Dover Corporation (NYSE:DOV) reported better-than-expected fourth-quarter results on Thursday.

For the quarter, Dover generated revenue of $2.099 billion, an increase of 9%, beating the consensus of $2.082 billion. Adjusted diluted earnings per share from continuing operations was $2.51, up 14% year over year, beating the consensus of $2.48.

Dover’s President and CEO, Richard J. Tobin, said, “Fourth quarter results reflect broad-based top line strength across the portfolio, with organic growth reaching its highest level of the year.”

For 2026, Dover expects to generate adjusted EPS of $10.45 to $10.65, versus a consensus of $10.54, based on full-year revenue growth of 5% to 7%. Dover expects fiscal 2026 sales to range between $8.498 billion and $8.656 billion, compared with the Street estimate of $8.524 billion.

Dover shares fell 0.9% to trade at $200.63 on Friday.

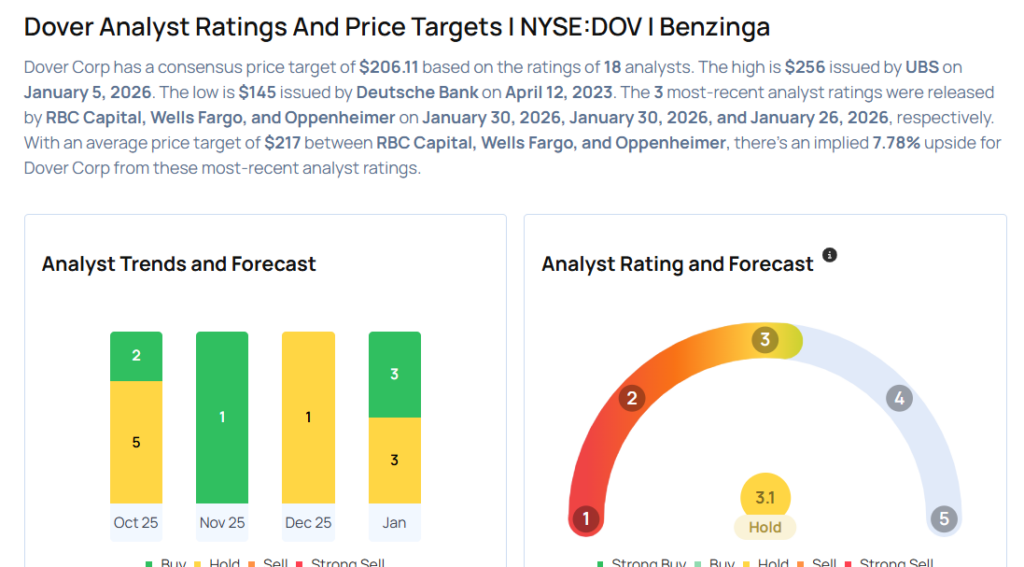

These analysts made changes to their price targets on Dover following earnings announcement.

- Wells Fargo analyst Joseph O’Dea maintained Dover with an Equal-Weight rating and raised the price target from $205 to $210.

- RBC Capital analyst Deane Dray maintained the stock with a Sector Perform and boosted the price target from $199 to $209.

Considering buying DOV stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments