Honeywell International Inc. (NASDAQ:HON) will release earnings for the fourth quarter before the opening bell on Thursday, Jan. 29.

Analysts expect the Purchase, New York-based company to report fourth-quarter earnings of $2.54 per share. That’s up from $2.47 per share in the year-ago period. The consensus estimate for Honeywell’s quarterly revenue is $9.92 billion (it reported $10.09 billion last year), according to Benzinga Pro.

On Jan. 22, Honeywell named Josh Jepsen as CFO of Honeywell Aerospace.

Shares of Honeywell fell 1.9% to close at $216.64 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

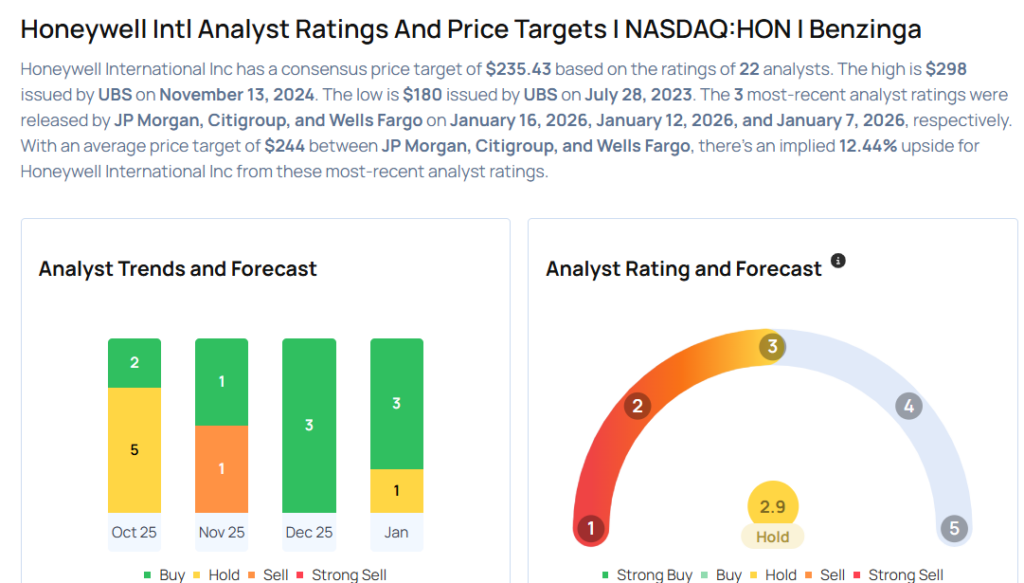

- JP Morgan analyst Stephen Tusa upgraded the stock from Neutral to Overweight and increased the price target from $218 to $255 on Jan. 16, 2026. This analyst has an accuracy rate of 70%.

- Citigroup analyst Andrew Kaplowitz maintained a Buy rating and cut the price target from $2670 to $262 on Jan. 12, 2026. This analyst has an accuracy rate of 83%.

- Wells Fargo analyst Joseph O’Dea maintained an Equal-Weight rating and slashed the price target from $218 to $215 on Jan. 7, 2026. This analyst has an accuracy rate of 68%.

- Mizuho analyst Brett Linzey maintained an Outperform rating and cut the price target from $250 to $240 on Jan. 5, 2026. This analyst has an accuracy rate of 73%.

- Barclays analyst Julian Mitchell maintained an Overweight rating and cut the price target from $269 to $250 on Dec. 24, 2025. This analyst has an accuracy rate of 75%

Considering buying HON stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments