U.S. stock futures were higher on Tuesday following Monday’s positive close. Futures of major benchmark indices were higher.

Gold and Silver staged a rebound from Monday’s low; however, Bitcoin (CRYPTO: BTC) was still trading below the $80,000 per coin mark.

Meanwhile, the federal government entered a partial shutdown Saturday, which will affect the release of economic data from the Bureau of Labor Statistics (BLS). The House is set to vote on a crucial funding bill on Tuesday, but the bill’s passage remains uncertain due to a lack of support from both Democrats and some Republicans.

Additionally, on Monday, President Donald Trump announced a major U.S.–India trade agreement with Prime Minister Narendra Modi that lowers reciprocal tariffs on the South Asian nation from 25% to 18%.

The 10-year Treasury bond yielded 4.29%, and the two-year bond was at 3.58%. The CME Group’s FedWatch tool‘s projections show markets pricing a 91% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | 0.002% |

| S&P 500 | 0.20% |

| Nasdaq 100 | 0.48% |

| Russell 2000 | 0.05% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Tuesday. The SPY was up 0.18% at $696.69, while the QQQ advanced 0.47% to $629.07.

Stocks In Focus

Palantir Technologies

- Palantir Technologies Inc. (NASDAQ:PLTR) jumped 10.84% in premarket on Tuesday after reporting better-than-expected fourth-quarter financial results and issuing FY26 sales guidance above estimates.

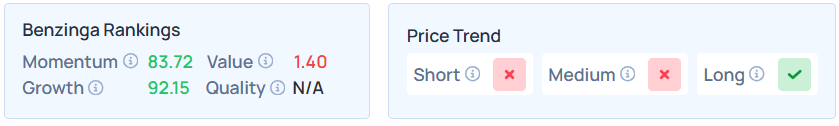

- PLTR maintains a stronger price trend over the long term but a weak trend in the short and medium terms, with a solid growth ranking, as per Benzinga’s Edge Stock Rankings.

Teradyne

- Teradyne Inc. (NASDAQ:TER) surged 22.23% after its fourth-quarter earnings report, beating estimates on the top and bottom lines. It sees first-quarter adjusted EPS between $1.89 to $2.25, versus the $1.24 analyst estimate, and revenue in the range of $1.15 billion to $1.25 billion, versus the $927.72 million estimate.

- Benzinga’s Edge Stock Rankings indicate that TER maintains a stronger price trend in the medium, short, and long terms, with a poor value ranking.

Advanced Micro Devices

- Advanced Micro Devices Inc. (NASDAQ:AMD) shares rose 2.33% ahead of its earnings scheduled to be released after the closing bell. Analysts are expecting earnings of $1.32 per share on revenue of $9.67 billion.

- AMD maintains a stronger price trend over the short, medium, and long terms with a solid quality ranking, as per Benzinga’s Edge Stock Rankings.

SanDisk

- SanDisk Corp. (NASDAQ:SNDK) gained 4.24%, continuing to surge following its blockbuster earnings last week. In addition to the impressive results, it provided optimistic guidance for the third quarter, projecting adjusted earnings per share between $12.00 and $14.00, compared to the consensus estimate of $3.63.

- Benzinga’s Edge Stock Rankings indicate that SNDK maintains a strong price trend over the short, medium, and long terms.

PepsiCo

- PepsiCo Inc. (NASDAQ:PEP) was 1.11% lower ahead of its earnings, scheduled to be released before the opening bell. Analysts were expecting earnings of $2.24 per share on the revenue of $28.97 billion.

- PEP maintains a stronger price trend over the short, medium, and long terms with a poor value ranking, as per Benzinga’s Edge Stock Rankings.

Cues From Last Session

Consumer staples, industrials, and financial stocks led the S&P 500’s majority gains on Monday, while utilities and energy stocks diverged to close lower.

| Index | Performance (+/-) | Value |

| Dow Jones | 1.05% | 49,407.66 |

| S&P 500 | 0.54% | 6,976.44 |

| Nasdaq Composite | 0.56% | 23,592.11 |

| Russell 2000 | 1.02% | 2,640.28 |

Insights From Analysts

LPL Financial anticipates that 2026 will be defined by a “policy-driven market regime” where fiscal and monetary decisions, rather than traditional business cycles, steer market direction.

While the economy is expected to experience a “modest slowdown” in early 2026, LPL predicts a rebound later in the year, steering clear of a full-blown recession.

Regarding the stock market, LPL forecasts the bull market will likely extend its run, targeting a fair value range for the S&P 500 between 7,300 and 7,400 by year-end.

This growth is expected to be fueled by “ongoing enthusiasm around artificial intelligence” and continued Federal Reserve rate cuts. However, they caution that high valuations mean “gains may be more tempered” than in previous years.

Key Perspectives from LPL:

- On Market Drivers: “In 2026, volatility will continue. Encouragingly, we anticipate that policy will provide supportive conditions for markets”.

- On Strategy: “Monetary decision-makers should continue to engage in easing policy as economic conditions downshift and inflation remains contained”.

- On Investor Behavior: LPL Research emphasizes that “patience is essential” to avoid overreacting to the sharp price fluctuations typical of a momentum-driven market.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Tuesday.

- December’s job opening data will be delayed due to the partial shutdown, and January’s ISM services data will be released by 10:00 a.m. Additionally, January’s S&P final U.S. services PMI data will be out by 9:45 a.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 1.09% to hover around $61.46 per barrel.

Gold Spot US Dollar rose 5.08% to hover around $4,896.65 per ounce. Its last record high stood at $5,595.46 per ounce. The U.S. Dollar Index spot was 0.14% lower at the 97.4920 level.

Meanwhile, Bitcoin was trading 1.01% higher at $77,922.18 per coin.

Asian markets closed higher on Tuesday as India’s Nifty 50, Hong Kong’s Hang Seng, China’s CSI 300, Australia’s ASX 200, Japan’s Nikkei 225, and South Korea’s Kospi indices rose. European markets were higher in early trade.

Photo courtesy: Shutterstock

Recent Comments