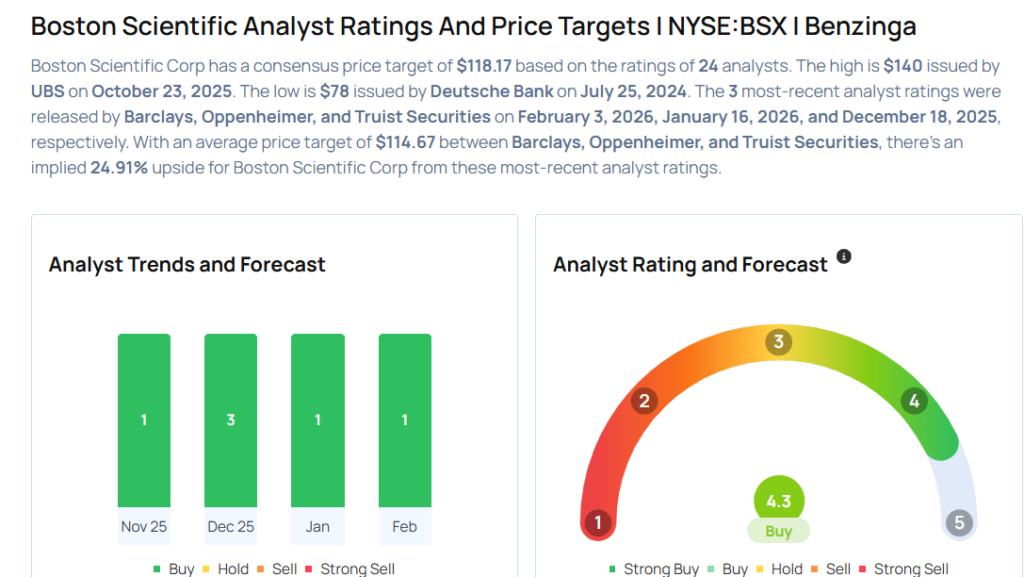

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Barclays analyst Matt Miksic maintained an Overweight rating and cut the price target from $136 to $124 on Feb. 3, 2026. This analyst has an accuracy rate of 65%.

- Oppenheimer analyst Suraj Kalia maintained an Outperform rating and cut the price target from $125 to $100 on Jan. 16, 2026. This analyst has an accuracy rate of 62%.

- Truist Securities analyst Richard Newitter maintained a Buy rating and slashed the price target from $130 to $120 on Dec. 18, 2025. This analyst has an accuracy rate of 68%.

- Canaccord Genuity analyst William Plovanic maintained a Buy rating and cut the price target from $132 to $131 on Dec. 17, 2025. This analyst has an accuracy rate of 57%.

- RBC Capital analyst Shagun Singh maintained an Outperform rating and raised the price target from $125 to $130 on Dec. 17, 2025. This analyst has an accuracy rate of 59%

Considering buying BSX stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments