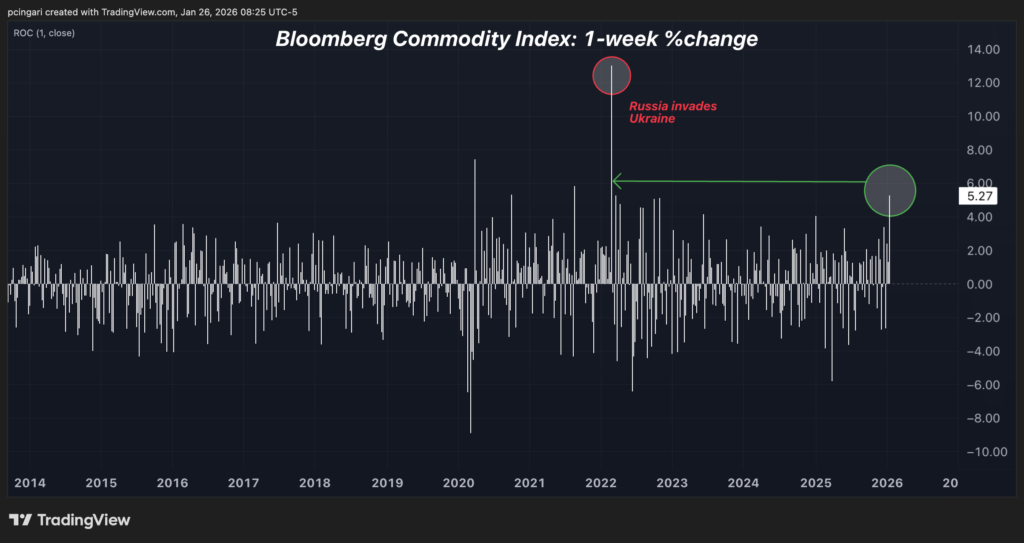

Something unseen in nearly four years just rippled through the global commodity market.

- The DBC ETF is already up 9% year-to-date. Check live prices here.

The Bloomberg Commodity Index — a closely watched benchmark tracking prices across 23 major commodities — posted its strongest weekly gain since February 2022, jumping 5.3% in the week that just ended. The rally marked a third consecutive weekly advance and pushed the index up by more than 9% year to date, outpacing the S&P 500.

The last time the index surged like this, Russia’s invasion of Ukraine had triggered a global energy shock. Crude oil vaulted above $100 a barrel, European natural gas prices exploded as Russian supply was cut off, and sweeping sanctions on the Kremlin sent commodity markets into chaos.

That post-pandemic rebound, combined with surging energy prices, led many Wall Street analysts to declare the return of a commodity supercycle reminiscent of the early 2000s.

But the thesis didn’t last.

Aggressive interest-rate hikes by global central banks quickly cooled demand, drained liquidity from financial markets, and pulled most commodity prices back from their extremes as the era of easy money came to an abrupt end.

Fast forward nearly four years, and a new commodity boom is unfolding — but this time, the epicenter looks very different.

Instead of oil and gas, the surge is being led by precious metals.

Gold prices — as tracked by the SPDR Gold Shares (NYSE:GLD) — topped $5,000 on Monday. Silver — tracked by the iShares Silver Trust (NYSE:SIL) — surged to nearly $110 per ounce.

Precious Metals Take Center Stage

Over the past year, silver is up 260%. Gold has climbed 85%. Both are on track for their strongest rolling 12-month returns since 1980.

“History is not a guide to the future, but the average increase in gold during four upward cycles was about 300% over 43 months, which means the gold price could reach $6000 by spring,” Michael Hartnett, chief investment strategist at Bank of America, said in a recent note.

Gold’s rally has been fueled by a weakening U.S. dollar, persistent geopolitical tensions, and rising concerns over political interference in Federal Reserve policy — forces that have drawn a new wave of private investors into the metal.

Silver’s story, however, may be even more complex.

“Silver has also been boosted by a historic short squeeze and strong retail buying. At the same time, industrial demand – particularly from solar, electrification, and grid infrastructure investment – has tightened the physical market at a time when mine supply growth remains limited,” said Ewa Manthey, commodities strategist at ING Group.

Why AI Is Changing The Silver Story

Silver is no longer just a precious metal. Its industrial role is becoming central to the artificial intelligence buildout.

“The global economy is not short of energy. Fossil fuels remain abundant. Renewable capacity continues to expand. From a purely volumetric perspective, there is no immediate energy scarcity,” said Jordi Visser, head of AI Macro Nexus research at 22V Research.

“But AI systems do not run on energy in the abstract. They run on electricity delivered with extreme precision, density, and reliability and that distinction is no longer academic,” he said.

“Electricity plays the same role in the physical world that memory plays in the digital one. It determines whether theoretical capacity can be turned into real performance,” Visser said.

“Silver sits precisely at this interface,” he added.

The Commodity Rally Is Now Spreading

The past week also delivered a reminder that energy markets haven’t gone quiet.

U.S. natural gas prices at the Henry Hub facility posted their largest one-week gain on record — surging roughly 70% — driven by a historic cold wave, heavy snowfall, and widespread ice storms across large parts of the country.

“The extreme conditions will boost heating demand and put energy infrastructure at risk,” warned ING’s Manthey on Monday.

“There will be stronger heating demand and supply hits, industrial demand could come under pressure, with some industrials reducing or temporarily halting operations due to weather conditions,” she added.

Copper could be next, with conditions aligning for a sustained and forceful bull run.

Industrial metals are already up about 40% over the past six months — their strongest run since 2021 — and some analysts believe the rally is only beginning.

Visser frames the broader macro picture as a clash between abundance and scarcity. Software has become ubiquitous. Code is cheap. AI-driven “vibe coding” is accelerating application development at record speed, while agentic AI threatens to disrupt traditional enterprise software models.

Critical minerals, however — including silver, copper, and rare earths — face structural shortages that could persist for more than a decade.

Nvidia Corp. (NASDAQ:NVDA) CEO Jensen Huang recently described the coming AI-driven infrastructure buildout as an $85 trillion opportunity. Bernstein projects copper shortages stretching into the 2040s.

That imbalance may keep commodities in the spotlight longer than many expect.

Image: Shutterstock

Recent Comments