Pinterest Inc (NYSE:PINS) announced a global restructuring plan that will lead to a reduction in its workforce by less than 15%. The stock declined 2.55% in Tuesday’s pre-market trading session.

The plan also calls for a reduction in office space. The company expects to record pre-tax restructuring charges of approximately $35 million to $45 million, and the process is expected to be completed by the end of the third quarter.

As of its latest annual report for 2024, Pinterest had 4,666 full-time employees.

The digital pinboard platform stated that the restructuring measures are intended to advance its transformation efforts by shifting resources toward AI-driven roles and teams.

Pinterest Reshapes Focus On AI Ads

The restructuring comes as Pinterest continues to pivot towards AI and other transformation initiatives. This is a plan to expand into connected television performance advertising. Pinterest’s acquisition of tvScientific in December was part of this effort to expand its AI-powered performance ad offerings to connected TV.

In November, Pinterest reported downbeat sales for the third quarter, leading to analysts slashing their forecasts. Despite this, CEO Bill Ready highlighted the company’s investments in AI and product innovation as paying off, turning the platform into an AI-powered shopping assistant for 600 million consumers.

Moreover, speculation around a potential OpenAI acquisition of Pinterest has been gaining traction, with Kalshi traders pricing a 54% chance, following The Information report, which included OpenAI acquiring Pinterest among its 2026 predictions.

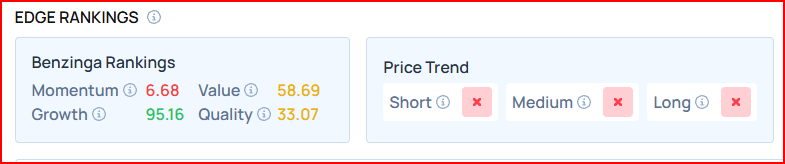

Benzinga’s Edge Rankings place Pinterest in the 95th percentile for growth and the 59th percentile for value, reflecting its mixed performance. Benzinga’s screener allows you to compare Pinterest’s performance with its peers.

Price Action: Over the past year, Pinterest stock declined 22.64%, as per data from Benzinga Pro. On Monday, the stock edged 0.04% lower to close at $25.90.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Images via Shutterstock

Recent Comments