Gold prices continued their record-breaking ascent on Thursday, Jan. 29, approaching the psychological $5,600 per ounce mark. This rally, which has seen gold gain more than 10% in just four sessions, is also aiding five key ETFs that have moved into the top 10th percentile of momentum score according to Benzinga Edge’s Stock Rankings.

Elite Momentum And The ‘Triple-Green’ Signal

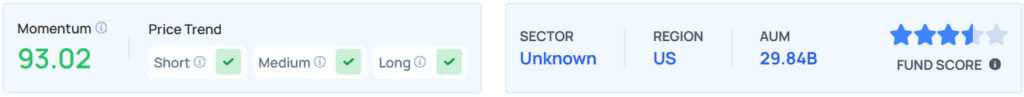

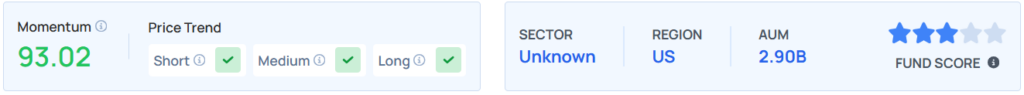

The Goldman Sachs Physical Gold ETF (BATS:AAAU), SPDR Gold Trust (NYSE:GLD), SPDR Gold MiniShares Trust (NYSE:GLDM), iShares Gold Trust (NYSE:IAU), and VanEck Merk Gold ETF (NYSE:OUNZ) have all secured momentum scores between 92.84 and 93.02.

According to the Benzinga Edge methodology, these scores represent a percentile-ranked composite metric measuring relative price strength and volatility.

Crucially, all five funds are flashing “green” checkmarks across three critical timeframes:

- Short-Term: Positive upward trend over the last couple of months.

- Medium-Term: Positive trend sustained over the last couple of quarters.

- Long-Term: Sustained upward movement over the past year.

Goldman Sachs Physical Gold ETF

SPDR Gold Trust

SPDR Gold MiniShares Trust

iShares Gold Trust

VanEck Merk Gold ETF

Macro Tailwinds: Fed Pause And Geopolitical Heat

The surge follows the Federal Reserve’s decision to leave interest rates unchanged at 3.50%–3.75%.

While the Fed remains cautious, markets interpreted the pause as a reinforcement of prolonged monetary support, lowering the opportunity cost for holding non-yielding bullion.

Analyst Rahul Kalantri, VP Commodities at Mehta Equities Ltd., noted that investors are increasingly shifting away from paper currencies toward tangible assets amid mounting geopolitical uncertainty.

Specifically, escalating tensions between the U.S. and Iran have fueled a “flight to safety,” with gold acting as a neutral store of value.

Investor Outlook

Gold spot is trading at $5,506.47, as of last check, after scaling an all-time high of $5,595.44. The technical resistance is now pegged between $5,525 and $5,600, and it “has support at $5340-5220,” as per Kalantri.

Here’s how these ETFs have performed.

| Gold ETFs | YTD Performance | 6-Month Performance | One Year Performance |

| SPDR Gold Trust | 24.17% | 61.49% | 94.56% |

| iShares Gold Trust | 24.14% | 61.51% | 94.71% |

| SPDR Gold MiniShares Trust | 24.14% | 61.64% | 95.02% |

| VanEck Merk Gold ETF | 24.16% | 61.57% | 94.62% |

| Goldman Sachs Physical Gold ETF | 24.12% | 61.59% | 94.75% |

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments