Baker Hughes Co. (NASDAQ:BKR) posted upbeat results for the fourth quarter.

The company posted adjusted earnings of 78 cents per share, beating market estimates of 67 cents per share. The company’s quarterly sales came in at $7.386 billion, topping expectations of $7.068 billion.

“Baker Hughes delivered exceptional performance in 2025. We continued to execute at a high level, delivering another quarter of strong results contributing to a record full‑year Adjusted EBITDA. This achievement demonstrates sustained momentum from our Business System, active portfolio management, and positive performance in IET, which more than offset continued macro‑driven softness in OFSE, where margins remained resilient through disciplined cost actions,” said Lorenzo Simonelli, Baker Hughes Chairman and Chief Executive Officer.

Baker Hughes shares rose 4.4% to close at $56.29 on Monday.

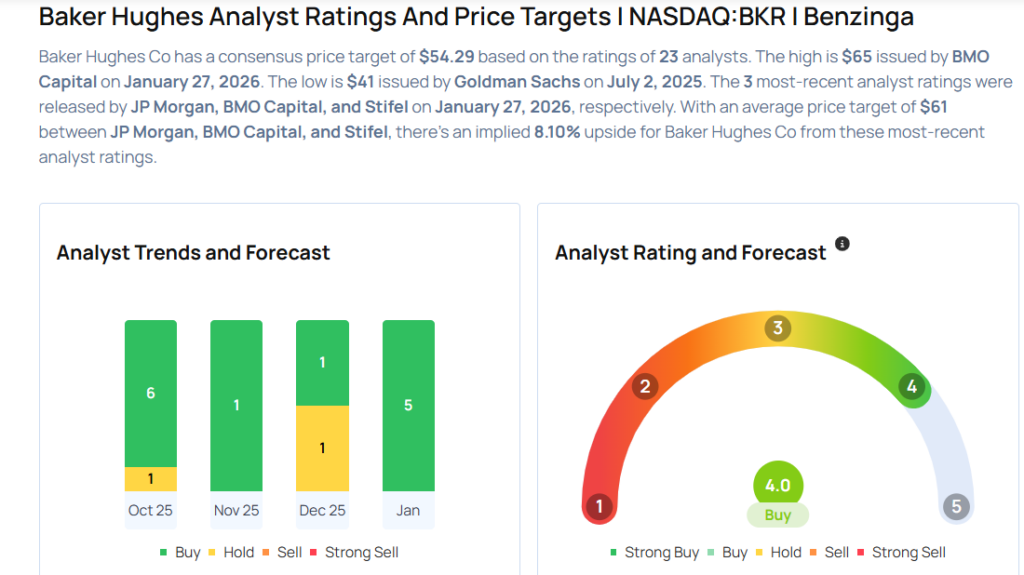

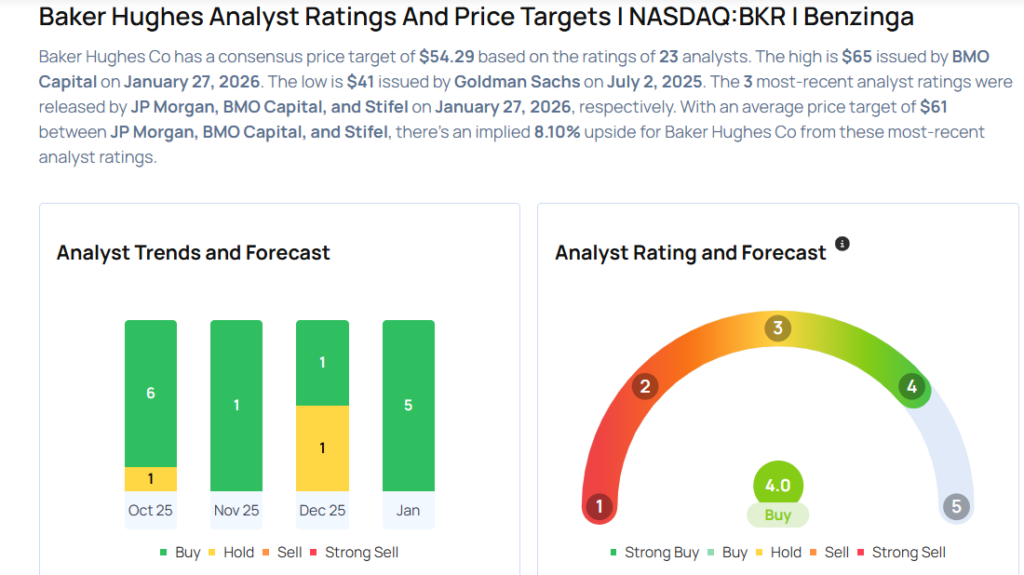

These analysts made changes to their price targets on Baker Hughes following earnings announcement.

- BMO Capital analyst Phillip Jungwirth maintained Baker Hughes with an Outperform rating and raised the price target from $55 to $65.

- JP Morgan analyst Sean Meakim maintained the stock with an Overweight rating and raised the price target from $53 to $60.

Considering buying BKR stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments