The first month of 2026 is drawing to a close, and a cluster of U.S. stocks has just posted their best — or worst — monthly performances on record, driven by a powerful mix of earnings surprises, guidance updated and AI-related sector disruptions.

January’s Most Extreme Stock Gainers: Who Just Logged A Best Month Ever?

On the upside, Sandisk Corp. (NASDAQ:SNDK) stood out as one of January’s biggest winners, surging more than 150% during the month as the company reported exceptional quarterly earnings that crushed Wall Street expectations.

The rally was fueled by tightening memory and storage supply conditions, as booming AI data-center demand continues to strain capacity.

January also marked Sandisk’s best-performing month since its IPO in February 2025. The stock is now up more than 1,400% since going public and was the top-performing S&P 500 constituent for the month.

Cameco Corp. (NYSE:CCJ) advanced 37%, supported by a series of analyst upgrades to earnings forecasts and price targets as expectations for long-term nuclear demand strengthened.

Rising uranium prices and renewed policy support for nuclear energy have reinforced the company’s growth outlook.

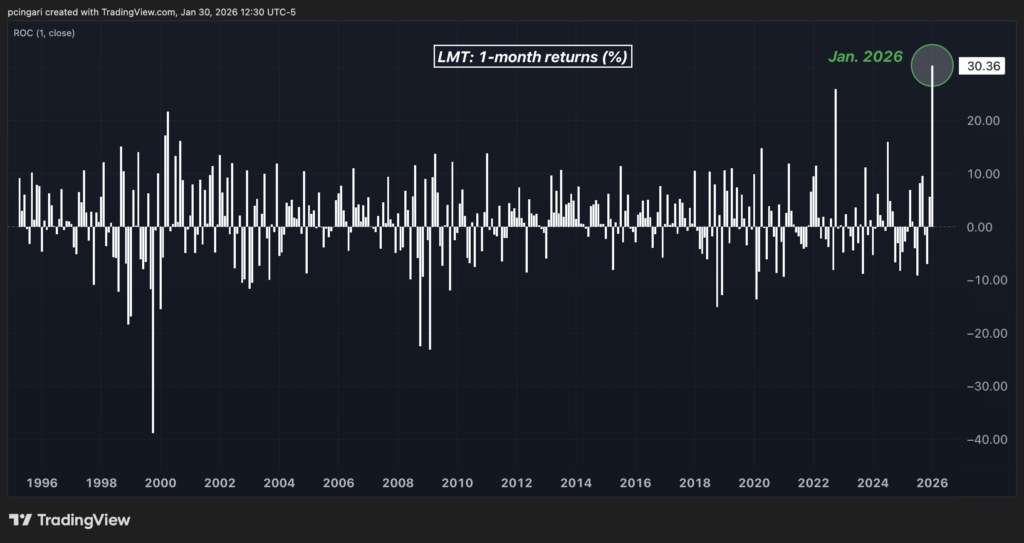

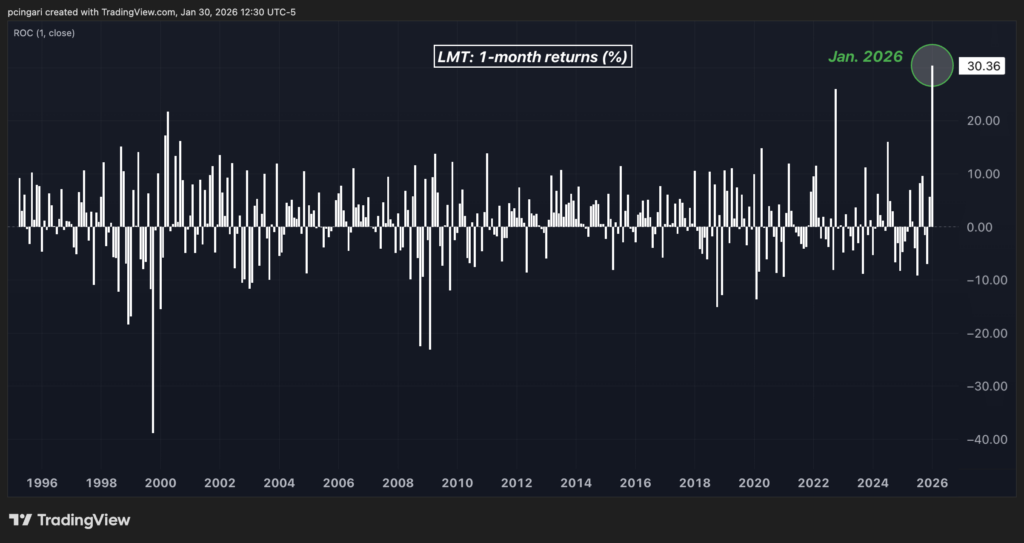

Defense giant Lockheed Martin Corp. (NYSE:LMT) jumped 30%, marking the strongest monthly gain in the company’s history since it began trading in 1995.

While Lockheed narrowly missed quarterly earnings estimates, investors focused instead on upbeat 2026 financial guidance and the announcement of a new missile contract with the U.S. Department of Defense.

Drone maker Karman Holdings (NYSE:KRMN) also posted its best month ever, climbing 45% after announcing an agreement to acquire Seemann Composites and Materials Sciences. The deal is expected to expand Karman’s exposure to the maritime market and strengthen its position within defense supply chains.

Biotech name ImmunityBio Inc. (NASDAQ:IBRX) delivered the most extreme move, surging more than 200% to log the strongest monthly performance in the Russell 2000. The rally followed multiple positive updates from clinical-stage cancer treatment trials.

Chart: Lockheed Martin Notches Best Month On Record

Software Stocks Lead January’s Historic Declines

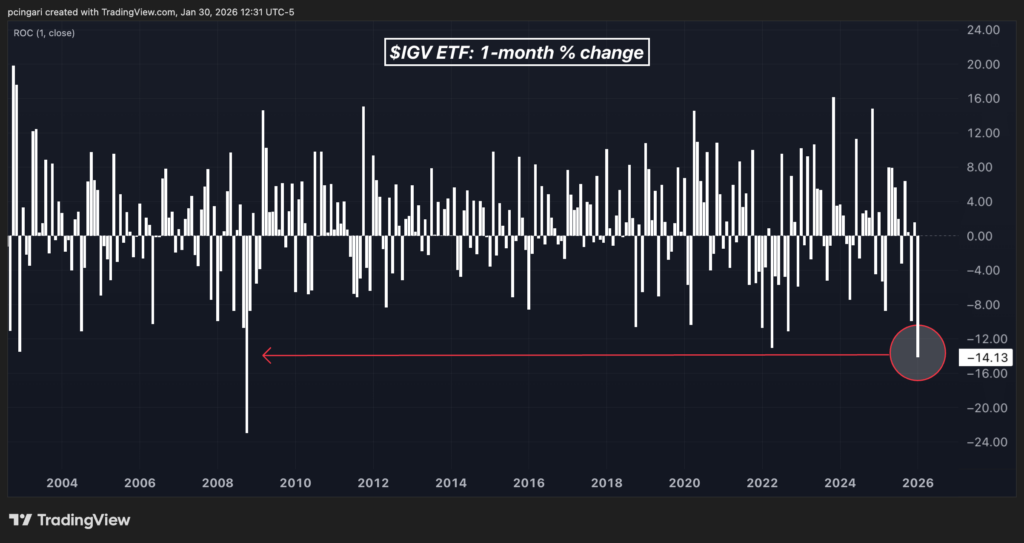

January’s worst performers were overwhelmingly software stocks, as artificial intelligence continues to reshape demand across the sector and force a reassessment of business models.

Braze Inc. (NASDAQ:BRZE) plunged 37%, while HubSpot Inc. (NYSE:HUBS) fell 30%, Rubrik Inc. (NYSE:RBRK) dropped 27%, Guidewire Software Inc. (NYSE:GWRE) slid 28%, and GoDaddy Inc. (NYSE:GDDY) declined 21%.

All five names logged their worst monthly performances on record, with the selloff largely unrelated to company-specific earnings releases.

Instead, the pressure reflected a broader sector-wide repricing. The software rout intensified Thursday after Microsoft Corp. (NASDAQ:MSFT) issued weaker-than-expected guidance for its Azure cloud business, triggering a 10% collapse in its shares — Microsoft’s worst single-day drop since March 2020.

The shock reverberated across the sector, pushing the iShares Expanded Tech-Software Sector ETF (NYSE:IGV) down 14% for the month, marking its steepest monthly decline since October 2008, at the onset of the great financial crisis.

Chart: Software Sector Suffers Worst Monthly Selloff Since Lehman Collapse

Photo: Shutterstock

Recent Comments