Swiss-American biotechnology company, CRISPR Therapeutics AG (NASDAQ:CRSP), has come under renewed pressure in recent weeks, amid insider sales, slow revenue growth, and weak adoption of its core products.

The company, which often features at the top of several funds managed by Cathie Wood’s Ark Invest, such as the Ark Innovation ETF (BATS:ARKK) and the Ark Genomic Revolution ETF (BATS:ARKG), is seeing its Momentum score slide over the past couple of days.

Biotech Stock Sees Momentum Slide

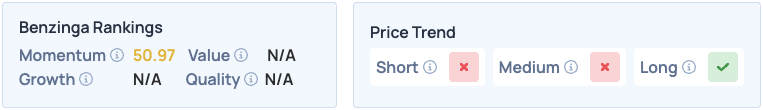

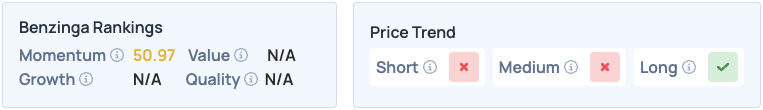

The Momentum score in Benzinga’s Edge Stock Rankings is calculated based on the strength of a stock, taking into consideration its price movements and volatility across multiple time frames, before being ranked as a percentile against others.

CRISPR Therapeutics AG has seen its Momentum score drop from 76.81 to 50.97 within the span of a week, as the stock itself plunged over 10% since last week.

The most immediate trigger for the pullback appears to be a pre-arranged share sale by CEO Samarth Kulkarni, who sold more than 90,000 shares over three days last week.

While the transactions were executed under a previously disclosed trading plan and Kulkarni still retains a sizable stake of roughly 85,000 shares, the scale and timing of the sales nonetheless unsettled investors.

This comes alongside its slow pace of revenue growth, which stood at just $890,000 during its third-quarter results, falling significantly short of consensus estimates at $8.06 million, which further spooked investors, leading to a loss of confidence in the stock.

The stock scores poorly in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short and medium terms.

Image via Shutterstock

Recent Comments