Editor’s Note: The headline in this story has been updated for clarity

U.S. stock futures are trading mixed on Monday night after President Donald Trump announced fresh tariffs against South Korea, for not “living up to” the trade agreement signed with the United States in July last year.

The S&P 500 Futures are up 0.05%, or 4.25 points, trading at 6,985.25, followed by Nasdaq Futures at 25,913.25, up 0.24%, or 62.25 points and finally Dow Futures, trading at 49,416.00, down 149 points, or 0.30%, on late Tuesday evening.

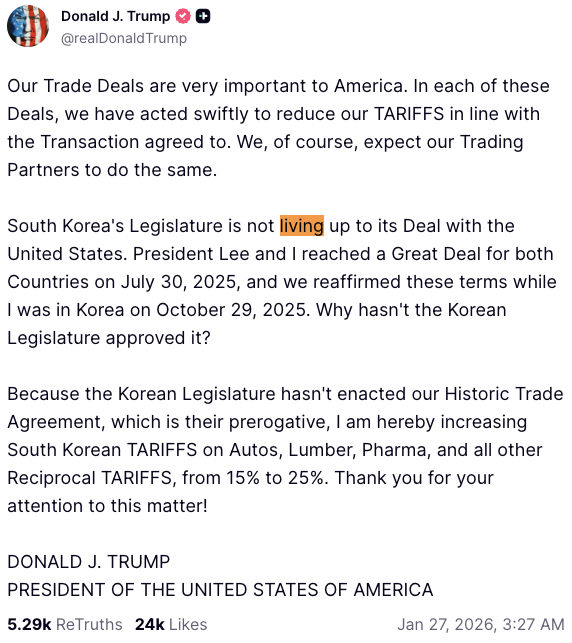

In a post on Truth Social on Monday, Trump said he would raise tariffs on South Korean automotives, lumber, pharmaceuticals and other major exports from 15% to 25%, citing failure of the country’s legislature to pass what he described as a “historic trade agreement.”

South Korea’s KOSPI index is, however, up 0.62% on Tuesday morning, trading at 4,980.26 after opening lower, but major stocks with exposure to U.S. markets, such as Hyundai Motor Company (OTC:HYMLF) and Kia Motors Corp. (OTC:KIMTF) are down by 1.93% and 2.96%, respectively.

Other Asian markets, such as Japan’s Nikkei 225, are down marginally by 0.04%, at 52,860.35 in early morning trade, with food, electricals and mining stocks leading the rally.

Silver witnessed a steep pullback on Monday, after touching a new record high of $117.69 per ounce, and is currently up 5.95%, trading at $109.92 per ounce. Gold prices similarly touched a new all-time high of $5,111.21 on Monday, before retreating, currently trading at $5,066.83 per ounce, up 1.17%.

The U.S. Dollar Index (DXY) is flat, trading up 0.01%, at 97.075 against a basket of other currencies, despite fresh tariff threats by Trump.

Investors on Tuesday will be looking forward to the earnings of UnitedHealth Group Inc. (NYSE:UNH), Boeing Co. (NYSE:BA) and General Motors Co. (NYSE:GM), among others, along with the release of the Case Shiller 20-City Home Price Index and the Consumer Confidence Report, earlier in the day.

Photo Courtesy: Tomas Ragina on Shutterstock.com

Recent Comments