Kevin O’Leary, investor and television personality, is backing a nationwide child investment policy by the Donald Trump administration, saying it could solve America’s financial literacy crisis by giving every child a foundation for lifelong wealth.

O’Leary Endorses Child Investment Accounts

On Saturday, O’Leary posted on X about the “Trump account,” a policy that automatically invests money in a child’s account from birth, locked for 18 years.

“We improved math. We improved reading. We failed at financial literacy. Today, over 100 million Americans have no real plan for their future. This idea changes that,” he wrote.

In a video clip, he elaborated, saying, “You’re basically making an investment not just in an individual that’s born, in their family. The burden of a family to educate or help a child launch can be really difficult, particularly if you have a large one.”

He added, “Let the power of the world’s largest economy go to work for a child for 18 years and stand back in awe and see what happens.”

O’Leary emphasized the policy’s broad appeal, calling it “bipartisan, pro-family, pro-entrepreneur, and forward-looking,” and said he could not find “anybody, red or blue, that doesn’t like this idea.”

He added, “This isn’t about government dependence. It’s about giving people a foundation to stand on.”

O’Leary Urges Diversification, Shares Career Lessons

Earlier, O’Leary urged young adults to avoid putting all their money into a single stock or idea, calling it the fastest route to financial disaster.

He advised spreading investments across sectors and companies, recommending no more than 20% in a sector or 5% in a single stock to survive market downturns.

Long before his TV fame, O’Leary received a blunt reality check from his stepfather, who told him he wasn’t good enough to pursue creative careers and encouraged him to focus on business and marketing.

Following that advice, O’Leary studied business in college, launched multiple ventures, including a film production company, and eventually rose as an entrepreneur and investor.

The experience shaped his philosophy that success comes from aligning enjoyment with ability and avoiding self-deception about one’s potential.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

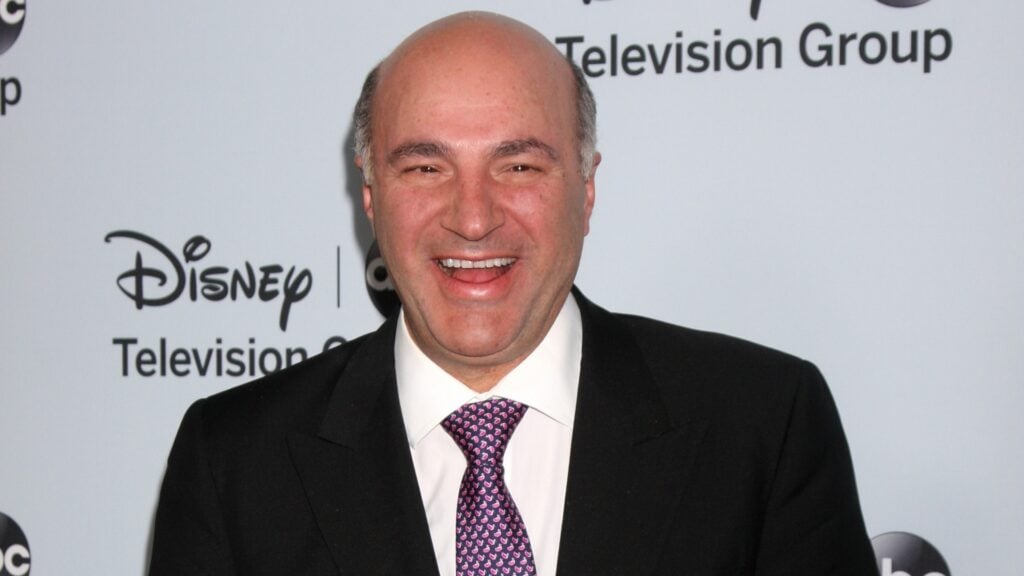

Photo courtesy: Kathy Hutchins / Shutterstock.com

Recent Comments