Silvercorp Metals Inc. (NYSE:SVM) has surged into the top tier of Benzinga Edge’s stock rankings this week, driven by a powerful breakout in silver prices and strong pre-earnings optimism.

Decoding The Benzinga Edge Rankings

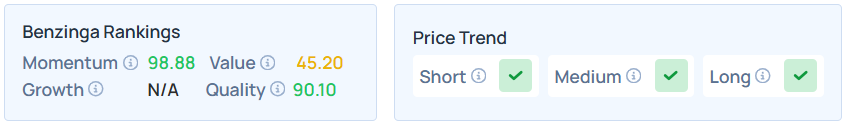

The mining firm’s quality score jumped significantly week-over-week, rising from 74.43 to 90.10, signaling a major improvement in its fundamental outlook relative to peers.

This fundamental strength is matched by elite price action. Silvercorp currently holds a momentum score of 98.88, placing it in the top percentile of all stocks tracked.

This aligns with the company’s price trend indicators, which, according to Benzinga’s Edge Stock Rankings, are now flashing green across all timeframes—short, medium, and long—confirming a sustained upward trajectory.

What Do Benzinga Edge Rankings Mean?

The surge in rankings highlights two distinct drivers of Silvercorp’s performance. The momentum score reflects the stock’s relative strength and volatility patterns, confirming it is outperforming the broader market.

Meanwhile, the jump in quality score indicates robust “operational efficiency and financial health,” based on historical profitability and fundamental strength.

While the stock is surging, its value score remains moderate at 45.20, suggesting investors are paying a premium for this momentum.

Macro Catalysts And Upcoming Earnings

The rally is heavily supported by the underlying commodity. Spot Silver recently spiked 6.34% to trade at $110.44 during the publication of this article, following a push toward new all-time highs near $117.73.

Investors are now looking toward Silvercorp’s upcoming earnings report on Feb. 9, where analysts expect significant growth.

Consensus estimates, as per Benzinga project, an EPS of $0.19, nearly double the prior period’s $0.10, alongside a revenue forecast of $124.66 million compared to $83.61 million previously.

SVM Jumps Over 53% YTD

Shares of SVM have gained 53.12% so far in 2026. It was also up 177.01% over the last six months and 327.09% over the last year.

On Monday, the stock fell 1.31% to $12.77 apiece and gained 0.55% in after-hours.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments