Newmont Corporation (NYSE:NEM) is trading higher Tuesday morning as gold prices rip sharply higher, reversing a brutal two-day selloff that rattled precious-metal bulls. Here’s what investors need to know.

- Newmont stock is building positive momentum. Why is NEM stock trading higher?

Why Gold Is Shining Amid Rate Cut Speculation

Gold futures are up around 6% Tuesday morning, on track for their strongest single-day gain since 2008 after a double-digit percentage slump late last week.

The rebound follows renewed expectations for meaningful Federal Reserve rate cuts this year, after policymakers signaled that current policy may now be too restrictive and underlying inflation pressures more benign.

Lower expected real interest rates tend to weaken the dollar and boost the appeal of non-yielding assets like gold, fueling today’s sharp move.

Why A Gold Spike Is Bullish For Newmont Stock

Newmont is one of the world’s largest gold miners, with a diversified portfolio of mines across North America, South America, Australia and Africa. Because its revenues are tied directly to the metal, a rapid upswing in gold prices typically expands Newmont’s margins, lifts free cash flow and strengthens its balance sheet.

Higher spot prices improve the economics of its existing reserves and can make lower-grade ore more profitable to mine, supporting longer-term production plans. Investors may also view Newmont as a key way to gain leveraged exposure to gold without holding the metal itself, so capital often flows into NEM when bullion rallies.

Uncovering The Bullish Momentum Behind Recent Gains

The stock is currently trading 0.6% above its 20-day simple moving average (SMA) and 24.1% above its 100-day SMA, demonstrating longer-term strength. Over the past 12 months, shares have increased 171.75% and are currently positioned closer to their 52-week highs than lows.

The RSI is at 48.96, which is considered neutral territory, indicating that the stock is neither overbought nor oversold. Meanwhile, MACD is below its signal line, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum, indicating that traders should watch for potential shifts in market sentiment.

- Key Support: $97.50

Newmont’s Business Model

Newmont is the world’s largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023.

The company is expected to sell roughly 5.6 million ounces of gold in 2025 from its core mines after selling six higher-cost, smaller mines following the Newcrest acquisition. Newmont also produces material amounts of copper, silver, zinc and lead as byproducts, which adds to its revenue streams.

What Analysts Predict For Newmont’s Earnings

Investors are looking ahead to the company’s next earnings report on Feb. 19, with analysts expecting earnings per share of $1.91, up from $1.40 from the same quarter last year and revenue of $6.01 billion, up from $5.65 billion from the same quarter last year.

Newmont Corporation has a consensus Buy rating among analysts with an average price target of $82.87, which aligns with current valuation levels, with 50 analysts covering the stock.

- EPS Estimate: $1.91 (Up from $1.40 YoY)

- Revenue Estimate: $6.01 Billion (Up from $5.65 Billion YoY)

- Valuation: P/E of 17.6x (Indicates fair valuation)

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $82.87. Recent analyst moves include: Scotiabank: Sector Outperform (Raises Target to $152.00) (Jan. 26) UBS: Buy (Raises Target to $125.00) (Dec. 1, 2025) Scotiabank: Upgraded to Sector Outperform (Raises Target to $114.00) (Oct. 23, 2025)

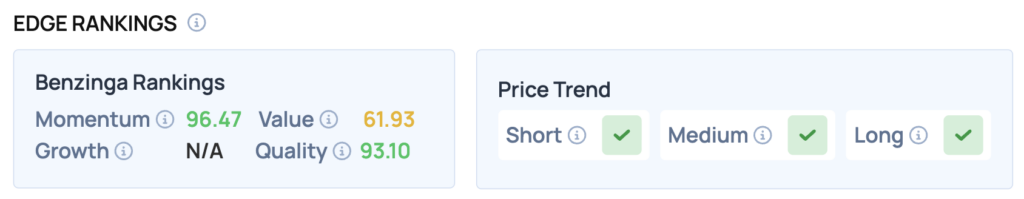

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Newmont, highlighting its strengths and weaknesses compared to the broader market:

- Value: 61.93 — The stock is trading at a fair valuation relative to peers.

- Quality: 93.1 — The company maintains a healthy balance sheet.

- Momentum: 96.47 — Stock is outperforming the broader market.

The Verdict: Newmont’s Benzinga Edge signal reveals a strong momentum score, indicating that the stock is currently outperforming the broader market. However, the neutral value score suggests that while the stock is performing well, it is not significantly undervalued, which may warrant caution for new investors.

NEM Shares Edge Higher Tuesday

NEM Price Action: Newmont shares were up 4.94% at $118.43 at the time of publication on Tuesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments