President Donald Trump’s proposal to curb institutional purchase of single-family homes has cast a fresh shadow on the real estate sector, as well as alternative asset managers such as Blackstone Inc. (NYSE:BX), which is set to report its fourth-quarter results on Thursday.

Blackstone’s Exposure Limited

Shares of Blackstone witnessed a pullback when Trump first announced an executive order to curb Wall Street institutions from acquiring single-family homes.

This comes despite repeated communications by the company, highlighting its limited exposure and impact on America’s single-family housing segment.

In reports published over the past year, Blackstone had stated that institutional ownership represents only a small share of the market, at 0.5%, and its own exposure to the segment is even smaller, at just 0.06% of all single-family homes in the country.

The company also noted that its involvement in the sector is primarily tied to build-to-rent activity through its Tricon Residential platform, for which an exemption has been carved out in Trump’s executive order.

Besides this, real estate accounted for just 12.7% of Blackstone’s revenue in fiscal year 2024, in which housing occupies a much smaller share.

PE Giant To Report Q4 Results

During its third-quarter results, Blackstone reported modest appreciation across its core real estate funds. As the firm heads into Q4, investors will be watching fund performance alongside inflows, deployment activity and asset sales for clues on the trajectory of both the segment and the broader real estate market.

The company has faced a series of bearish analyst revisions in recent weeks, with TD Cowen, UBS and Barclays each lowering their price targets.

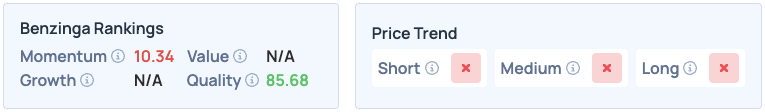

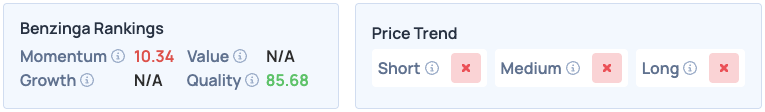

Blackstone’s shares were down 1.09% on Wednesday, closing at $146.79, and are up 0.62% overnight. The stock scores poorly on Momentum in Benzinga’s Edge Stock Rankings, and has an unfavorable price trend in the short, medium and long terms.

Photo courtesy: Gumbariya/Shutterstock

Recent Comments