Walt Disney (NYSE:DIS) CEO Bob Iger has reportedly told associates he plans to step down and pull back from daily management before his contract expires on Dec. 31, and the entertainment giant’s board is set to meet next week to vote on a successor.

In private conversations over the last few months, Iger has told people close to him that he is ready to move on from the grind of being CEO and was frustrated by conflicts at Disney’s ABC network over the brief suspension of late-night host Jimmy Kimmel, the Wall Street Journal reported on Friday, citing people familiar with the matter.

Disney did not immediately respond to Benzinga‘s request for comment outside office hours.

Iger is expected to remain CEO for several months after the company announces who will succeed him so that he can mentor the new leader, according to WSJ. He could retain a role on the board and at the company after the CEO transition, the report said.

Successor Talks Heat Up

Investors have been increasingly focused on who will get the top job at the century-old company, home to legendary characters like Mickey Mouse and the blockbuster Marvel films.

After a 15-year tenure, Iger stepped down as CEO in 2020, handing the reins to his handpicked successor, Bob Chapek, who had risen through Disney’s theme parks division. Iger stayed on as executive chairman to advise Chapek, but the pandemic brought frequent clashes and operational challenges. By November 2022, the board ousted Chapek, prompting Iger to return for a second stint at the helm.

Disney’s theme-parks chief Josh D’Amaro, entertainment co-heads Dana Walden and Alan Bergman, and ESPN head Jimmy Pitaro are being seen as possible contenders for the CEO position. Many believe D’Amaro is the front-runner, according to the WSJ report.

Disney’s board, led by former Morgan Stanley CEO James Gorman, has recently said it would make its decision in the current quarter.

Q1 Earnings On The Cards: What To Expect

Disney is set to report its first-quarter earnings for the fiscal year 2026 on Monday, Feb. 2, before markets open.

Analysts expect the company to report earnings of $1.58 per share. That’s down from $1.76 per share in the year-ago period. The consensus estimate for Disney’s quarterly revenue is $25.6 billion (it reported $24.69 billion last year), according to data from Benzinga Pro.

Although streaming has been a bright spot for the company, its TV Networks business has been a drag as consumers continue to turn away from the pay TV bundle.

Price Action: DIS stock gained about 3% from its $111.35 start in 2025, but struggled to sustain momentum from a $124.69 high in June. Shares climbed roughly 1.09% on Friday, closing at $112.80.

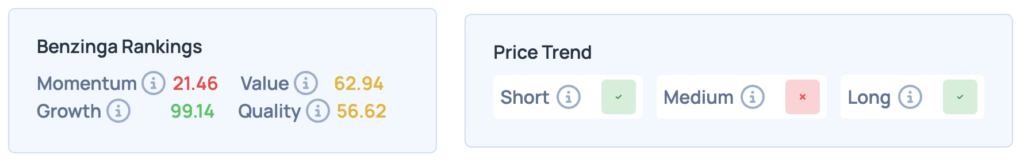

Benzinga’s Edge Rankings highlight strong growth potential, supported by moderate value and quality scores, though momentum remains weak. Price trends indicate positive signals in the short and long term, with some medium-term volatility.

Image via Shutterstock

Recent Comments