Mastercard Incorporated (NYSE:MA) will release earnings for the fourth quarter before the opening bell on Thursday, Jan. 29.

Analysts expect the Purchase, New York-based company to report fourth-quarter earnings of $4.24 per share. That’s up from $3.82 per share in the year-ago period. The consensus estimate for Mastercard’s quarterly revenue is $8.78 billion (it reported $7.49 billion last year), according to Benzinga Pro.

On Dec. 9, Mastercard raised its quarterly cash dividend from 76 cents to 87 cents per share and announced a $14 billion share repurchase program.

Shares of Mastercard gained 0.2% to close at $521.37 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

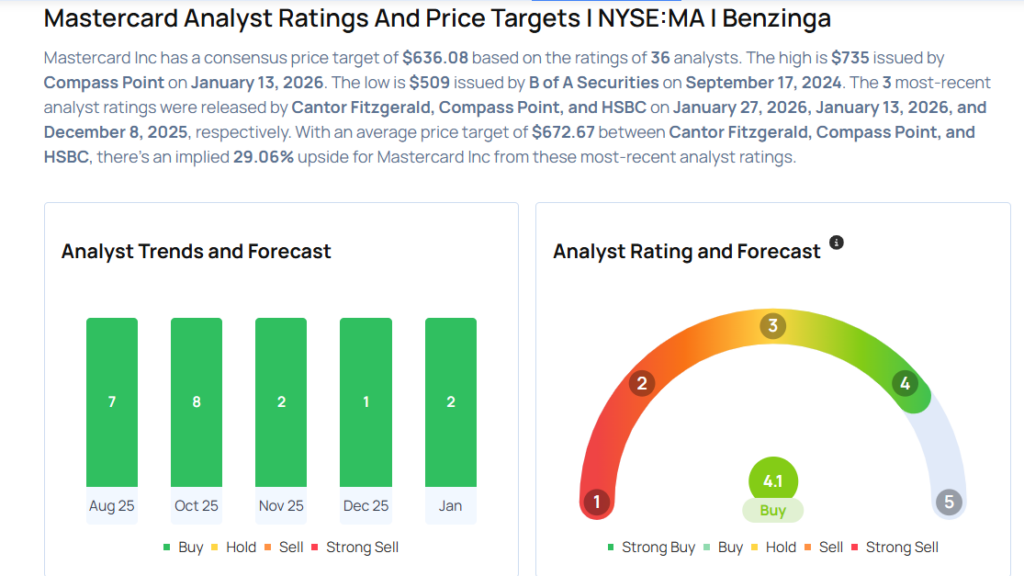

- Cantor Fitzgerald analyst Ramsey El-Assal initiated coverage on the stock with an Overweight rating and a price target of $650 on Jan. 27, 2026. This analyst has an accuracy rate of 62%.

- Compass Point analyst Dominick Gabriele upgraded the stock from Neutral to Buy and boosted the price target from $620 to $735 on Jan. 13, 2026. This analyst has an accuracy rate of 61%.

- HSBC analyst Saul Martinez upgraded the stock from Hold to Buy and raised the price target from $598 to $633 on Dec. 8, 2025. This analyst has an accuracy rate of 66%.

- Tigress Financial analyst Ivan Feinseth maintained a Strong Buy rating and raised the price target from $685 to $730 on Nov. 6, 2025. This analyst has an accuracy rate of 73%.

- Macquarie analyst Paul Golding maintained an Outperform rating and increased the price target from $655 to $660 on Oct. 31, 2025. This analyst has an accuracy rate of 73%

Considering buying MA stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments