by Benzinga Insights | Jan 19, 2026 | General

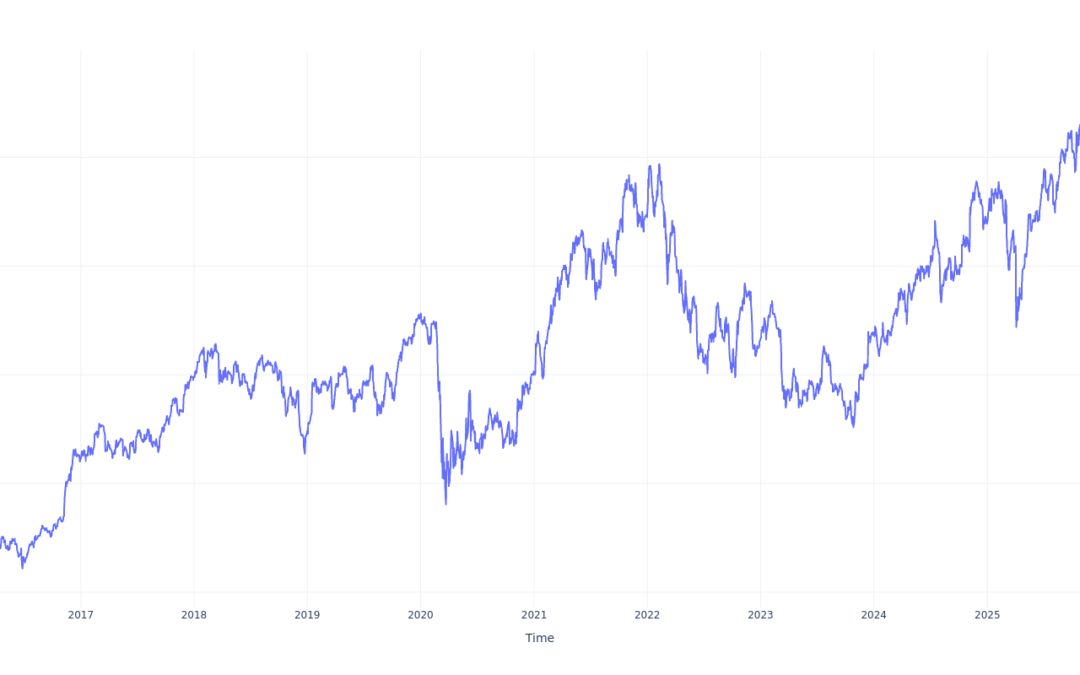

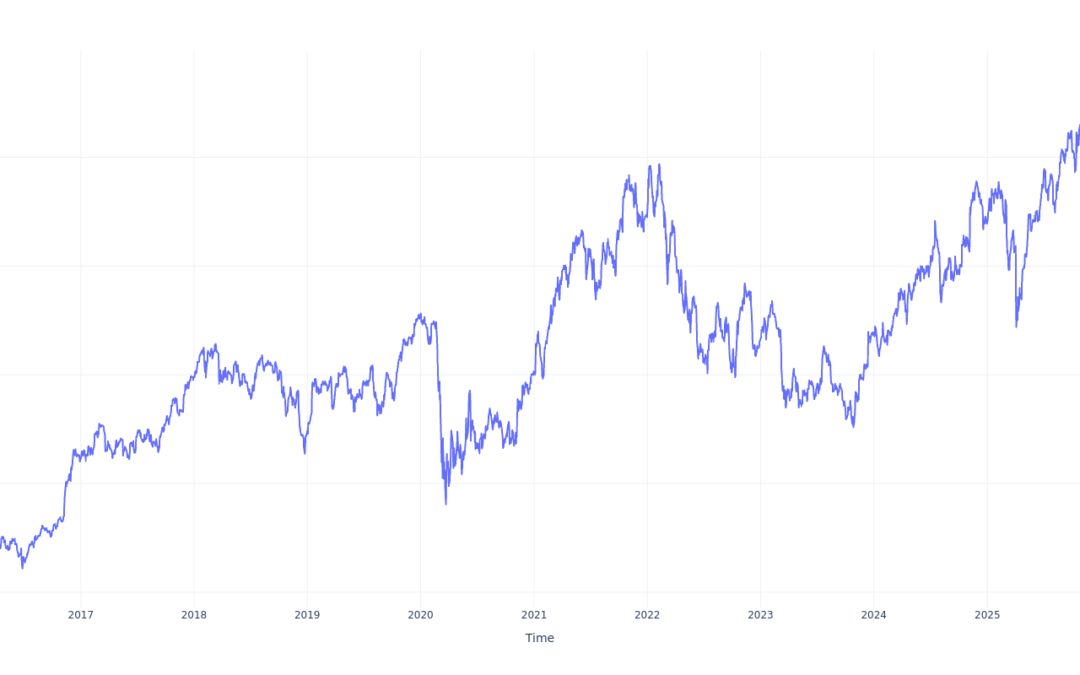

Intuit (NASDAQ:INTU) has outperformed the market over the past 15 years by 6.0% on an annualized basis producing an average annual return of 17.84%. Currently, Intuit has a market capitalization of $151.72 billion. Buying $1000 In INTU: If an investor had bought $1000...

by Benzinga Insights | Jan 19, 2026 | General

Bank of America (NYSE:BAC) has outperformed the market over the past 10 years by 1.03% on an annualized basis producing an average annual return of 14.81%. Currently, Bank of America has a market capitalization of $381.98 billion. Buying $1000 In BAC: If an investor...

by Benzinga Insights | Jan 19, 2026 | General

ASE Technology Holding Co (NYSE:ASX) has outperformed the market over the past 10 years by 2.78% on an annualized basis producing an average annual return of 16.56%. Currently, ASE Technology Holding Co has a market capitalization of $42.33 billion. Buying $1000 In...

by Benzinga Insights | Jan 19, 2026 | General

NetEase (NASDAQ:NTES) has outperformed the market over the past 20 years by 11.37% on an annualized basis producing an average annual return of 20.2%. Currently, NetEase has a market capitalization of $88.92 billion. Buying $100 In NTES: If an investor had bought $100...

by Benzinga Insights | Jan 19, 2026 | General

Jabil (NYSE:JBL) has outperformed the market over the past 5 years by 28.36% on an annualized basis producing an average annual return of 40.92%. Currently, Jabil has a market capitalization of $26.58 billion. Buying $1000 In JBL: If an investor had bought $1000 of...

Recent Comments