U.S. stock futures rose on Thursday following Wednesday’s mixed close. Futures of major benchmark indices were higher.

The Federal Reserve kept the federal funds rate unchanged at 3.5%–3.75% on Wednesday, putting its easing cycle on hold after three rate cuts last year that brought borrowing costs to their lowest since 2022.

Meanwhile, during the press conference, Fed Chair Jerome Powell declined to engage with political criticism related to ongoing legal scrutiny of the central bank, reiterating that he does not respond to comments from other officials. “We will continue to make our decisions meeting by meeting… letting the data light the way for us,” he added.

The 10-year Treasury bond yielded 4.26%, and the two-year bond was at 3.58%. The CME Group’s FedWatch tool‘s projections show markets pricing an 86.5% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | 0.15% |

| S&P 500 | 0.27% |

| Nasdaq 100 | 0.37% |

| Russell 2000 | 0.26% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Thursday. The SPY was up 0.30% at $697.50, while the QQQ advanced 0.36% to $635.50.

Stocks In Focus

Microsoft

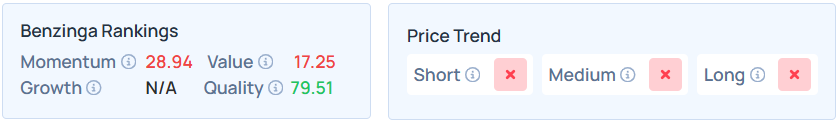

- Microsoft Corp. (NASDAQ:MSFT) fell 5.77% in premarket on Thursday despite reporting better-than-expected second-quarter financial results after market close on Wednesday. However, MSFT’s remaining performance obligations (RPO), or the value of contracts with customers that haven’t been paid, hit $625 billion.

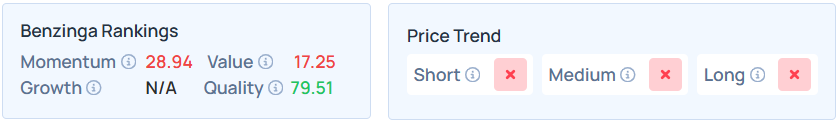

- Benzinga’s Edge Stock Rankings indicate that MSFT maintains a weak price trend in the medium, short, and long terms with a good quality ranking.

Tesla

- Tesla Inc. (NASDAQ:TSLA) advanced 2.71% after posting better-than-expected results for the fourth quarter and announcing plans to invest approximately $2 billion into CEO Elon Musk’s artificial intelligence (AI) startup, xAI.

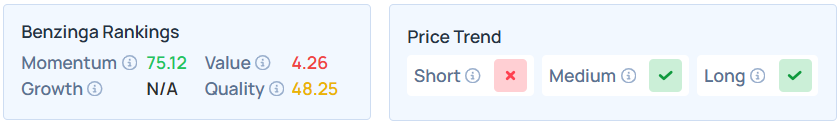

- TSLA maintains a stronger price trend over the long and medium terms but a weak trend in the short term with a poor value ranking, as per Benzinga’s Edge Stock Rankings.

Apple

- Apple Inc. (NASDAQ:AAPL) was 0.48% higher as it is projected to post quarterly earnings of $2.67 per share on revenue of $138.42 billion after the closing bell.

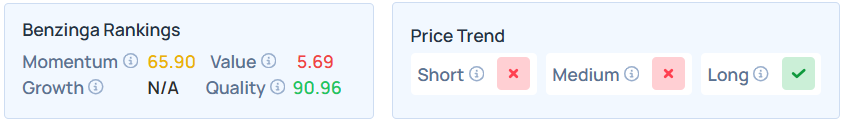

- AAPL maintains a stronger price trend over the long term but a weak trend in the short and medium terms with a solid quality ranking, as per Benzinga’s Edge Stock Rankings.

Meta Platforms

- Meta Platforms Inc. (NASDAQ:META) jumped 7.67% after reporting fourth-quarter revenue of $59.89 billion, beating analyst estimates of $58.30 billion. Its fourth-quarter adjusted earnings came in at $8.88 per share, beating estimates of $8.16 per share.

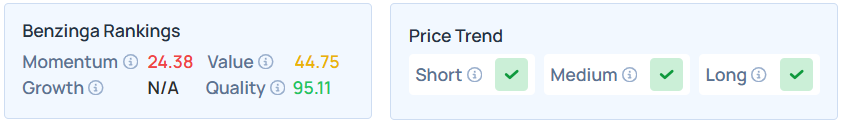

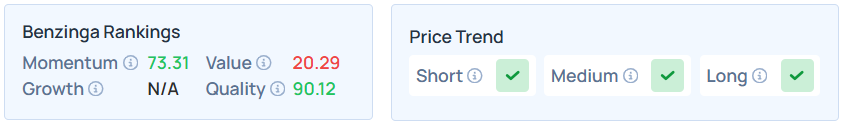

- Benzinga’s Edge Stock Rankings indicate that META maintains a strong price trend over the short, medium, and long terms with a good quality ranking.

International Business Machines

- International Business Machines Corp. (NYSE:IBM) shares climbed 7.98% after reporting fourth-quarter revenue of $19.69 billion, beating the consensus estimate of $19.23 billion and adjusted earnings of $4.52 per share, beating analyst estimates of $4.32 per share.

- IBM maintains a stronger price trend over the short, medium, and long term with a solid quality ranking, as per Benzinga’s Edge Stock Rankings.

Cues From Last Session

Energy and information technology stocks bucked the overall market trend, closing the session higher, while real estate, consumer staples and health care recorded the biggest losses on Wednesday.

| Index | Performance (+/-) | Value |

| Dow Jones | 0.025% | 49,015.60 |

| S&P 500 | -0.0082% | 6,978.03 |

| Nasdaq Composite | 0.17% | 23,857.45 |

| Russell 2000 | -0.49% | 2,653.55 |

Insights From Analysts

BlackRock maintains a constructive outlook on the economy, driven by the belief that “immutable economic laws” are currently limiting extreme policy shifts.

While recent volatility followed geopolitical tensions and tariff threats, the firm notes that the U.S. economy’s “dependence on foreign financing” to fund its debt acts as a natural stabilizer.

They expect the Federal Reserve to adopt a “wait-and-see” stance, likely leaving interest rates unchanged this week due to mixed signals in recent jobs and inflation data.

Regarding the stock market, BlackRock remains overweight U.S. equities, viewing the “AI buildout” as a major structural driver supported by strong earnings. However, they highlight a “leveraging up” theme, forecasting record U.S. investment-grade bond issuance of $1.85 trillion this year.

While they believe mega-cap tech firms are issuing debt from a “position of strength,” they caution that increased leverage makes the financial system “more vulnerable to shocks” such as bond yield spikes.

Consequently, they prefer high-yield bonds over investment-grade bonds and remain underweight long-term government bonds.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Thursday.

- Initial jobless claims data for the week ending Jan. 24, the delayed report of November’s U.S. trade deficit, and the revised third quarter data for U.S. productivity will be released by 8:30 a.m. ET.

- November’s delayed report for wholesale inventories and factory orders will be out by 10:00 a.m. ET.

Commodities, Gold, Crypto And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 2.55% to hover around $64.82 per barrel.

Gold Spot US Dollar rose 1.88% to hover around $5,519.32 per ounce. Its last record high stood at $5,595.44 per ounce. The U.S. Dollar Index spot was 0.19% higher at the 96.2600 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 1.57% lower at $87,847.25 per coin.

Asian markets closed higher on Thursday, except Australia’s ASX 200 index. Hong Kong’s Hang Seng, China’s CSI 300, South Korea’s Kospi, Japan’s Nikkei 225, and India’s Nifty 50 indices rose. European markets were mixed in early trade.

Photo courtesy: Shutterstock

Recent Comments