Parker-Hannifin Corporation (NYSE:PH) reported better-than-expected second-quarter financial results and raised its FY26 guidance on Thursday.

The motion and control technologies company posted adjusted EPS of $7.65, beating the $7.17 analyst estimate. Net sales totaled $5.174 billion, exceeding the $5.066 billion estimate. Sales increased 9% year over year with organic sales growth of 6.6%.

CEO Jenny Parmentier said, “This was another outstanding quarter that reflected the performance of our global team, the power of our business system The Win Strategy, and the strength of our transformed portfolio.”

For fiscal 2026, Parker raised GAAP EPS guidance to $26.26 to $26.86 from $25.53 to $26.33, versus a $26.46 estimate. Adjusted EPS guidance was raised to $30.40 to $31.00 from $29.60 to $30.40, versus a $30.33 estimate.

Sales guidance was increased to $20.942 billion to $21.339 billion from $20.644 billion to $21.239 billion, compared with a $21.106 billion estimate.

Parker-Hannifin shares fell 1.6% to trade at $933.42 on Friday.

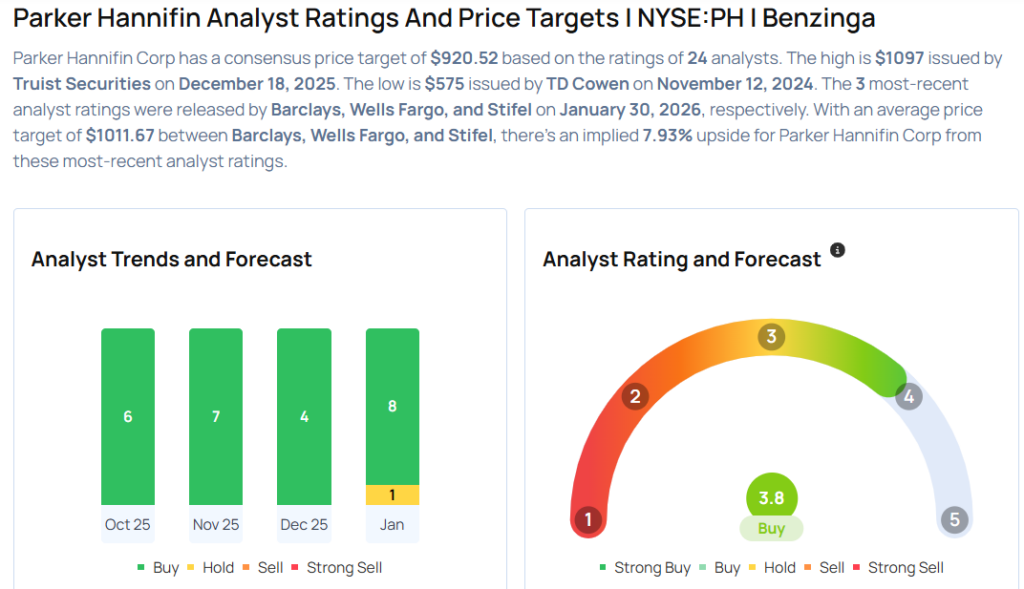

These analysts made changes to their price targets on Parker-Hannifin following earnings announcement.

- Stifel analyst Nathan Jones maintained Parker Hannifin with a Hold and raised the price target from $941 to $965.

- Wells Fargo analyst Joseph O’Dea maintained the stock with an Overweight rating and raised the price target from $1,000 to $1,050.

- Barclays analyst Julian Mitchell maintained Parker Hannifin with an Overweight rating and boosted the price target from $990 to $1,020.

Considering buying PH stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments