Coinbase Global Inc. (NASDAQ:COIN) CEO Brian Armstrong announced on Monday the formation of an advisory board to assess the implications of quantum computing for the blockchain industry and prepare for “future threats.”

Coinbase Moves Against Quantum Threats

In an X post, Armstrong said the group will comprise “distinguished” researchers in quantum computing, cryptography and blockchain systems to ensure quantum threats are properly considered.

“Security is our highest priority at Coinbase. Preparing for future threats, even those many years away, is crucial for our industry,” Armstrong said. “It’s important we’re thinking these through and preparing where necessary.”

The advisory board will be responsible for publishing research papers on the state of quantum computing and its impact on blockchains, issuing recommendations for organizations and responding in real time to tangible threats.

The board will feature Justin Drake, an Ethereum Foundation researcher, and Sreeram Kannan, founder of restaking platform EigenLayer, among other notable researchers.

The Quantum Computing Debate Heats Up

This move by Coinbase aligns with recent industry discussions around the potential impact of quantum computing on cryptocurrencies.

Ethereum (CRYPTO: ETH) creator Vitalik Buterin called for the swift deployment of quantum-resistant technology for the network earlier this month, emphasizing its importance for long-term cryptographic safety.

On the other hand, Michael Saylor, Executive Chairman of Strategy Inc. (NASDAQ:MSTR), expressed his belief that quantum computing will not weaken Bitcoin (CRYPTO: BTC), but rather make it more resilient.

Jameson Lopp, Chief Security Officer at self-custody platform firm Casa, stated in December that upgrading Bitcoin, which involves migrating funds to a quantum-resistant version, could take up to a decade.

Digital asset management firm Grayscale said in a December report that quantum computing won’t have a significant impact on cryptocurrency valuations in 2026, while acknowledging that “Bitcoin and most other blockchains will eventually need to be updated for post-quantum tools.”

Price Action: Coinbase shares rose 0.46% in after-hours trading after closing 1.60% lower at $213.48 during Monday’s regular trading session, according to data from Benzinga Pro.

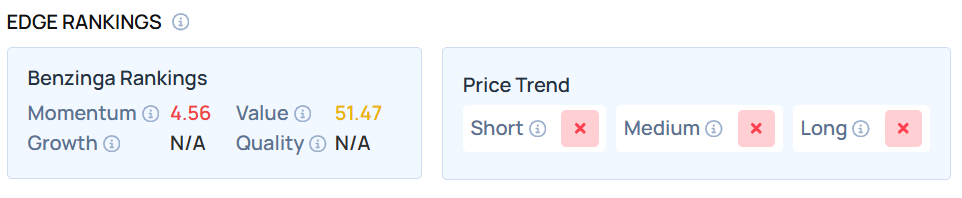

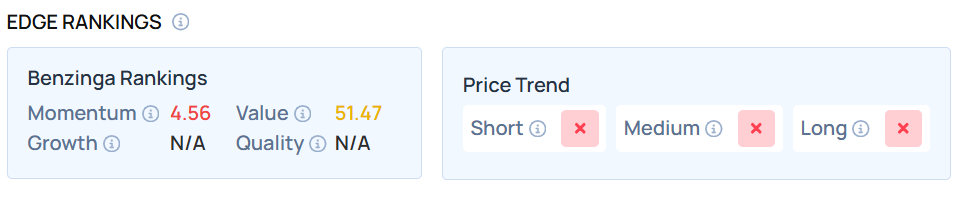

The stock maintains a weaker price trend over the short, medium, and long term with a poor Momentum ranking, according to Benzinga’s Edge Stock Rankings.

Image via Shutterstock By Thrive Studios ID

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Recent Comments