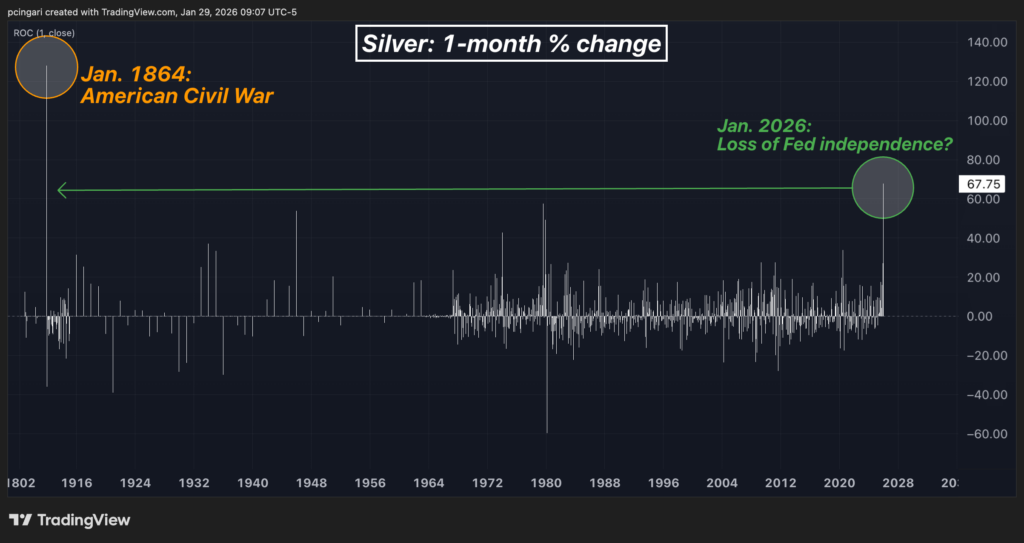

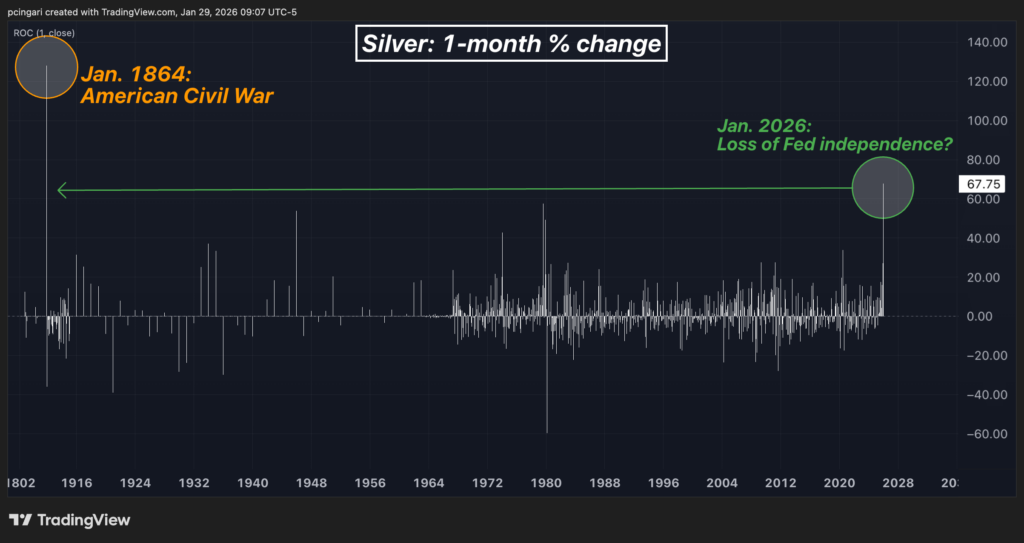

Silver is staging a rally not seen in more than 150 years, reaching back to one of the most extreme monetary stress episodes in U.S. history: the American Civil War.

The gray metal — tracked by the iShares Silver Trust (NYSE:SLV) — surged above $118 per ounce on Thursday, extending its monthly gain to roughly 65%.

According to long-term silver price data, the metal has not recorded a monthly advance of this magnitude since January 1864, at the height of the Civil War.

That comparison is not incidental — and it carries a warning markets tend to take seriously.

Chart: Silver’s Biggest Monthly Surge Since the 1864 Civil War

American Civil War: What Happened To Silver In January 1864?

In January 1864, silver prices more than doubled, surging from roughly $1.29 to $2.94 per ounce — a gain of about 128% in a single month.

The move had nothing to do with industrial demand, supply shortages, or monetary easing as markets understand them today.

Instead, silver exploded higher because the U.S. monetary system was breaking down under the strain of the Civil War.

To finance the conflict, the federal government suspended specie payments and began issuing large amounts of paper currency known as greenbacks, which were not convertible into gold or silver.

As wartime deficits ballooned and issuance accelerated, confidence in paper money eroded rapidly, triggering a sharp rise in inflation.

That breakdown produced the first documented monetary shock of the modern U.S. era.

The Civil War caused a massive contraction in gold and silver coin circulation in the Union as specie payments were suspended and coins were hoarded for their intrinsic value, effectively removing them from everyday commerce.

Precious metals were no longer just assets — they were the real money.

The episode became a textbook case of Gresham’s Law, as depreciating paper currency (“bad money”) drove silver and gold (“good money”) out of circulation and into hoards.

Silver prices, quoted in depreciating greenbacks, soared as the dollar rapidly lost purchasing power.

By 1864, gold traded above $40 per ounce in greenbacks, double its pre-war statutory price of $20.67. Silver moved in lockstep, marking one of the most powerful historical votes of no confidence in paper money.

So acute was the currency stress that in June 1864, Congress passed the Anti-Gold Futures Act, banning forward contracts in gold and foreign exchange in an attempt to curb speculation.

The move underscored how soaring precious-metal premiums were increasingly seen as a direct challenge to the credibility of a monetary system.

Why Is Silver Sending A Macro Warning Today?

History doesn’t repeat — but it often rhymes.

In 2025, silver surged 148%, marking its strongest annual performance since 1979, when the Hunt Brothers attempted to corner the market.

The momentum didn’t fade with the calendar turn.

Prices jumped another 68%, the largest monthly rally since January 1864.

This isn’t a move driven by a single narrative.

Silver’s 2025–2026 surge sits at the intersection of structural demand from the AI infrastructure buildout, reflexive spillover from gold, rising retail participation, and growing unease over Federal Reserve independence — the last echoing the same loss-of-credibility dynamic that fueled silver’s historic surge in 1864.

Why Is Fed Independence At Risk — And Why Is Powell Dismissing Precious Metals?

Concerns about Federal Reserve independence escalated after Jan. 11, 2026, when the Department of Justice served the Fed with grand jury subpoenas tied to Chair Jerome Powell‘s prior Senate testimony on a long-running building renovation — a move Powell framed as political pressure rather than a genuine legal dispute.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President [Donald Trump],” Powell stated.

On Wednesday, Jan. 29, Powell moved to downplay the broader implications of the precious metals rally during his post-FOMC press conference, after the committee voted to hold interest rates steady in the 3.50%–3.75% range.

“If you look at where inflation expectations are, our credibility is right where it needs to be,” Powell said.

“We don’t get spun up over particular asset change prices, although we do monitor them, of course.”

Powell’s remarks did little to cool the move, with silver pushing past $118 per ounce, gold climbing above $5,500, and the U.S. dollar sliding to a four-year low—a backdrop that suggests markets continue to price precious metals as a hedge against currency erosion and Fed credibility.

And history suggests markets reach for those comparisons only when something fundamental is shifting.

Image: Shutterstock

Recent Comments