As of Jan. 29, 2026, two stocks in the consumer staples sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

Turning Point Brands Inc (NYSE:TPB)

- On Nov. 5, Turning Point Brands reported better-than-expected third-quarter financial results. Graham Purdy, President and CEO, said, “Our consolidated third quarter results exceeded expectations. Modern Oral sales were $36.7 million, increasing by 22% versus the prior quarter and 628% over the prior year. In addition, we now expect to qualify our first U.S. white pouch production lines in the first half of 2026.” The company’s stock gained around 17% over the past month and has a 52-week high of $124.73.

- RSI Value: 79

- TPB Price Action: Shares of Turning Point Brands gained 2.2% to close at $124.49 on Wednesday.

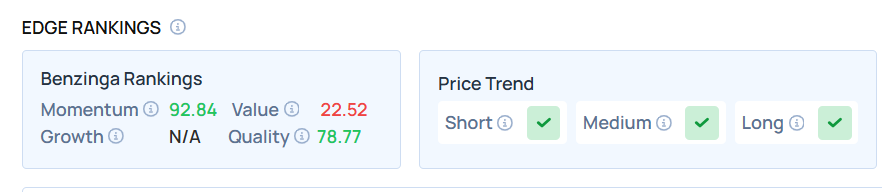

- Edge Stock Ratings: 92.84 Momentum score with Value at 22.52.

TreeHouse Foods Inc (NYSE:THS)

- On Nov. 13, Truist Securities analyst Bill Chappell maintained Treehouse Foods with a Hold and raised the price target from $20 to $22.5. The company’s stock gained around 4% over the past month and has a 52-week high of $40.77.

- RSI Value: 77.6

- THS Price Action: Shares of TreeHouse Foods rose 0.4% to close at $24.67 on Wednesday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Photo via Shutterstock

Recent Comments