U.S. stock futures dropped on Monday following Friday’s mixed close. Futures of major benchmark indices were lower.

This week, investors are eyeing earnings from UnitedHealth Group Inc. (NYSE:UNH), General Motors Co. (NYSE:GM), Microsoft Corp. (NASDAQ:MSFT), Meta Platforms Inc. (NASDAQ:META), Tesla Inc. (NASDAQ:TSLA), Starbucks Corp. (NASDAQ:SBUX), and others.

The investors will also keep an eye on the Federal Open Market Committee’s decision on interest rates, slated to be announced on Wednesday.

Meanwhile, the 10-year Treasury bond yielded 4.21%, and the two-year bond was at 3.59%. The CME Group’s FedWatch tool‘s projections show markets pricing a 97.2% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Index | Performance (+/-) |

| Dow Jones | -0.12% |

| S&P 500 | -0.24% |

| Nasdaq 100 | -0.44% |

| Russell 2000 | -0.29% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Monday. The SPY was down 0.22% at $687.69, while the QQQ declined 0.43% to $620.04.

Stocks In Focus

Baker Hughes

- Baker Hughes Co. (NASDAQ:BKR) was 3.74% higher in premarket on Monday after posting upbeat results for the fourth quarter. The company posted adjusted earnings of 78 cents per share, beating market estimates of 67 cents per share.

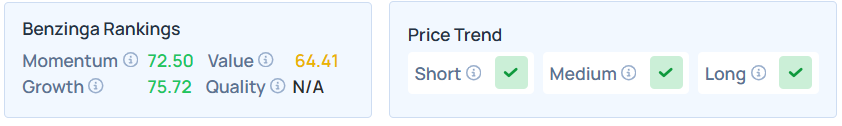

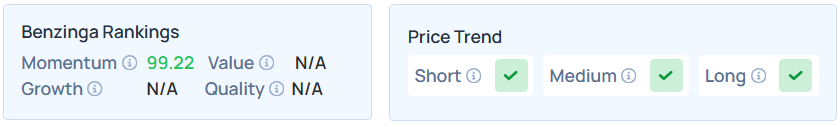

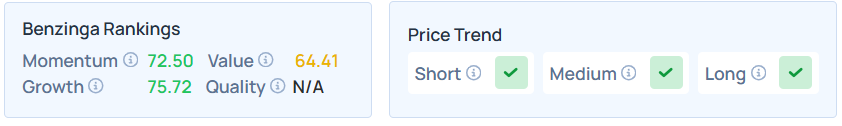

- BKR maintains a stronger price trend over the short, medium, and long terms with a moderate value ranking, as per Benzinga’s Edge Stock Rankings.

Sarepta Therapeutics

- Sarepta Therapeutics Inc. (NASDAQ:SRPT) jumped 6.72% after it announced the completion of the confirmatory trial commitment for its ultra-rare disease PMO therapies AMONDYS 45 and VYONDYS 53, along with its third-quarter results.

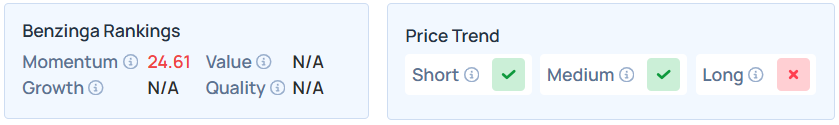

- Benzinga’s Edge Stock Rankings indicate that SRPT maintains a weak price trend over the long term but a strong trend in the short and medium terms.

Nucor

- Nucor Corp. (NYSE:NUE) was 0.29% higher as it is projected to post quarterly earnings of $1.91 per share on revenue of $7.87 billion after the closing bell.

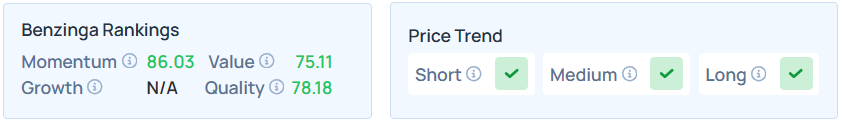

- NUE maintains a stronger price trend over the short, medium, and long term with a solid quality ranking, as per Benzinga’s Edge Stock Rankings.

WR Berkley

- WR Berkley Corp. (NYSE:WRB) was 0.18% lower ahead o fits earnings scheduled to be released after the closing bell. Analysts expect quarterly earnings of $1.13 per share on revenue of $3.66 billion

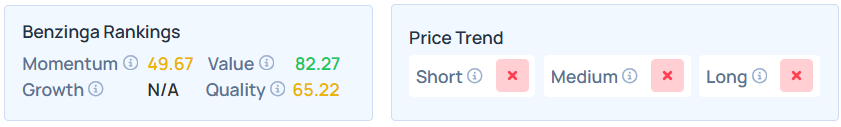

- WRB maintains a weaker price trend over the short, medium, and long terms with a strong value ranking, as per Benzinga’s Edge Stock Rankings.

Brand Engagement Network

- Brand Engagement Network Inc. (NASDAQ:BNAI) popped 221.60% as bullish sentiment persists following last week’s strategic announcement that has reinvigorated investor interest. The catalyst remains the strategic partnership with Valio Technologies (Pty) Ltd, designed to create an exclusive AI licensing structure for government and commercial sectors across Africa.

- Benzinga’s Edge Stock Rankings show that BNAI maintains a stronger price trend over the short, medium, and long term.

Cues From Last Session

Materials, consumer discretionary, and consumer staples stocks recorded the biggest gains on Friday, while financial and industrials stocks bucked the trend to close lower.

The Dow Jones index ended 0.58% lower at 49,098.71, whereas the S&P 500 index rose 0.033% to 6,915.61. Nasdaq Composite advanced 0.28% to 23,501.24, and the small-cap gauge, Russell 2000, fell 1.82% to end at 2,669.16.

| Index | Performance (+/-) | Value |

| Dow Jones | -0.58% | 49,098.71 |

| S&P 500 | 0.033% | 6,915.61 |

| Nasdaq Composite | 0.28% | 23,501.24 |

| Russell 2000 | -1.82% | 2,669.16 |

Insights From Analysts

Mohamed El-Erian highlights a continuing “2025 Paradox,” where financial markets and economic forecasts remain surprisingly resilient despite investors being “forced to drink from a geo-economic firehose.”

While U.S. economic activity appears robust—evidenced by strong consumer spending and third quarter growth revised upward to 4.4%—he notes a divergence in global views. Some see recent tremors as temporary, while others warn that “global paradigms are shifting in a fundamental and durable fashion.”

Regarding the stock market, El-Erian observes that equities have successfully retraced losses triggered by geopolitical tensions, though he points to a historic surge in precious metals as a notable counter-narrative.

Looking ahead, he anticipates the Federal Reserve will maintain interest rates, as markets have “priced out virtually any Fed cut until the change in Chair.”

El-Erian expects the immediate focus to shift to corporate earnings from tech giants like Apple Inc. (NASDAQ:AAPL) and Microsoft, alongside political friction involving trade tariffs and the Federal Reserve’s independence.

Ultimately, while the economy shows strength, El-Erian suggests investors must navigate a landscape where political and structural shifts constantly challenge market stability.

Upcoming Economic Data

Here’s what investors will be keeping an eye on this week.

- On Monday, the delayed report of November’s durable-goods orders will be released by 8:30 a.m. ET.

- On Tuesday, January’s consumer confidence data will be out by 10:00 a.m. ET.

- On Wednesday, FOMC will announce its interest-rate decision at 2:00 p.m. and Fed Chair Jerome Powell will hold a press conference at 2:30 p.m. ET.

- On Thursday, the initial jobless claims data for the week ending Jan. 24, the delayed report of November’s U.S. trade deficit, and the revised third quarter data for U.S. productivity will be released by 8:30 a.m. ET.

- November’s delayed report for wholesale inventories and factory orders will be out by 10:00 a.m. ET.

- On Friday, December’s delayed producer price index data will be released at 8:30 a.m. ET.

- January’s Chicago Business Barometer (PMI) will be out by 9:45 a.m., St Louis Fed President Alberto Musalem will speak at 1:30 p.m., and Fed Vice Chair for Supervision Michelle Bowman will speak at 5:00 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 0.20% to hover around $60.95 per barrel.

Gold Spot US Dollar rose 2.15% to hover around $5,089.93 per ounce. Its last record high stood at $5,111.11 per ounce. The U.S. Dollar Index spot was 0.55% lower at the 97.0630 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.69% lower at $87,670.70 per coin.

Asian markets closed mixed on Monday, as China’s CSI 300, Hong Kong’s Hang Seng, and Australia’s ASX 200 indices rose. South Korea’s Kospi and Japan’s Nikkei 225 fell. European markets were mostly lower in early trade.

Photo courtesy: Shutterstock

Recent Comments