Brian Armstrong, CEO of Coinbase Global Inc. (NASDAQ:COIN), said on Wednesday that the company has signed up for the Trump Accounts initiative, pledging to match the $1,000 contribution for eligible children of employees.

Coinbase Supports Trump-Branded Program

In an X post, Armstrong lauded the federal government initiative, emphasizing the importance of early investments in financial security and literacy for kids.

“We’re proud to join POTUS’s initiative by matching the $1,000 from the U.S. Treasury for all eligible children of Coinbase employees,” Armstrong said.

He expressed hope that the contribution could be made in Bitcoin (CRYPTO: BTC).

Will Trump Accounts Transform Wealth Building?

Under the Trump Accounts program, all American babies born between 2025 and 2028 are eligible to receive $1,000 from the government. The funds will be “automatically” invested in U.S-based companies, growing in value over time.

Parents will serve as the sole custodians of these accounts until the child reaches 18, at which point the child can choose to withdraw funds or let the account grow.

Coinbase matching the federal government’s contribution means that the children of its employees will have a total of $2,000 to begin with.

Notably, Dell Technologies, Inc. (NYSE:DELL) billionaire Michael Dell and his wife, Susan, have pledged $6.25 billion to fund the initiative.

While the government’s initial $1,000 seed deposit and charitable donations are safe, contributions by parents currently lack a crucial exemption from federal gift tax laws.

Coinbase Strives For Pro-Crypto Legislation

Coinbase recently withdrew its support for the Senate Banking Committee’s cryptocurrency market structure bill, leading to a postponement of the vote on the legislation.

Despite this, Armstrong refuted claims that the White House is unhappy with Coinbase’s handling of the bill, describing their relationship as “super constructive.”

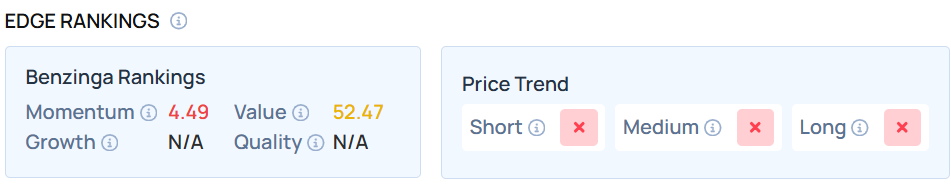

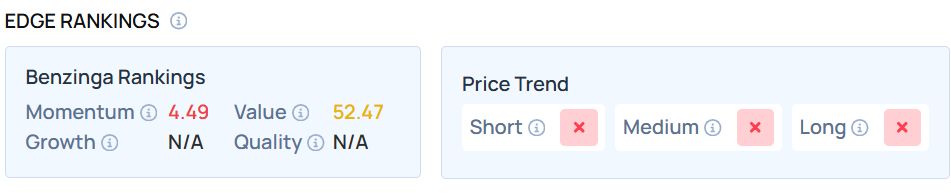

Price Action: Coinbase shares fell 0.29% in after-hours trading after closing 0.66% lower at $209.43 during Wednesday’s regular trading session, according to data from Benzinga Pro.

The stock maintains a weaker price trend over the short, medium, and long term with a moderately high Value ranking, according to Benzinga’s Edge Stock Rankings.

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Recent Comments