Germany’s gross domestic product (GDP) rose by an annual 0.4% in the fourth quarter last year, even as Europe’s biggest economy struggles with falling exports and weaker manufacturing.

GDP rose by 0.3% quarter-on-quarter, buoyed by household and government expenditures, the country’s Federal Statistical Office (Destatis) said on Friday. That was higher than the analysts’ consensus of 0.2%.

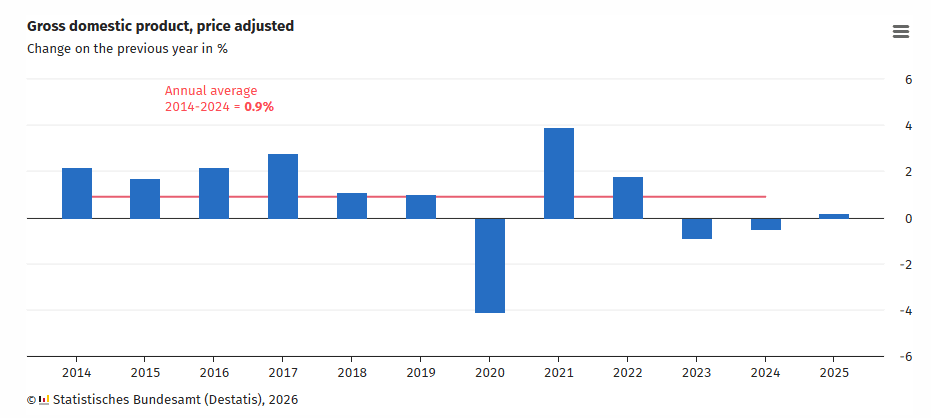

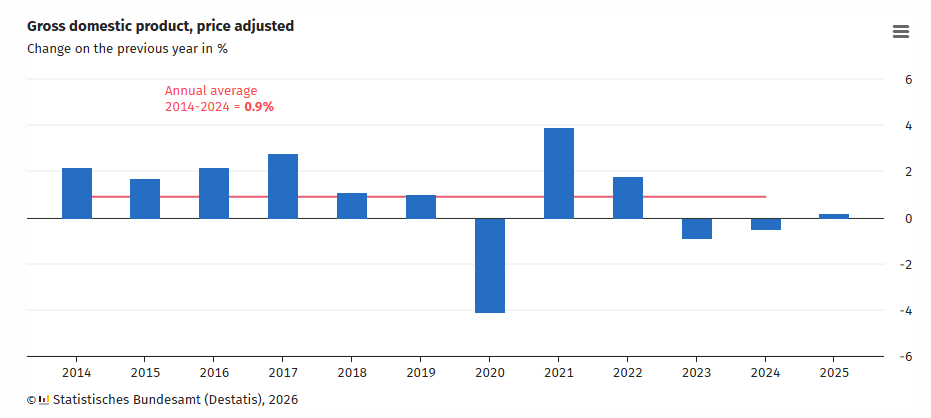

“The German economy thus ended 2025 in positive territory after a turbulent year, particularly for foreign trade,” Destatis said. The economy grew by 0.2% in 2025, breaking two consecutive years of recession. This occurred despite headwinds related to its shipments to the US and China.

US tariffs, a stronger euro, and increased Chinese competition have curbed Germany’s exports, with fewer motor vehicles, trailers and semi-trailers, machines, and chemical products shipped abroad. Overseas sales fell 0.3% last year, the third decline in a row, due to stiff competition in international markets, according to Destatis.

Germany Annual GDP: Source, Destatis.

The country must pivot toward new “growth engines,” Germany’s Economy Minister Katherina Reiche said on Friday. “The sources of global growth today lie in areas like digitalization and artificial intelligence; in new energy technologies, biotechnology, advanced materials, and the defense industry.”

Manufacturing Output Falls Again

Despite the improved GDP figures, German factory output in 2025 fell for the third year, down 1.3%. The automotive industry and the manufacture of machinery and equipment recorded losses from stiffer competition in global markets.

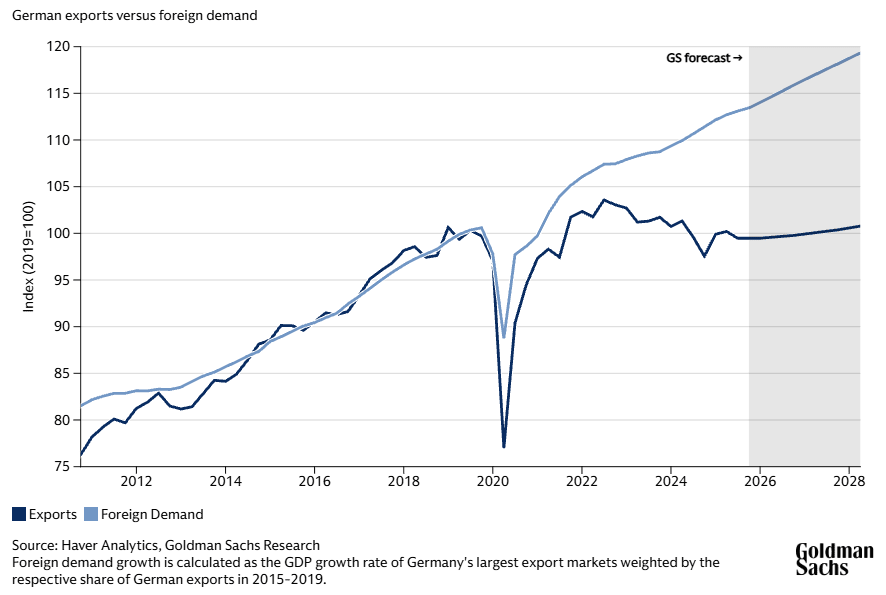

“The underperformance of the German economy has been driven by a decline in manufacturing in recent years,” Goldman Sachs Research said on Monday in its 2026 outlook report for Germany. “The sector’s economic value added peaked in 2017 and has declined 7% since then, while overall industrial production and sales have fallen by almost 15% from their peak.”

German shipments have grown “significantly” less than foreign demand, resulting in a loss of market share, according to Goldman. Chinese manufacturing has displaced German goods, with the impact of “this competition to continue to restrain exports in coming years,” it said.

German exports to the US in November fell by an annual 23% to €10.8 billion, Destatis data show. Germany ran a trade deficit with China in November, with imports of €14.9 billion compared to exports of €6.5 billion.

Sentiment Improves

Expectations about Germany’s economic situation improved even as the country faces significant challenges.

The ZEW Indicator of Economic Sentiment climbed monthly by 13.8 points to 59.6 points in January, the non-profit ZEW Institute said on January 20. The assessment of the current economic situation rose to minus 72.7 points, 8.3 points above the value recorded in the previous month.

This year “could mark a turning point,” ZEW President Achim Wambach, PhD, said. “Despite the positive economic sentiment, work should continue to strengthen the attractiveness of the location in order to enable sustainable growth.”

ING Think echoed this sentiment, pointing to industrial orders, increased fiscal stimulus, and the defense sector as reasons for optimism. The “period of national gloom has come to an end,” ING Think said on January 15. “There are good reasons to finally be more positive about the German economy.”

The ifo Business Climate Index held steady at 87.6 points for January. The assessment of the current situation edged up somewhat, while expectations were revised slightly downward, ifo said in its monthly report on Monday.

Confidence in the German economy may be premature, given the drop in production capacity in key industries. Sentiment indicators show improving expectations, yet they sharply contrast with the deep structural challenges now unfolding across Germany’s industrial base.

Chemical Plant Closures Accelerate

Germany and other European countries have witnessed a six-fold surge in chemical plant closures from 2022 to the end of 2025, Roland Berger, a Munich-based global management consulting firm, said in a report commissioned by the Brussels-based European Chemical Industry Council (Cefic). The bloc has also seen a slide in chemical plant investment, the report said.

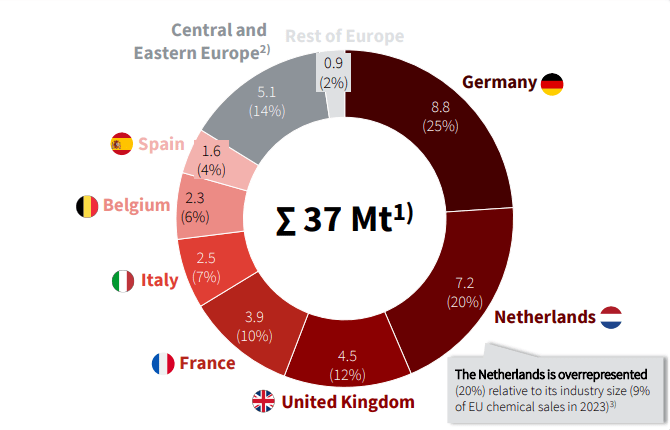

Out of a total 37 million tons (Mt) of announced closures across Europe, Germany’s share stood at 8.8 Mt, or 25%, the Roland Berger report said. Closures occurred mostly in energy-intensive petrochemicals, especially steam crackers, and were primarily driven by poor energy cost competitiveness, it said.

Germany and the Netherlands account for ~45% of the capacity announced for closure, source: Cefic

The annual announced investment capacity fell from 2.7 Mt in 2022 to just 0.3 Mt year-to-date in 2025. This drop reflects a shift from broad investment across multiple innovation pathways – like electrification, hydrogen feedstocks, and circular plastics – to barely one pilot initiative, according to the report.

“It’s no longer a question of being five minutes before or after twelve,” Marco Mensink, Cefic’s Director General, said in the press release on Wednesday. “The sector is under severe stress and breaking. The rate of closures has doubled in a year, and even worse, annual investments are half and close to zero.”

Job Risks Mount

The chemical plant closures threaten jobs across Europe. Approximately 20,000 direct jobs and 89,000 indirect jobs are at risk, with Germany experiencing the highest impact at 34,000, or 31% of direct and indirect jobs, according to the report.

More broadly, Germany’s economic situation has had an increasingly strong impact on the labor market. The number of unemployed people in Germany passed the 3 million mark at the start of 2026 and reached a 12-year high, German labor office figures showed on Friday.

The lack of investment, European energy cost competitiveness, overcapacity, and regulations have impacted German chemical makers. Ludwigshafen, Germany-based BASF SE (OTCQX:BASFY) has started to revamp its main chemicals, industrials, and nutrition businesses.

In 2023, Europe’s biggest chemical company began cutting 2,600 jobs at European production sites, including Ludwigshafen, the continent’s largest chemical site. BASF started to close down smaller production units to cut costs from September 2024, Bloomberg News reported.

The restructuring underscores how Germany’s flagship industrial players are being forced to adapt to a harsher competitive landscape, highlighting the long-term pressures weighing on the country’s economic model and raising questions about future competitiveness.

Disclaimer: Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments