On Wednesday, Meta Platforms, Inc. (NASDAQ:META) CEO Mark Zuckerberg said the company is looking beyond video toward interactive, immersive formats that let users step inside content, as Horizon Worlds and AI converge to reach mobile audiences.

Meta Says Video Is Just One Step In A Longer Content Evolution

During the company’s fourth-quarter earnings call, Zuckerberg said video, while still growing, is not the final stage of digital expression.

He told analysts that the way people communicate has consistently evolved as technology improves, moving from text to photos and eventually to video as smartphones and faster networks enabled richer formats.

“People always want to express themselves and experience the world in whatever the richest format is that they can,” Zuckerberg said, adding that video “is not the end of the line.”

Horizon Worlds And AI Could Enable Interactive Content On Mobile

The Meta CEO also highlighted Horizon Worlds as a key example of where Meta sees the future heading, particularly as the company works to bring the platform beyond virtual reality headsets and onto mobile devices.

He suggested a future in which users don’t just watch content but actively participate in it, describing experiences where someone could tap a video and “jump into it” to engage in a more immersive way.

Meta’s investments in virtual reality software, Horizon and artificial intelligence are expected to work together to make those experiences scalable, he said.

AI, in particular, could help create interactive environments and lower the barrier to building immersive content.

“I think the investments that we’ve done… are going to pair well with these AI advances to be able to bring some of those experiences to hundreds of millions and billions of people through mobile,” Zuckerberg said.

“That’s the thing that I’m quite excited about, but it’s just sort of one flavor of a theme that I think is going to be very interesting,” Zuckerberg concluded.

Meta Beats Q4 Revenue And Earnings Estimates

Meta posted fourth-quarter revenue of $59.89 billion, topping analysts’ expectations of $58.30 billion, while adjusted earnings came in at $8.88 per share, surpassing the consensus estimate of $8.16, according to Benzinga Pro.

Looking ahead, the company forecasts first-quarter revenue between $53.5 billion and $56.5 billion, above Wall Street’s estimate of $51.31 billion.

Meta also said it expects full-year 2026 expenses to range from $162 billion to $169 billion and projected capital expenditures of $115 billion to $135 billion.

Price Action: After-hours trading saw Meta surge 6.64% to $713.12, following a regular session close of $668.73, down 0.63% on Wednesday, according to Benzinga Pro.

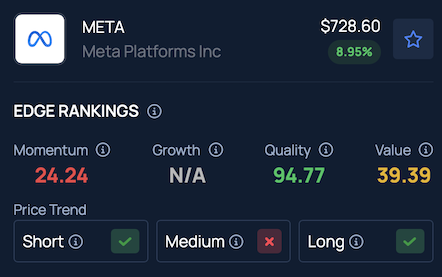

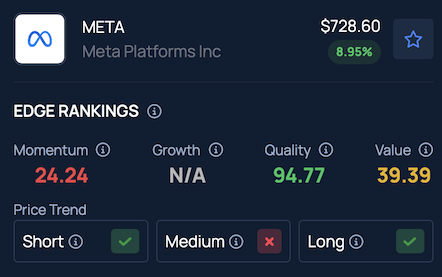

Meta stock ranks low on Momentum in Benzinga’s Edge Stock Rankings, showing a positive price trend in both the short and long term, but a negative trend in the medium term.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: FotoField on Shutterstock.com

Recent Comments