PayPal Holdings, Inc. (NASDAQ:PYPL) will release earnings for its fourth quarter before the opening bell on Tuesday, Feb. 3.

Analysts expect the San Jose, California-based company to report quarterly earnings of $1.29 per share. That’s up from $1.19 per share in the year-ago period. The consensus estimate for PayPal’s quarterly revenue is $8.78 billion (it reported $8.37 billion last year), according to Benzinga Pro.

The company has beaten analyst estimates for revenue in eight of the last 10 quarters, including in two straight quarters.

Shares of PayPal fell 0.7% to close at $52.33 on Monday.

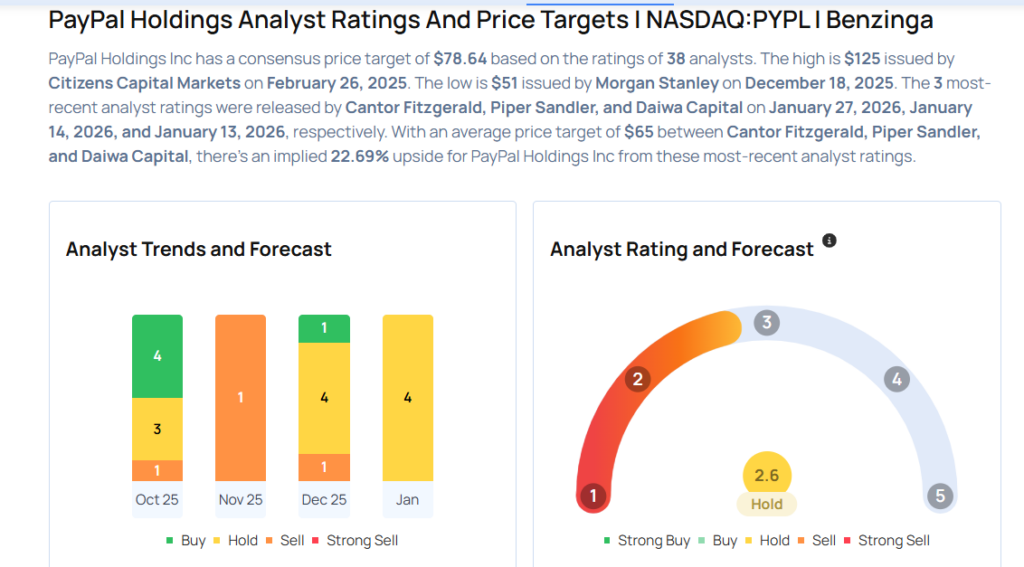

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Cantor Fitzgerald analyst Ramsey El-Assal initiated coverage on the stock with a Neutral rating and a price target of $60 on Jan. 27, 2026. This analyst has an accuracy rate of 61%.

- Piper Sandler analyst Patrick Moley maintained a Neutral rating and cut the price target from $76 to $74 on Jan. 14, 2026. This analyst has an accuracy rate of 85%.

- Susquehanna analyst James Friedman maintained a Positive rating and slashed the price target from $94 to $90 on Jan. 8, 2026. This analyst has an accuracy rate of 53%.

- Citigroup analyst Bryan Keane maintained a Neutral rating and cut the price target from $78 to $60 on Jan. 5, 2026. This analyst has an accuracy rate of 68%.

- Mizuho analyst Dan Dolev maintained an Outperform rating and lowered the price target from $84 to $75 on Dec. 22, 2025. This analyst has an accuracy rate of 65%

Considering buying PYPL stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments