During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the information technology sector.

HP Inc (NYSE:HPQ)

- Dividend Yield: 6.06%

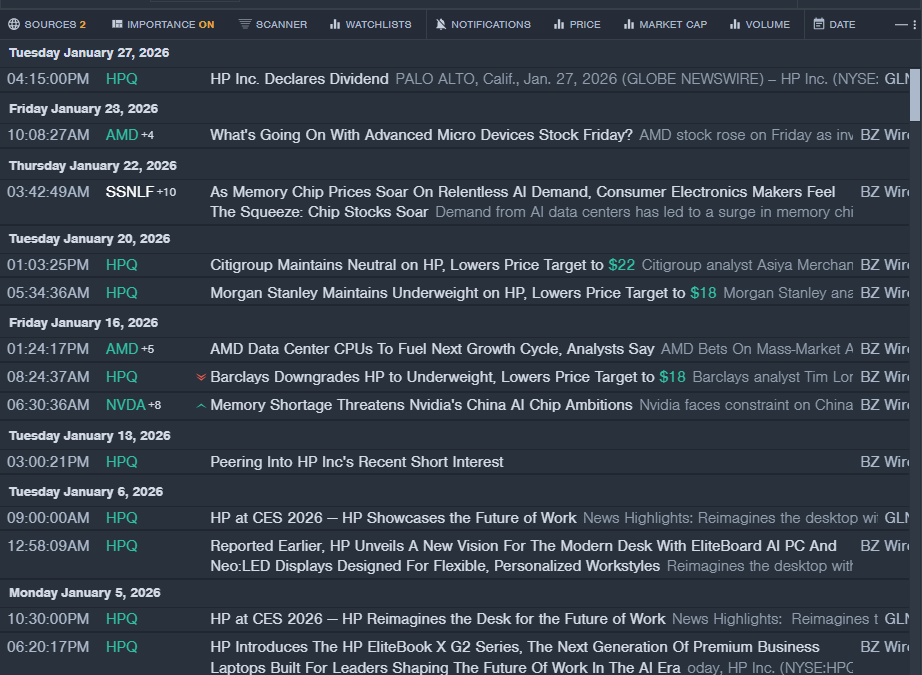

- Citigroup analyst Asiya Merchant maintained a Neutral rating and slashed the price target from $25 to $22 on Jan. 20, 2026. This analyst has an accuracy rate of 89%.

- Morgan Stanley analyst Erik Woodring maintained the stock with an Underweight rating and decreased the price target from $20 to $18 on Jan. 20, 2026. This analyst has an accuracy rate of 81%

- Recent News: On Nov. 25, HP reported quarterly earnings of 93 cents per share, which beat the analyst estimate of 92 cents.

- Benzinga Pro’s real-time newsfeed alerted to latest HPQ news.

Skyworks Solutions Inc (NASDAQ:SWKS)

- Dividend Yield: 5.00%

- Morgan Stanley analyst Joseph Moore maintained an Equal-Weight rating and cut the price target from $89 to $68 on Feb. 2, 2026. This analyst has an accuracy rate of 79%.

- B. Riley Securities analyst Craig Ellis maintained a Neutral rating and cut the price target from $70 to $60 on Jan. 26, 2026. This analyst has an accuracy rate of 83%

- Recent News: Skyworks Solutions said it will host a conference call with analysts to discuss its first quarter fiscal 2026 results on Feb. 3.

- Benzinga Pro’s real-time newsfeed alerted to latest SWKS news

Opera Ltd (NASDAQ:OPRA)

- Dividend Yield: 5.67%

- Goldman Sachs analyst Eric Sheridan maintained a Buy rating and cut the price target from $24.5 to $21.5 on Jan. 13, 2026. This analyst has an accuracy rate of 77%.

- Lake Street analyst Mark Argento maintained a Buy rating and raised the price target from $23 to $24 on April 29, 2025. This analyst has an accuracy rate of 55%.

- Recent News: On Feb. 2, Opera issued strong FY25 revenue guidance.

- Benzinga Pro’s real-time newsfeed alerted to latest OPRA news

Photo via Shutterstock

Recent Comments