UnitedHealth Group Incorporated (NYSE:UNH) will release earnings results for the fourth quarter, before the opening bell on Tuesday, Jan. 27.

Analysts expect the Eden Prairie, Minnesota-based company to report quarterly earnings at $2.11 per share, down from $6.81 per share in the year-ago period. The consensus estimate for UnitedHealth’s quarterly revenue is $113.73 billion, versus $100.81 billion a year earlier, according to data from Benzinga Pro.

Stephen Hemsley, chairman and CEO of UnitedHealth Group, recently told lawmakers that rising hospital prices, consolidation, specialty services, and prescription drug costs—not insurers—are the primary forces pushing U.S. health care spending higher. He urged policy reforms to improve affordability and access.

UnitedHealth shares gained 0.5% to close at $356.26 on Friday.

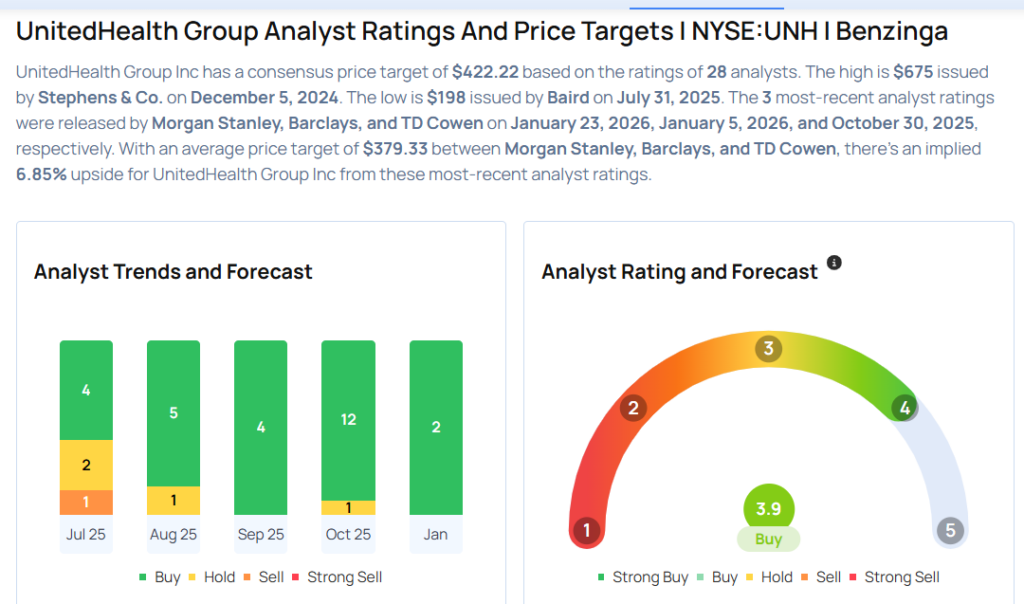

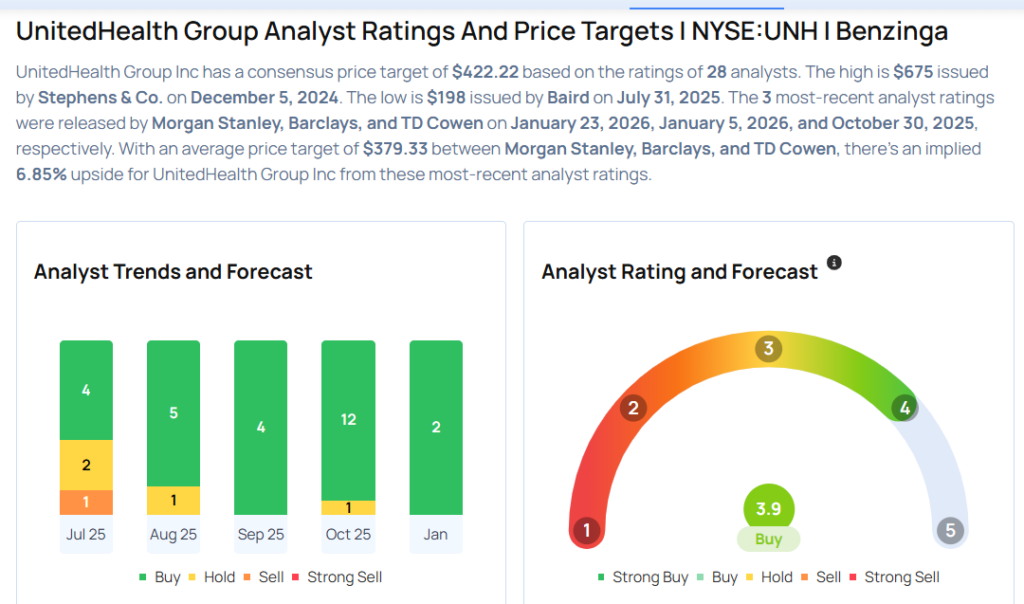

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Morgan Stanley analyst Ricky Goldwasser maintained an Overweight rating and cut the price target from $411 to $409 on Jan. 23, 2026. This analyst has an accuracy rate of 69%.

- Barclays analyst Andrew Mok maintained the stock with an Overweight rating and raised the price target from $386 to $391 on Jan. 5, 2026. This analyst has an accuracy rate of 60%.

- Bernstein analyst Lance Wilkes maintained the stock with an Outperform and raised the price target from $433 to $440 on Oct. 30, 2025. This analyst has an accuracy rate of 57%.

- UBS analyst Kevin Caliendo maintained the stock with a Buy rating and raised the price target from $378 to $430 on Oct. 29, 2025. This analyst has an accuracy rate of 71%.

- RBC Capital analyst Ben Hendrix maintained the stock with an Outperform rating and raised the price target from $286 to $408 on Oct. 29, 2025. This analyst has an accuracy rate of 61%.

Considering buying UNH stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments