On Tuesday, Advanced Micro Devices Inc. (NASDAQ:AMD) CEO Lisa Su said the chipmaker is limiting its China revenue outlook to $100 million in the first quarter as U.S. export licensing for advanced AI chips remains uncertain.

AMD Limits China Outlook

During the company’s fourth-quarter earnings call, AMD said it is not assuming any additional revenue from China beyond the $100 million it expects to generate in the first quarter of 2025, citing ongoing uncertainty around U.S. export licenses for its advanced AI chips.

Su said recent China-related sales were tied to a previously approved license and should not be viewed as a signal of broader near-term momentum in the region.

“We were pleased to have some MI308 sales in the fourth quarter,” Su said. “Those orders were actually from very early in 2025” and were approved through the licensing process.

MI308 Sales Approved, But No Further China Revenue Assumed

Su further stated that AMD recorded some MI308 accelerator revenue in the fourth quarter and is forecasting $100 million in China-related sales for the first quarter.

Beyond that, the company is not building any incremental China revenue into its outlook.

“We are not forecasting any additional revenue from China just because it’s a very dynamic situation. So given that it’s a dynamic situation, we’re still waiting for we’ve submitted licenses for the MI325,” Su stated.

China Strategy Reflects Broader Regulatory Caution

U.S. export controls on advanced AI chips have tightened in recent years, forcing semiconductor companies to carefully manage product road maps and regional revenue expectations.

AMD posted fourth-quarter revenue of $10.27 billion, topping Wall Street expectations of $9.67 billion, while adjusted earnings came in at $1.53 per share, exceeding the $1.32 per-share estimate, according to Benzinga Pro.

Price Action: AMD shares closed Tuesday at $242.11, down 1.69% and fell further in pre-market trading to $224.50, a drop of 7.20%, according to Benzinga Pro.

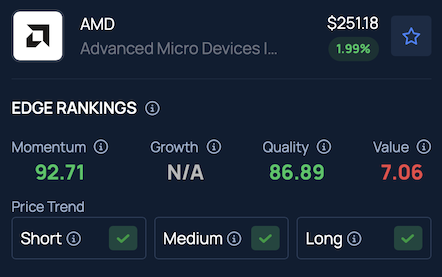

AMD shows a stronger price trend across the short, medium and long term, though it carries a weak value ranking, according to Benzinga’s Edge Stock Rankings.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Piotr Swat via Shutterstock

Recent Comments