Texas Capital Bancshares (NASDAQ:TCBI) reported better-than-expected earnings for the fourth quarter on Thursday.

The company posted quarterly earnings of $2.08 per share which beat the analyst consensus estimate of $1.77 per share. The company reported quarterly sales of $327.483 million which beat the analyst consensus estimate of $324.621 million.

“Consecutive strong quarters to close 2025 validate our multi-year transformation strategy and demonstrate the resilience of our business model in a complex market environment,” said Rob C. Holmes, Chairman, President & CEO. “Surpassing our long-term Return on Average Assets goal of 1.1% in the final two quarters underscores the effectiveness of our deliberate, disciplined approach. We are now positioned to capitalize on our increasingly differentiated platform, executing seamlessly for clients, delivering comprehensive solutions across market events and driving meaningful, sustainable value for our investors.”

Texas Capital Bancshares shares fell 2% to trade at $100.25 on Friday.

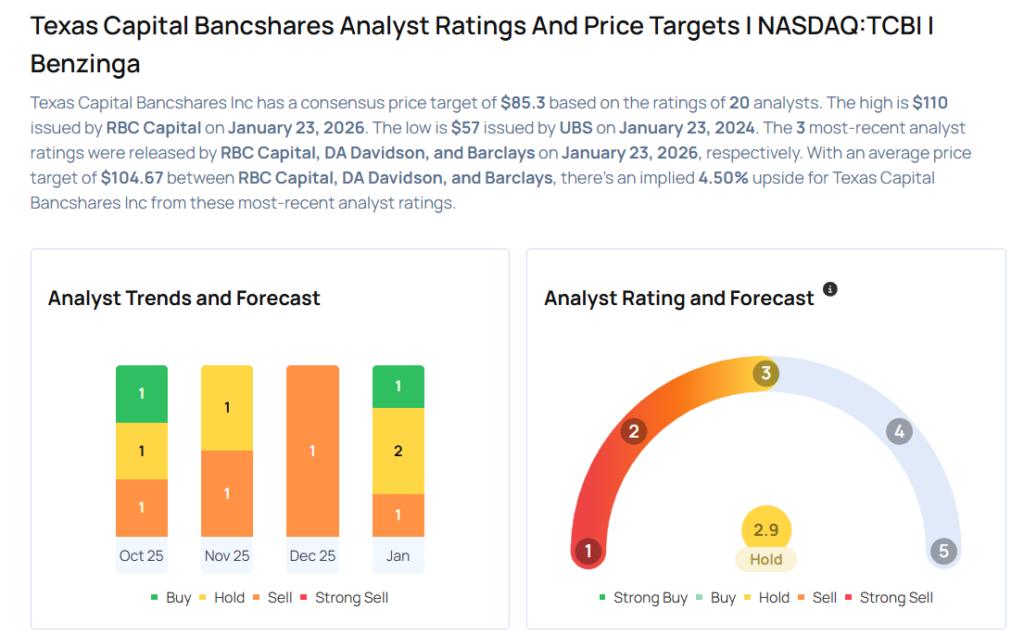

These analysts made changes to their price targets on Texas Capital Bancshares following earnings announcement.

- Piper Sandler analyst Stephen Scouten maintained Texas Capital Bancshares with a Neutral and raised the price target from $86 to $96.

- Barclays analyst Jared Shaw maintained the stock with an Underweight rating and raised the price target from $90 to $100.

- DA Davidson analyst Peter Winter maintained Texas Capital Bancshares with a Neutral and raised the price target from $94 to $104.

- RBC Capital analyst Jon G. Arfstrom maintained the stock with a Sector Perform and raised the price target from $105 to $110.

Considering buying TCBI stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments