Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) shares are climbing as investors extrapolate Royal Caribbean’s upbeat earnings and booking trends to the broader cruise industry. Here’s what investors need to know.

- Norwegian Cruise Line stock is among today’s top performers. Why is NCLH stock surging?

Royal Caribbean’s Results Point to Industrywide Pricing Power

Royal Caribbean reported fourth-quarter adjusted EPS of $2.80 and revenue of $4.259 billion, while pointing to strong demand, higher yields and tighter cost control signals that the sector’s pricing environment remains firm.

A key read-through for peers like NCLH is Royal Caribbean’s ability to keep ships exceptionally full and still raise economics. The company said its load factor hit 108% and gross margin yields rose 9.2%, with net yields up 3.1% year over year.

That combination suggests consumers are accepting higher ticket prices and onboard spending, conditions that typically lift revenue expectations across competing cruise lines.

Why Cost Discipline At RCL Matters For NCLH Valuation

Royal Caribbean also reported net cruise costs (excluding fuel) down 5.8% per Available Passenger Cruise Days. When an industry leader expands margins through efficiency, investors often assume peers can capture similar operating leverage, supporting higher forward earnings estimates and valuation multiples for stocks like NCLH.

2026 Bookings and Guidance Fuel Optimism For Cruise Peers

The biggest catalyst: Royal Caribbean said about two-thirds of 2026 capacity is already booked at record rates and cited the strongest seven booking weeks in company history, evidence of sustained demand into next year.

It also guided first-quarter 2026 adjusted EPS to $3.18–$3.28 and full-year EPS to $17.70–$18.10, both above consensus, reinforcing the bullish sector backdrop lifting NCLH.

Short-Term Gains Mask Long-Term Struggles

The stock is currently trading 0.75% above its 20-day simple moving average (SMA) and 7.2% above its 50-day SMA, indicating short-term strength. Over the past 12 months, shares have decreased by 21.17%, and they are currently positioned closer to their 52-week lows than highs, suggesting some long-term challenges.

The RSI is at 40.52, which is considered neutral territory, while the MACD is below its signal line, indicating bearish pressure on the stock. The combination of neutral RSI and bearish MACD suggests mixed momentum.

- Key Resistance: $24.50

- Key Support: $22.00

Norwegian Cruise Line’s Business Model

Norwegian Cruise Line is the world’s third-largest publicly traded cruise company by berths, operating 34 ships across three brands—Norwegian, Oceania and Regent Seven Seas.

The company redeployed its entire fleet as of May 2022 and is increasing capacity faster than its peers, with 13 passenger vessels on order through 2036, representing 38,400 incremental berths.

Earnings Expectations: A Mixed Bag Ahead

Investors are looking ahead to the next earnings report on Feb. 26.

- EPS Estimate: 24 cents (Down from 26 cents YoY)

- Revenue Estimate: $2.34 billion (Up from $2.11 billion YoY)

- Valuation: P/E of 15.0x (Indicates value opportunity)

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $27.76. Recent analyst moves include:

- JP Morgan: Overweight (Lowers Target to $28.00) (Jan. 20)

- Citigroup: Buy (Raises Target to $29.00) (Jan. 14)

- Wells Fargo: Overweight (Raises Target to $33.00) (Jan. 13)

Valuation Insight: While the stock trades at a value P/E multiple, the strong consensus and 8% expected earnings decline suggest analysts view this growth as justification for the 23% upside to analyst targets.

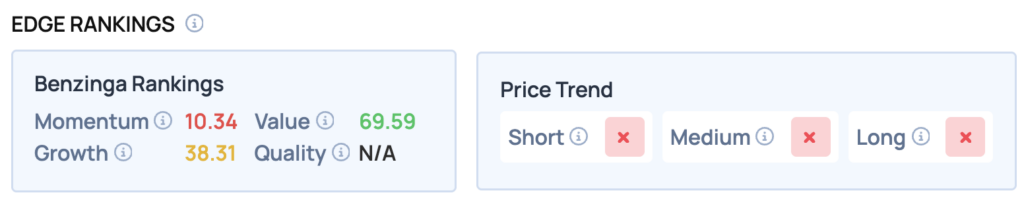

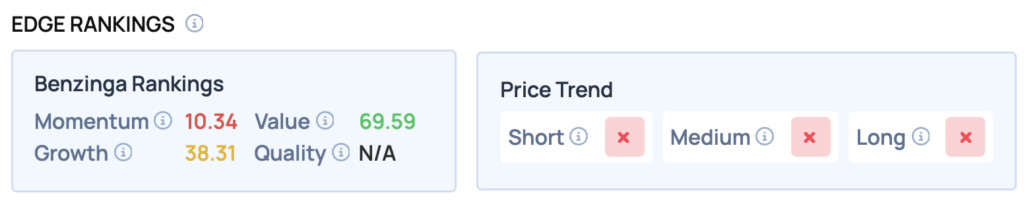

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Benzinga Edge scorecard for Norwegian Cruise Line’s Shares, highlighting its strengths and weaknesses compared to the broader market:

- Value: 69.59 — The stock is reasonably valued relative to its peers.

- Growth: 38.31 — Indicates moderate growth potential.

- Momentum: 10.34 — The stock is underperforming the broader market.

The Verdict: Norwegian Cruise Line’s Benzinga Edge signal reveals a mixed outlook. While the Value score suggests some attractiveness, the low Momentum score indicates that the stock is currently underperforming relative to the broader market.

NCLH Shares Surge Thursday Afternoon

NCLH Price Action: Norwegian Cruise Line shares were up 8.68% at $22.59 at the time of publication on Thursday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments