On Wednesday, Tesla Inc. (NASDAQ:TSLA) posted better-than-expected results for the fourth quarter and announced plans to invest approximately $2 billion into CEO Elon Musk’s artificial intelligence startup, xAI.

Tesla said preparations are underway in North America for production ramps of Tesla Semi and CyberCab, both set to commence in the first half of 2026. The company also plans to unveil the Gen 3 version of Optimus in the first quarter of this year.

Tesla reported quarterly earnings of 50 cents per share, which beat the consensus estimate of 45 cents by 12.36%, according to Benzinga Pro data. Quarterly revenue came in at $24.9 billion, which beat the analyst consensus estimate of $24.78 billion.

“2025 marked a critical year for Tesla as we further expanded our mission and continued our transition from a hardware-centric business to a physical AI company. We laid the foundation for the future of Tesla as we further advanced FSD (Supervised)4, launched our Robotaxi service, began installing production lines for Cybercab and fine-tuned our production-primed Optimus design while expanding our AI training infrastructure,” the company wrote in its shareholder deck.

Tesla shares rose 2.3% to $440.32 in pre-market trading.

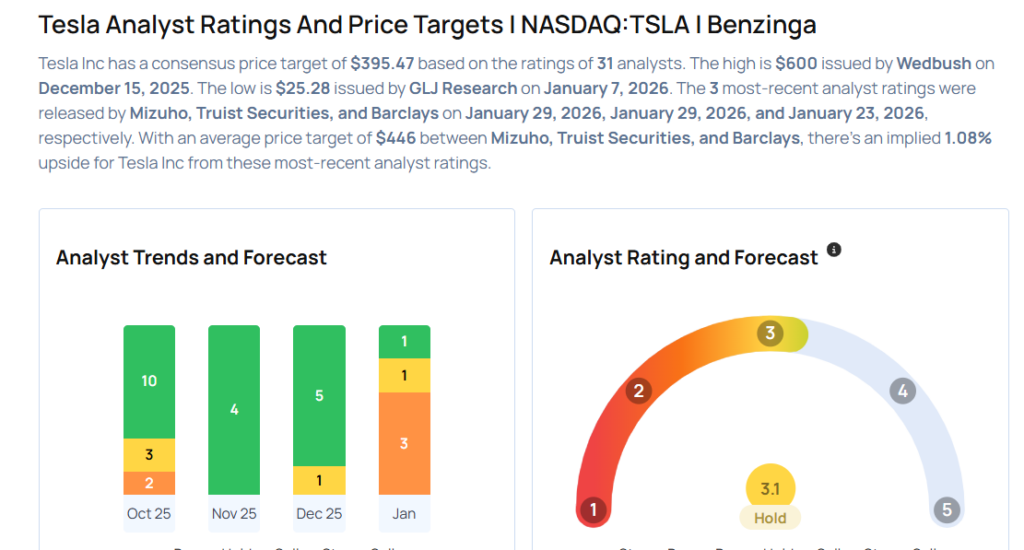

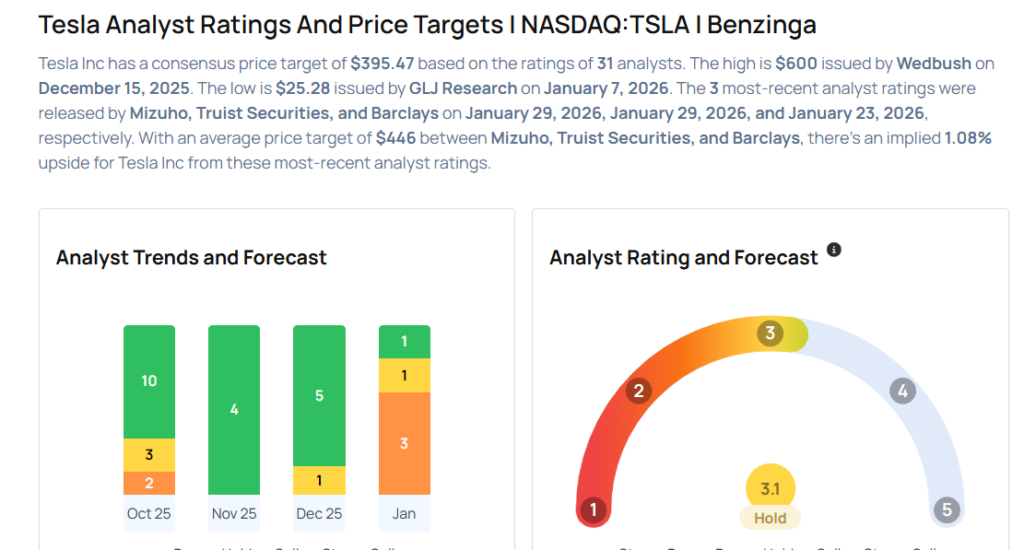

These analysts made changes to their price targets on Tesla following earnings announcement.

- Truist Securities analyst William Stein maintained Tesla with a Hold and lowered the price target from $439 to $438.

- Mizuho analyst Vijay Rakesh maintained the stock with an Outperform rating and raised the price target from $530 to $540.

Considering buying TSLA stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments