Fitz-Gerald Group CIO Keith Fitz-Gerald shared his optimism about Apple‘s (NASDAQ:AAPL) potential in the field of artificial intelligence (AI). He also hinted at a ” very impressive” release from the tech giant this spring.

Fitz-Gerald, in a conversation with host Stuart Varney on Fox Business on Monday, pointed out Apple’s strong market presence, high margins, and cash flow, and predicted a major product launch in the spring, akin to the iPhone’s revolutionary form factor change.

“It reminds me of the lead-up to the iPhone when they changed the form factor forever,” he stated.

The CIO said that they believed the announcement would be made at the developers’ conference.

When asked if he would be buying more Apple stock, the CIO responded affirmatively, stating that Apple is not lagging in AI as commonly believed. He also commended Apple’s “outrageous” margin and cash flows.

When Varney inquired about the nature of this upcoming release, Fitz-Gerald suggested a significant development in the form factor domain. He mentioned rumors and Apple’s patent filings hinting at “dynamic things” that could potentially redefine the concept of iPhones and watches.

Apple Unveils AirTag 2, Strong iPhone Demand

Fitz-Gerald’s comments come amid a series of significant developments for Apple. The company, on Monday, unveiled the second-generation AirTag, featuring an upgraded Ultra Wideband chip and a louder chime for easier tracking. This release was preceded by reports of Apple’s plans to launch an AI-powered wearable pin to compete with OpenAI’s wearable.

Despite concerns about rising memory costs and slowing App Store growth, Apple’s stock has been performing well. JPMorgan recently raised its price target for Apple, citing strong iPhone demand and a potential reduction in operating expenses as drivers for an earnings beat. Analyst Samik Chatterjee believes that these factors could lead to nearly 25% upside from the current stock price levels.

Apple is set to report its first-quarter results on Jan. 29.

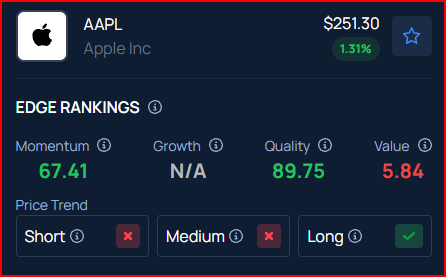

Benzinga’s Edge Rankings place Apple in the 90th percentile for quality and the 67th percentile for momentum, reflecting its average performance. Benzinga’s screener allows you to compare Apple’s performance with its peers.

Price Action: Over the past year, Apple stock climbed 11.12%, as per data from Benzinga Pro. On Monday, the stock climbed 2.97% to close at $255.41.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments