Enter: Kevin Warsh

After months of discussion and endless speculation, we finally know who Trump’s nominee for the next Fed chair will be- Kevin Warsh, one of the more hawkish nominees going into this much-anticipated decision. A Fed Governor during the Financial Crisis turned Fed critic after his 2011 departure, who would then go on to work under one of the most prolific macro investors of all time- Stanley Druckenmiller.

How did the markets react?

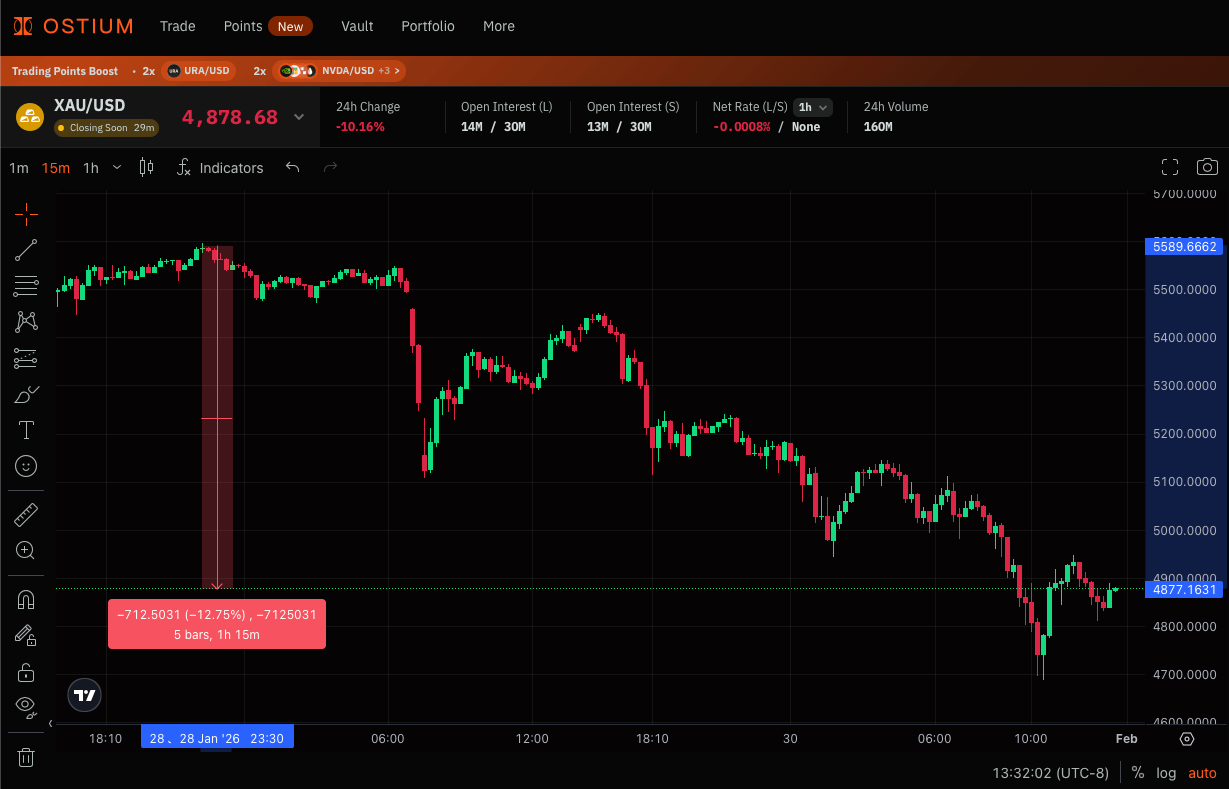

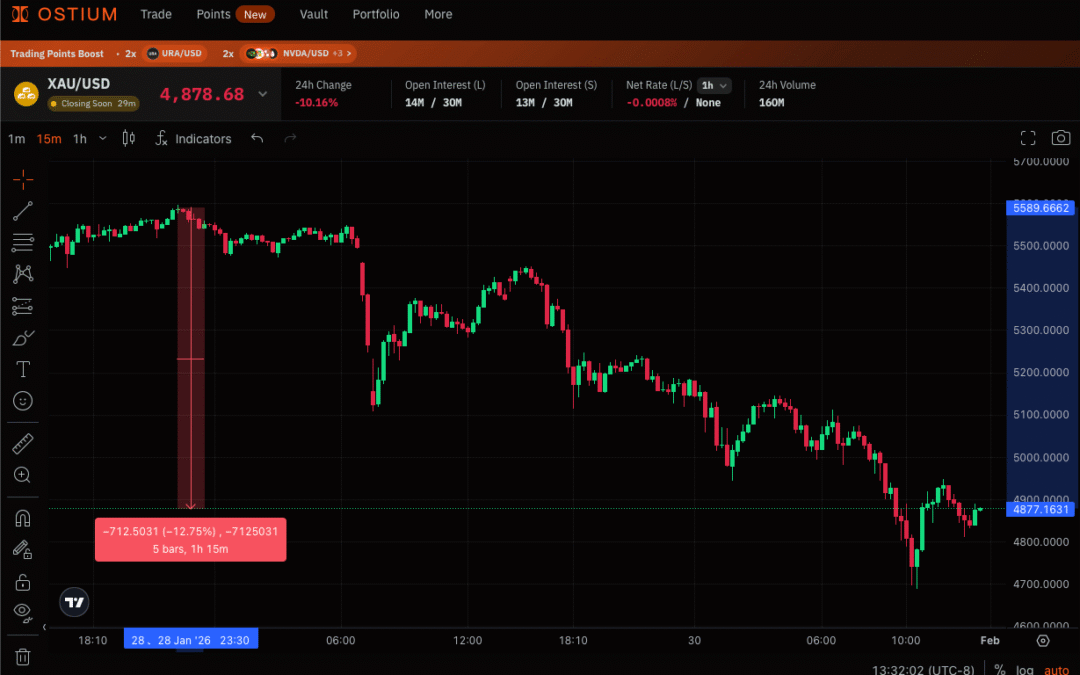

It depends on what asset(s) you own. If you owned treasury bonds (namely, the front end), you were probably relieved. If you were long the Euro, you were probably rushing to close your short dollar positions. If you owned silver and gold? You were probably having one of the worst days that you’ve ever had, as months’ worth of profits evaporated in a single trading day.

The New Fed Chair is In… And… Silver Crashes 35%

Nearly $4 trillion in market cap was wiped out of the gold market since yesterday’s intraday high

What about Bitcoin?

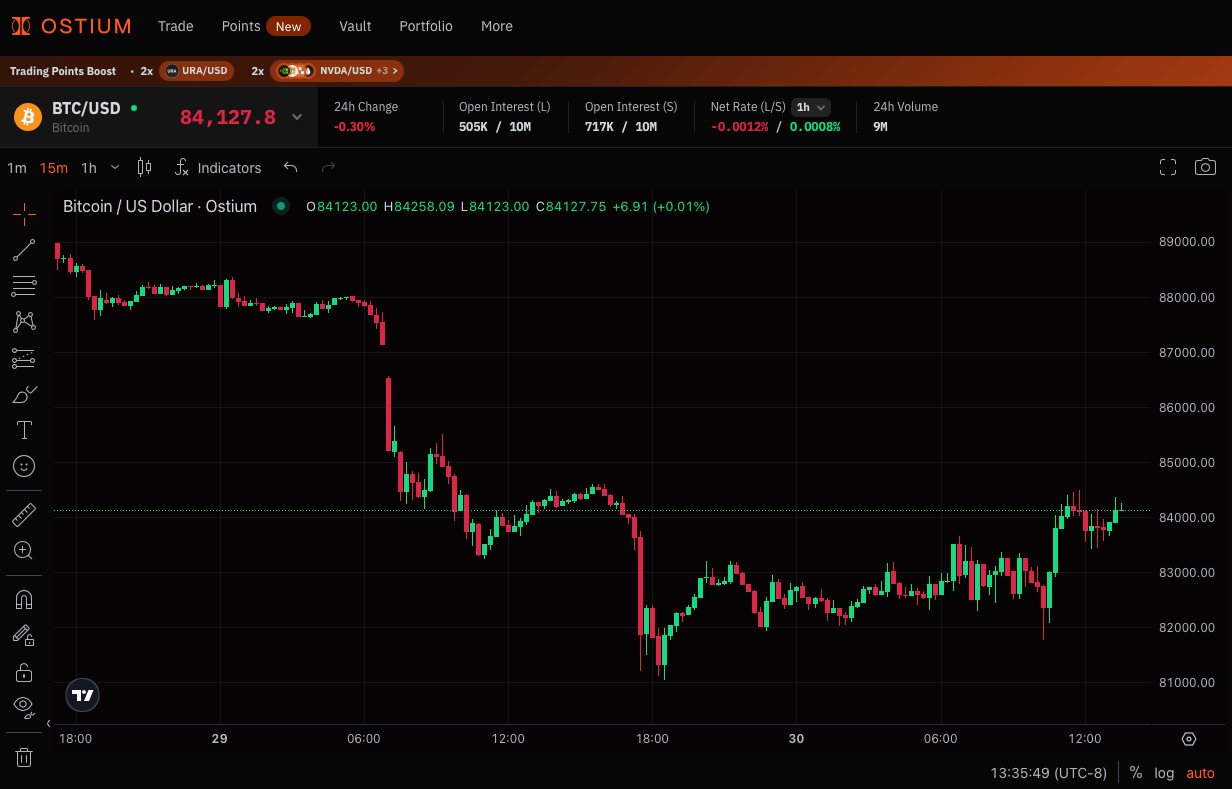

But what about if you owned Bitcoin? Surprisingly, despite the overall hawkish views of Mr. Warsh, bitcoin held up quite well after bouncing at $81,000 earlier in the day and finished down just a mere 1%, outperforming silver by over 30% today.

In fact, once you look through the general tilt of his views, Mr. Warsh has voiced explicit support for bitcoin in prior conversations. One such interview, Mr. Warsh said, “If you’re under 40, Bitcoin is your new gold.”

In another, Warsh said that bitcoin is “an important asset that can help inform policymakers when they’re doing things right and wrong” and a “policeman for policy.”

Bitcoin held up surprisingly well, considering the significant weakness in equities and severe sell-offs in precious metals

Debasement Trade = Over?

What about liquidity? What about the debasement trade? Is it all over?

Nothing is likely to materially change with Mr. Warsh as Fed chair. The federal deficit is still running at about 6% of GDP ($1.6 trillion per year). The federal government’s interest expense is still 23% of tax receipts, still $1.2 trillion per year, and still growing at ~15% annual growth rate.

Rate cuts are still required to keep the debt serviceable and to keep the federal deficit from continuing to widen. Remember, interest expense is not paid out of tax revenue- it’s paid via the issuance of new US Treasuries.

Warsh supports rate cuts (albeit for different reasons). This is bullish for risk assets like bitcoin.

Money Printer = Taking a Break?

What about liquidity? Is Warsh really going to shrink the balance sheet and compress liquidity?

It’s highly unlikely that Warsh is able to enact his prior views of a dramatically smaller Fed balance sheet. As we saw in Q3 and Q4 of 2025, there were significant issues in the repo market as liquidity was contracting. The repo market is incredibly important, as we now know that the highly levered basis trade (which is financed in the repo market) was responsible for the absorbtion of about FORTY percent of new US Treasury issuance.

They cannot afford to have their biggest buyer of the debt go under. Liquidity (via the “Reserve Management Purchases”) must continue to increase. An emerging consensus on M0/Bank Reserves is starting to become clear: ‘Bank Reserves should grow in line with GDP’ and it’s unlikely to see Warsh reverse that.

We are still going to get rate cuts, and we are still going to get increasing liquidity, both of which should prove bullish for bitcoin. Having an outspoken bitcoin proponent on the Fed will certainly not hurt.

To put it very simply, Kevin Warsh doesn’t have a magical superpower to ‘stop the train’.

Thanks for reading! For more updates throughout the week, follow @WOLF_Bitcoin

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments